Maybe it’s Time to Take the Training Wheels Off Your Retirement Plan

Bullion.Directory precious metals analysis 01 September, 2021

Bullion.Directory precious metals analysis 01 September, 2021

By Peter Reagan

Financial Market Strategist at Birch Gold Group

The days of pensions, however, are pretty much over. Nearly every corporation rebelled against the uncertain, long-term costs associated with securing their former employees’ retirements. Instead, they argued for (and got) a different kind of employee retirement benefit: the retirement account, specifically the 401(k). Workers could contribute pre-tax payroll dollars, and the employer would pay administrative costs and even sometimes kick in a little extra.

This had the side effect of putting every American worker directly in charge of his or her long-term retirement plan. Whether or not they were ready for it.

Today, we’re discussing the state of American retirement, and exploring the benefits and drawbacks of a system that makes each of us our own financial advisor.

The financial services industry

The boom in retirement accounts has been a gift to the financial services industry…

There are over 7,600 mutual funds, more than 2,300 exchange-traded funds (ETFs) and 3,400 FINRA-registered broker-dealers to help you buy them.

While this may sound like a ridiculous number of options, the truth is, many of these investment choices aren’t offered to your benefit. They’re included on the menu because:

- They’re easily transacted (meaning paper-based)

- They generate income for someone other than you (possibly the broker, likely the fund provider)

For example: the average mutual fund charges 0.54% in fees. If your retirement plan administrators really wanted to help you retire, they’d offer Fidelity’s zero-fee mutual funds instead (cost: 0%). Or Vanguard’s extremely low-cost mutual funds (average expense ratio: 0.09%). After all, every dollar you don’t spend in fees is just as good as a dollar earned in investment returns.

With that in mind, why don’t brokers just offer you the lowest-possible-cost options? Well, traditionally, they’re paid commissions. And you can bet the lowest-cost funds don’t offer top payouts.

The best choice for you isn’t likely the same as the best choice for them. Because, in order to pay for those commissions, hungry mutual funds crank up their expense ratios or, even worse, charge a 3-6% “front load” fee which they deduct before investing your money. And that’s not instead of an expense ratio, that’s in addition to an ongoing tax on your savings.

Employer-sponsored 401(k) programs are often the worst offenders. They typically have only a “curated” list, a menu offering a handful of investment options, heavily tilted toward expensive, actively-managed mutual funds. (Most employers look for the plan that costs the least for themselves, so brokers are smart enough to pack the inexpensive plans with dud funds that still pay high commissions, and instantly create a captive market for a heap of investments no one else wants.)

Furthermore, when we take a closer look at the nearly 10,000 investment options available from brokers, we find the illusion of choice all but disappears…

“Any customer can have a car painted any color that he wants so long as it is black.”

This quote, attributed to Henry Ford during a 1909 company meeting, might as well apply to the typical retirement account.

Here’s the thing: when you boil down all these 10,000 options, they’re either:

- Stocks

- Bonds

- A mix of stocks and bonds

Does this sound far-fetched? Here’s an actual breakdown of the 26 different funds offered by one employer-sponsored 401(k) retirement program:

- 11 stock funds

- 3 bond funds

- 11 blended stock/bond funds

- 1 cash fund

This isn’t a choice — it’s the illusion of choice. It’s Henry Ford’s “any color he wants, so long as it’s black.”

It’s like going to Baskin Robbins and finding out all 47 flavors are either chocolate or vanilla.

What’s wrong with stocks and bonds?

Nothing! Investing in stocks and bonds has been the bedrock of American investments for decades. (Even the Social Security trust fund holds U.S. Treasury bonds.)

Except… Buying stocks today, at the peak of the 2nd-most-overvalued stock market in 250 years of American history, might not be in your best interests.

Why not?

Well, there’s no crystal ball. If we settle for the next-best thing, historical data , here’s what we see…

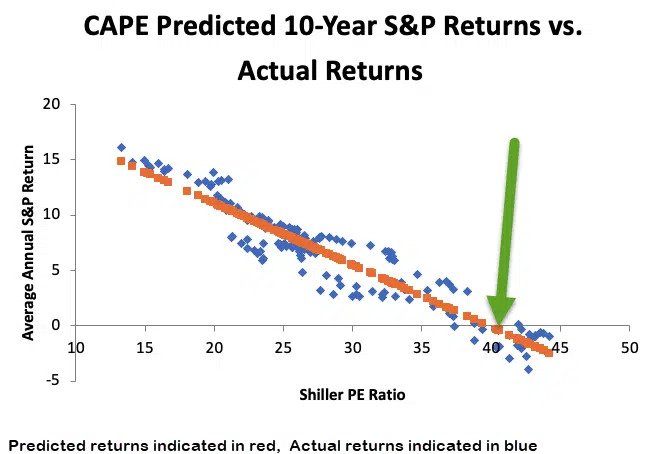

The Cyclically-Adjusted PE ratio (also known as Shiller PE) might be the next-best thing to a crystal ball. One analyst said , “CAPE’s ability to predict 10-year future returns during the last 25 years has been remarkable.”

The green line represents where CAPE is today, predicting a 10-year annual return of 0%. Before inflation , which, remember, is currently near a 30-year high after notching three consecutive months over 5%.

Based on history, anyone who buys stocks today will lose 5% per year if they’re lucky (and they don’t get hit by the steamroller ).

Buying bonds today, sure, you can do that. The Federal Reserve sure is. On the other hand, should you buy a government bond, you’ll lock in a negative real interest rate (“real” means after inflation) for the bond’s duration. Let’s take a look at current yields adjusted for today’s inflation rate of 5.4%:

- 10-year Treasury: 1.30% yield, -4.1% real yield

- Vanguard corporate bond index fund (VBLTX), 1.94% yield, -3.46% real yield

- Vanguard high-yield (“junk bond”) index fund (VWEHX), 2.88% yield, -2.52% real yield

Savers and investors are so desperate for returns, even risky bonds issued by businesses teetering on the verge of bankruptcy are only paying after-inflation returns you’d expect to see on a savings account… Even U.S. 10-year Treasury Inflation Protected Securities (TIPS) have a negative yield!

Today, the financial services industry tells Americans they’re forced to choose between buying stocks at double their long-term historic price , and hoping history means nothing or buying bonds to lock in long-term, after-inflation losses.

Are you going to listen?

“Alternative” assets: stuff the financial services industry loves to hate

Broker/dealers, financial advisors and even banks aren’t equipped to handle assets that have intrinsic value. Investments like real estate, precious metals and cryptocurrencies are simply out of bounds for them. That sounds crazy, doesn’t it? It’s true: your financial advisor won’t recommend physical precious metals. Here’s why…

The reason is simple: When you insist on buying 100 acres of farmland or 20 gold bullion bars, you have to withdraw money from your broker or retirement plan administrator. They aren’t equipped to trade assets that aren’t paper-based. For tangible assets, they can’t simply register your ownership with the Depository Trust Company (DTC).

Even worse (from their perspective), they can no longer make commissions on your savings, or charge administrative fees.

Non-paper-based assets are called “alternative” for a number of reasons. Most probably in the interests of frightening investors away from them. (Commercial banks spent $62 million on lobbyists this year so far ; brokers spent nearly $52 million. That kind of money buys a lot of favors.)

Americans saving for retirement, for the most part, simply aren’t aware that these so-called alternative investments are an option…

Opening a self-directed IRA (SDIRA) is the equivalent of taking the training wheels off your retirement. Americans who open and fund an SDIRA have access not only to the world of 10,000 paper-based stock and bond funds, they can also invest in:

- Physical gold, silver and other precious metals

- Bitcoin and other cryptocurrencies

- Real estate and undeveloped or “raw” land

- Promissory notes and tax lien certificates

- Water, mineral, oil and gas rights

- Livestock

If you’re confused and exhausted by struggling to understand the jungle of 10,000 mutual funds and ETFs…

Or if you’re struggling to understand how anyone can save for retirement in an environment that looks to offer negative return on investment for the foreseeable future…

Or if you just want the security of owning tangible assets with real intrinsic value…

Consider opening your own self-directed IRA. After all, it’s your money. It’s your future. Shouldn’t you be the one in charge?

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply