Gold Prices Rally After GLD Sees 2nd Outflow, Fed Split Over Low-Rate Risks

Bullion.Directory precious metals analysis 06 July, 2017

Bullion.Directory precious metals analysis 06 July, 2017

By Adrian Ash

Head of Research at Bullion Vault

New US jobs data today came in much worse than expected, with the private-sector ADP report saying US employers added a net 158,000 jobs last month, well below the 185,000 consensus forecast from analysts.

The official non-farm payrolls estimate for June is due from the Bureau of Labor Statistics on Friday.

Last week’s US claims for jobless benefits today also said employment growth has slowed, with both continuing and new claims rising above Wall Street’s average estimate.

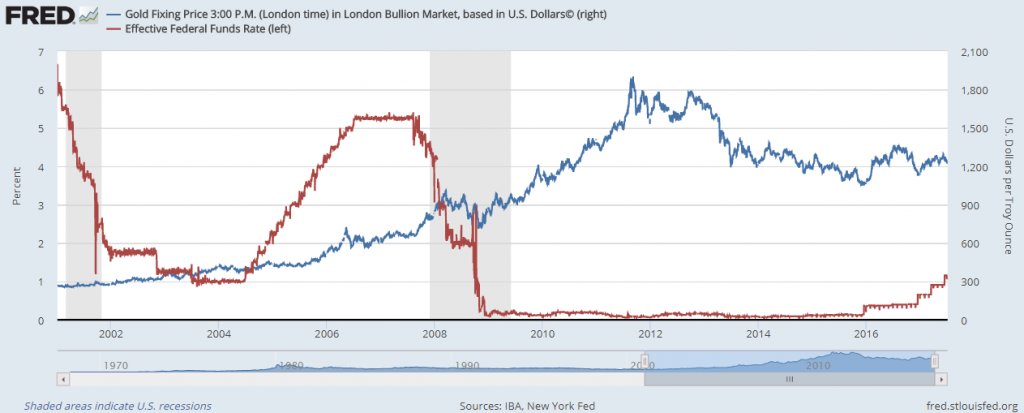

Thursday’s US jobs data came after Wednesday’s release of meeting notes from the US Federal Reserve’s June interest-rate rise decision, showing a split between voting members over the pace and extent of future hikes following that 0.25 point increase to a ceiling of 1.25%.

“The Fed grows worried its loose policy threatens US financial stability,” says CNBC’s summary of the notes.

But “Fed minutes suggest increasing tensions on inflation shortfall,” says Reuters’ report.

Looking at gold price action overnight, “For a second day in a row there was heavy Comex [gold futures and options] offering ahead of $1230,” says the daily trading note from Swiss refiners and finance group MKS Pamp.

“Traders’ next event to focus on will be Friday’s NFP [US jobs] figures, which always have the potential to provide fireworks.”

Wednesday’s drop in gold prices to $1217 per ounce saw a second day of liquidation by shareholders in the world’s largest gold-backed exchange-traded fund, the SPDR Gold Trust (NYSEArca:GLD).

Losing 13 tonnes on Wednesday, the GLD has now shrunk to its smallest size since mid-April at 840 tonnes.

Sponsored by the mining-backed PR and market-development organization the World Gold Council, the GLD closed yesterday needing 840 tonnes of bullion backing – 62% of the ETF’s peak weight, hit at the end of 2012, and equal to 42% of its peak value in Dollars, hit when gold prices topped at $1900 per ounce in September 2011.

Together with the London Metal Exchange, the World Gold Council today confirmed next Monday’s launch of new gold-based derivatives contracts, settled in London and widely seen as a challenge to the established ‘over-the-counter’ trade in wholesale gold bars done between each buyer and seller directly (known as OTC).

Now owned by Hong Kong-based financial trading exchange HKEX, the LME attempted to launch a London gold futures contract in the early 1980s, but closed it 3 years later due to lack of interest.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply