How can you tell when a big economic bubble is forming? When Wall Street tells Main Street, ‘It’s not a bubble.’

Bullion.Directory precious metals analysis 03 September, 2021

Bullion.Directory precious metals analysis 03 September, 2021

By Peter Reagan

Financial Market Strategist at Birch Gold Group

“How can you tell when a big economic bubble is forming? When Wall Street tells Main Street, ‘It’s not a bubble.’”

Smith proceeds by leveling a harsh criticism of the present economic moment:

The post-bubble-crash phase is already being prepared: “No one could have seen this coming” – except anyone who paid attention to anything other than self-interested shills.

Of course, we’ve seen this bubble forming as well. It’s fairly easy to “pay attention” with so many obvious economic signals the Fed keeps giving off. So many signals that you might even call the latest big bubble a “FedBubble.”

And it seems like the Fed doesn’t want that bubble to collapse quite yet…

How the “FedBubble” keeps inflating

Minus some added commentary on each “move,” Smith summarized his theory of how the process works:

Wall Street and the Federal Reserve inflate an unprecedented debt-funded speculative bubble and then lure retail “investors” in with the promise that the enormous gains are just starting, there’s so much more easy money ahead, etc. Then Wall Street distributes its shares of overpriced rubbish to bagholders, and then to everyone’s surprise, the market suddenly crashes as the unsustainable bubble pops.

Who are Smith’s “bagholders”? Simple: retail investors like you and me. Everyone who downloaded Robinhood to play day-trader during the pandemic, and now thinks they’re geniuses because the stocks they pick always go up. Every working American who contributes to their 401(k) to buy overpriced mutual funds, all crammed with outrageously high-priced stocks.

In short, the bagholders are everyone who keeps believing “stocks go up forever” until the market proves them wrong.

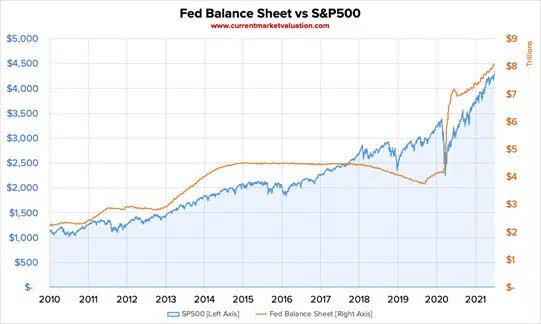

In support of Smith’s thinking, the Fed’s balance sheet in 2020 spikes right at the same time the S&P 500 crashes, then begins its recent climb (chart below):

According to the Current Market Evaluation analysis:

This suggests that the economy isn’t actually doing as well as the S&P 500 suggests, and raises serious concern over the sustainability of the current stock market performance.

That may be the understatement of the century…

You don’t have to be an economist or a statistician to see the correlation between the yellow line and the blue line. They move together almost perfectly in sync for the last 20 years. (Is it possible today’s stock bulls aren’t so much buying stocks, as they’re buying hope the Fed will keep the party going forever?)

The markets are also historically severely overvalued right now, according to three radically different, closely-watched indicators:

- The Buffet indicator, which currently values stocks at 238% above GDP, and 90% above the acceptable long-term trendline (also known as reality).

- The PE ratio model, which currently values S&P 500 stocks 97% above the historical average for earnings, and close to the dot-com bubble peak.

- The mean reversion model, which is 89% above the trendline (compared to the dot-com bubble, which only registered 82% above the same line).

All three models above offer obvious warnings that a speculative bubble has inflated, just as Smith says.

Wall Street, well, they have to talk their books. You could call it selling, or you could also call it “distributing overpriced rubbish,” to borrow Smith’s phrase.

And if that weren’t bad enough, the Fed might already be out of options…

Abuse of power? Trust? Both?

In a one-page statement of longer run goals, the Federal Reserve restated its dual mandate of: “[…] promoting maximum employment, stable prices, and moderate long-term interest rates.” (Note there’s not a word about the stock market in there.)

Regardless of what the Fed says, watch what they do.

Maximum employment? Today’s jobs report came in a 1/3 the expected total. Strike one.

Stable prices? Does the Fed’s preferred “lowest of lowball” inflation report of 5.4% sound stable to you? Strike two.

Moderate long-term interest rates? Today, the U.S. 30-year Treasury yields 1.9%, less than half its historic average? Strike three. They’re out.

No more excuses, no more hand-waving about blips and global macroeconomic environments. Here’s what’s really going on…

Charles Hugh Smith recently spoke of the “fatal synergies” unleashed deliberately by the Fed, and the purpose behind them…

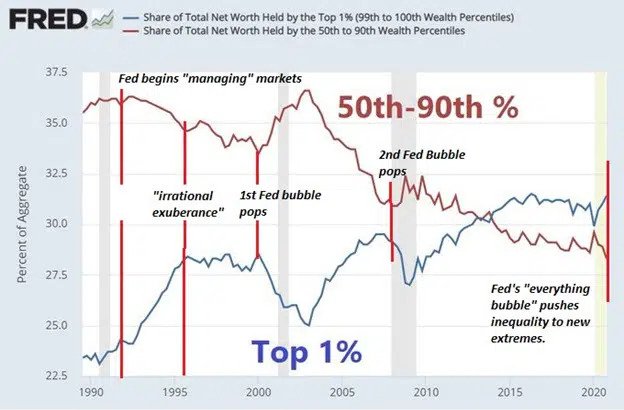

Let the record show what the Fed has accomplished: 1) inflating three ever-more destructive speculative bubbles and 2) unprecedented extremes of wealth and income inequality. The Billionaires are grateful for the free trillions the Fed showers on the super-wealthy while destroying the safe yields that once benefited the middle class.

Sometimes, a picture’s worth a thousand words. Here’s Smith’s picture:

The top 1% wealthiest Americans (blue line) get richer while the rest of us middle-class folks, well, we just don’t. Notice also how closely these lines move. They look like exact opposites, mirror images, don’t they? Could anything better illustrate the Fed’s true intentions?

Today, we’re stuck in an economy that says the only possible way to make money is either to be born rich, or sink all your savings into the stock market and hope with all your might the party never stops.

What do we have to look forward to?

Smith says:

…those early days of the Fed’s abuse of power–stripmining the middle class to boost the wealth of America’s top tier–now look positively quaint compared to today’s Fed-fueled speculative mania which has poisoned the entire society and hoisted the economy on a rickety ladder to the sky that will crush everything below when it finally snaps. [emphasis added]

We’ve done our best to caution Americans about the hyper-speculative Wall Street mania driving the “FedBubble” higher and higher.

Some have listened. Many have not. (Most won’t, because hope withers in the face of skepticism – and if hope is all you have, you cling to it. If you lose it, you’ll have nothing left.)

The only question left is, when will Smith’s “rickety ladder” finally snap?

Consider watching what the “smart money” does next

While the outcome of every speculative market bubble is both inevitable and disastrous, it doesn’t affect everyone the same way. (Otherwise, those red and blue lines would move down together).

Smith gave us a clue about smart money:

Generations of punters have learned the hard way that their unwary greed is the tool the Smart Money uses to separate them from their cash and capital.

This time, he’s calling his bagholders “punters,” but it amounts to the same thing. At some point, the “smart money” investors who know their history must sell before the “FedBubble” pops. That’s how they maximize their profit in the high-risk mania-fueled speculative market. (In short, they’ll make a run for the exit.)

They’ll be quick to park their ill-gotten gains in a “safe haven” to protect it during the ensuing market panic. Physical precious metals, especially gold and silver, are two favorite safe havens among the elite. Gold and silver tend to thrive during panics and market collapses And, just in case the “dumb money” ever catches on and the torches and pitchforks come out, you can always load your gold onto a truck and flee the country. (Because gold spends everywhere.)

Here’s the thing:

We cannot know the day the market bubble peaks. Historians and economists retroactively identify the apex of a speculative frenzy, and the handful of lucky investors who sold that day will boast of their wisdom for the rest of their lives.

We will not know the specific event that sets off the alarm bells that everyone finally hears. Years down the road, finance writers and journalists will collaboratively choose an event to symbolize the moment the Emperor of the market realized he was naked. (Remember Pets.com? Or Lehman Brothers?)

We do know that every speculative bubble in history, from the South Sea Bubble of 1721 that took the United Kingdom to its knees to the dot-com bubble two decades ago, come to an end. It might be a good idea to make your move now, because a month early is probably a while lot better than a day late.

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply