With Palladium at 10 year highs, an S&P drop could be on the horizon

Bullion.Directory precious metals analysis 1 September, 2014

Bullion.Directory precious metals analysis 1 September, 2014

By Christopher Lemieux

Senior FX and Commodities Analyst at FX Analytics

The industrious metal has climbed 27 percent in 2014, reaching $908.7 per ounce. Palladium is primarily used in catalytic converters used in auto manufacturing, and car sales have been strong throughout Europe and the United States (although showing some weakness in the latter).

The increase in car sales have ramped up demand for palladium, but the geopolitical tension with Russia, the world’s largest producer, has traders wondering if supplies could be restricted.

Interestingly enough, the trend in palladium looks relatively similar to that seen in the S&P. Both seem to be bets on the economy, and both seem to trade higher unabated.

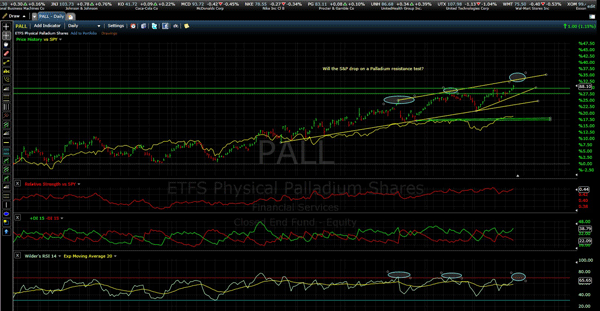

The daily chart of ETFS Physical Palladium Shares (PALL) is up large, 21.55 percent, this year. It has outperformed the SPDR S&P 500 (SPY), but there is a relationship between the trends.

PALL is trading higher into a wedge pattern, and price action will likely test $90 while testing the resistance trend line.

The price action remains strong, but this could change if there is no significant change in supplies. The prior two attempts to break this resistance has led to sizable declines in PALL, and the SPY soon followed.

If PALL cannot break the resistance trend line, a 1 to 1.25 percent decline in S&P are likely to follow.

Click chart to view full size

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply