And Will Inflation Crash the Economy in 2022?

Bullion.Directory precious metals analysis 30 December, 2021

Bullion.Directory precious metals analysis 30 December, 2021

By Peter Reagan

Financial Market Strategist at Birch Gold Group

For Baby Boomers who lived through the Carter years, 2021 might feel like déjà vu. That’s because inflation rose 6.8% again in November 2021, which is the highest level since June of 1982.

That’s bad enough. And that’s not the worst of it…

When we look higher up the product pipeline, inflation at the manufacturing level is even higher. U.S. producers are dealing with inflation of their own, clocking in at an incredible 9.6% in November. That means prices on all manufactured goods, from coffee mugs to SUVs, are still going up. And we haven’t even experienced the sticker shock yet. Producer prices are a forecast of rising prices just down the road.

Things have gotten so bad that Bloomberg recently published an “inflation survival guide” after interviewing a number of Argentines (who routinely struggled with 50% inflation). Those who survived Argentinian hyperinflation know paper money is worthless.

Here’s their advice, lightly edited for clarity:

- Spend your paycheck immediately (particularly on big-ticket items like houses and cars in the U.S.) – In a high-inflation economy, money that sits in the bank is losing value. Each day, those dollars on deposit buy a little, or a whole lot, less.

- Borrow as much money as you can – When we borrow money to finance those big purchases, we’re getting credit at a rate below That means all the debt we take out is actually being devalued month after month. Eventually, we can always pay it off with otherwise-useless paper money.

- Flee the country – If nothing else, you can always run away from government-created economic problems. In other words, “Come to Argentina to spend your dollars. Here you are very rich.”

Choosing to follow this advice sounds downright disastrous. Save nothing? Spend everything and more? Presumably, Bloomberg intended this advice to be tongue-in-cheek, with the unspoken message, Come on, it’s not as bad as all that…

On the other hand, it’s pretty bad. Just like Argentina, the U.S. economy is following a pattern first recognized by the economist Ludwig von Mises.

Why a “crack up boom” isn’t funny

If people keep piling up debt thanks to the Fed’s loose monetary policy of near-zero interest rates, and inflation keeps rising, that’s exactly what policy makers don’t want to happen. Especially if expectations of rising inflation devalue the dollar severely.

It’s called a “crack up boom,” and here’s a brief summary of how it works:

1.Continual credit expansion, also known as “quantitative easing,”, fuels

2. Ongoing price increases, also known as inflation, which causes

3. Inflation expectations accelerate to the point that money becomes worthless, and

4. The economic system crashes.

Former Congressman Ron Paul thinks the crack-up boom is already here. He points out that the Federal Reserve and Chairman Powell are in a tight spot:

Even if the Fed does follow through on its promise to hike rates, it will do little if anything to combat rising prices. If the Fed allowed interest rates to rise to anything approaching market levels, it would make the federal government’s debt servicing costs unsustainable. This puts tremendous pressure on the Fed to maintain low rates.

Maintaining low rates makes getting credit attractive for consumers, especially when inflation is high.

But it comes with a price, the potential for severe dollar debasement. “Debasement” comes from the days of hard currency, and was said to occur when a nation “debased” their gold or silver money by diluting its precious metals content with base metals. The face value of the money was unchanged, but its intrinsic value was diminished.

Of course we have no intrinsic value in our dollars any longer. Even so we still use the word “debasement” to reflect the reduction in purchasing power that happens when there are suddenly trillions more dollars in circulation. Every new dollar printed shrinks the purchasing power of every other dollar in the world.

The real-world effects of this debasement? Simply this: It takes us a larger pile of dollars to buy goods, services and items that have their own intrinsic value (like physical gold).

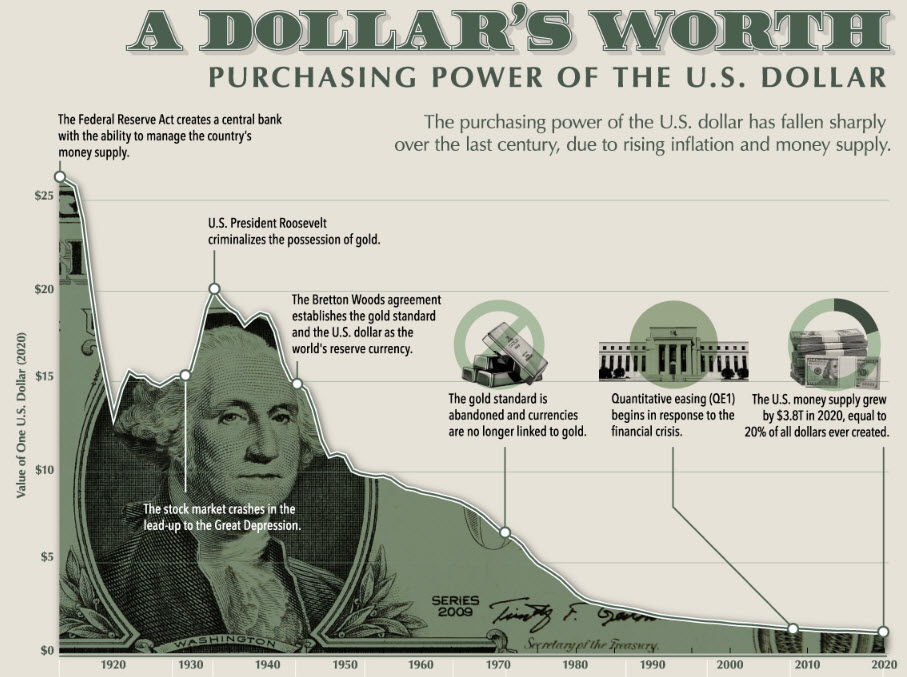

You can see the value of the U.S. dollar has slid steadily downward since the dot-com boom, courtesy of trillions in Fed money printing. And thanks to this jaw-dropping graphic from Visual Capitalist, we can see just how far the dollar has fallen:

Even worse, Ron Paul’s concerned that progressives are pushing the Fed to “stick to its guns.” Thanks to the fantasy called Modern Monetary Theory (MMT), they believe they can keep printing money to fund everything. Everything including, of course, misguided environmental and social justice objectives, multi-trillion-dollar budgets, massive infrastructure spending and so on.

Let’s be very clear:

Every single new dollar printed reduces the value of every other dollar in the world.

Regardless of whether you believe MMT is right or wrong, take a look at the chart again. There are noticeably few upturns in the dollar’s purchasing power, aren’t there? And all of them happened before the U.S. left the gold standard.

Since then, the dollar’s value decays, month after month, year after year.

If progressives get their way and the Fed continues to finance unlimited government spending, we expect to see even more downward pressure on the dollar’s value.

According to the definition above, if the U.S. dollar ends up losing much more of its value, thanks to money-printing and inflation, we’re headed toward the end of the “crack up boom.”

And the next step would be a monumental economic collapse.

See, the entire financial system would “crack up.” Everyday Americans won’t laugh though, because it won’t be funny at all.

The Argentine antidote to the crack-up boom

Eventually fundamentals will take over, and the “Piper must be paid.” If the U.S. dollar is abandoned at the local or global level, things will go south in a hurry. Some experts might even argue that we’re in the early stages of a “crack up boom” right now, but isolated to equities, real estate, and crypto — and it’s possible they’re right.

In those suggestions on dealing with inflation at the top of this article, there’s one that’s noticeably absent. Which is strange, because Bloomberg reported on it before:

Argentines sniffed a crisis and rapidly exchanged their pesos for gold, causing the currency to tumble.

So did MarketWatch:

Any Argentine with some bullion buried in his backyard has seen its value rocket 25% this month alone in terms of pesos, according to data from FactSet. An ounce of bullion will now buy 10,000 pesos, a record high. That’s compared with fewer than 8,000 a month ago. Gold is proving to be a very good safe haven in the crisis. In the past five years, the value of gold has trebled when measured in pesos—again, using the official figures. In the black market it has risen further.

“We view gold as an insurance policy,” says Josh Strauss, co-manager of the Appleseed mutual fund. Everyday folks in Buenos Aires know exactly what he means.

And like any other “insurance policy,” it’s too late to buy it when you already need it. Try insuring your home while it’s on fire, or modifying your collision insurance policy while waiting for a tow truck. It’s too late.

Anyone who hasn’t diversified their savings with physical precious metals before the next crisis will wish they had. Until the invention of a time machine, our only choice is to prepare ourselves now. Even inflation-resistant investments like TIPS and I-bonds don’t help much when they’re paying you in a worthless currency.

Prudent savers will want to own physical gold and silver before they’re the only safe havens left.

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply