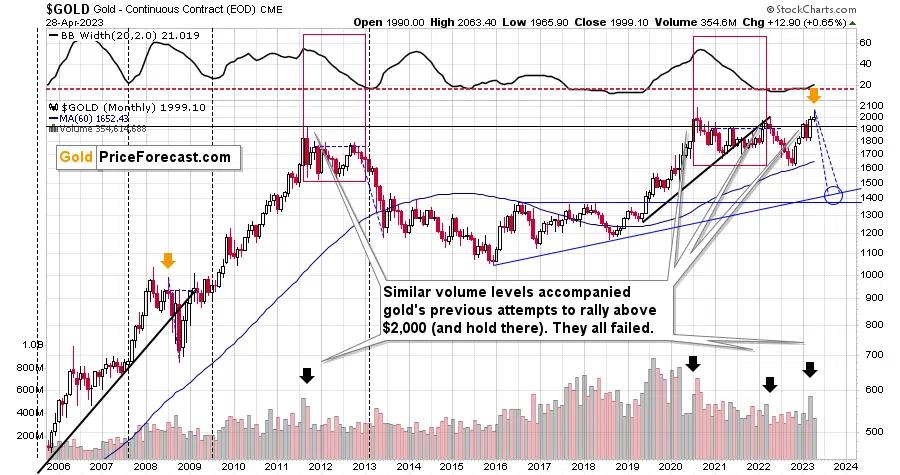

In Friday’s analysis, I wrote that gold price was likely about to form a monthly reversal – and now it’s a fact. Will gold slide?

Bullion.Directory precious metals analysis 01 May, 2023

Bullion.Directory precious metals analysis 01 May, 2023

By Przemysław K. Radomski

Founder of GoldPriceForecast.com

Most likely, yes. I explain the reasons in detail in Friday’s premium analysis, but to make a long story short, the single fact that we just saw a powerful monthly reversal makes it very likely.

April is now completely over, so it’s not a supposed reversal but a real one.

And just as this kind of price movement started a powerful price slide in 2008, it’s quite likely to trigger big declines in the following weeks / months.

Why would that be the case? Let’s remember that the real rates are going higher – either through increases in the nominal rates or by decreases in (expected) inflation. And that’s very bearish for gold.

Zooming in allows one to see that gold closed the week and the day below $2,000, thus cementing the move back below this important threshold. Yes, that’s bearish, too.

And while gold moved slightly ($0.10) higher on Friday, gold stocks moved visibly lower.

The GDXJ ETF ended the day 0.82% lower, which might not seem like a lot, but it’s actually an important sign of weakness. Junior miners didn’t even magnify gold’s decline – they declined despite gold’s tiny rally, which is even more bearish.

Also, our short position in the FCX remains greatly profitable, despite the small upswing that we just saw.

Please note that the latter materialized on low volume, and this indicates that further declines are just around the corner. In contrast, when the FCX moved higher on higher volume after a decline, it heralded rallies. We saw this in early January 2023 and in late February. Also, the March reversal took place on a big volume.

What we saw on Friday (and Thursday) was nothing like that – it looks much more like a breather before the decline continues and makes our FCX-based profits bigger.

All in all, the outlook for the precious metals market remains very bearish.

Przemyslaw Radomski

Przemyslaw K. Radomski, CFA, has over twenty years of expertise in precious metals. Treating self-growth and conscious capitalism as core principles, he is the founder of GoldPriceForecast.com

As a CFA charterholder, he shares the highest standards for professional excellence and ethics for the ultimate benefit of society and believes that the greatest potential is currently in the precious metals sector. For that reason it is his main point of interest to help you make the most of that potential.

This article was originally published here

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply