Precious Metals Market Report

Thursday 06 July, 2017

Fundamentals and News*

Asia Stocks Face Mixed Start as Fed Minutes Parsed

Stocks in Asia are headed for a mixed start as investors digested details from the Federal Reserve’s most recent meeting.

Equity index futures in Japan and Hong Kong were flat, while contracts signaled gains for Australian shares. The S&P 500 Index posted small gains and technology shares boosted the Nasdaq 100. Oil recovered some losses after slumping toward $45 a barrel, snapping eight days of gains.

Minutes from the Federal Reserve’s most recent meeting showed consensus about when to shrink its balance sheet and how to approach policy strategy in a time of low inflation is starting to fragment. The officials continued to view gradual interest-rate increases as appropriate, while starting the process of unwinding their $4.5 trillion balance sheet this year.

Geopolitical risk remains on investors’ minds as Kim Jong Un’s test of an intercontinental ballistic missile capable of striking the U.S. mainland sparked an emergency meeting at the United Nations Security Council. Despite brief flurries of risk aversion, money managers aren’t showing signs of undue worry in reaction to North Korea’s provocations.

The European Central Bank on Thursday releases minutes from its last meeting, with investors on the lookout for clues on whether the bank is closer to tightening policy.

A G-20 summit takes place in Hamburg. U.S. President Donald Trump is expected to hold his first meeting with Russia’s Vladimir Putin as well as meet his Chinese counterpart Xi Jinping.

American employers probably added around 175,000 workers in June and wage growth probably strengthened, consistent with a solid labor market, economists project the U.S. Labor Department to report on Friday.

The yen traded at 113.26 per dollar as of 7:01 a.m. in Tokyo. The Bloomberg Dollar Spot Index gained 0.1 percent on Wednesday.

The yield on 10-year Treasuries fell three basis points to 2.32 percent on Wednesday.

Futures on the Nikkei 225 Stock Average were flat in Singapore trading. Contracts on Australia’s S&P/ASX 200 Index rose 0.4 percent.

Futures on the S&P 500 Index were little changed after the underlying gauge rose 0.2 percent. The Nasdaq 100 index jumped 0.9 percent and the Stoxx Europe 600 Index advanced 0.2%

West Texas Intermediate crude futures rose 1.2 percent in early trading. The contact dropped 4.1 percent to settle at $45.13 a barrel on Wednesday, ending the longest winning streak this year, as Russia was said to oppose any proposal to deepen OPEC-led production cuts.

(*source Bloomberg)

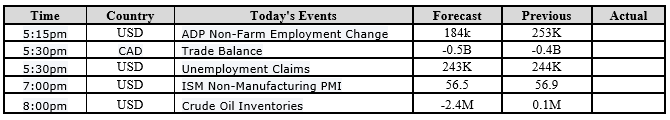

Data – Forthcoming Release

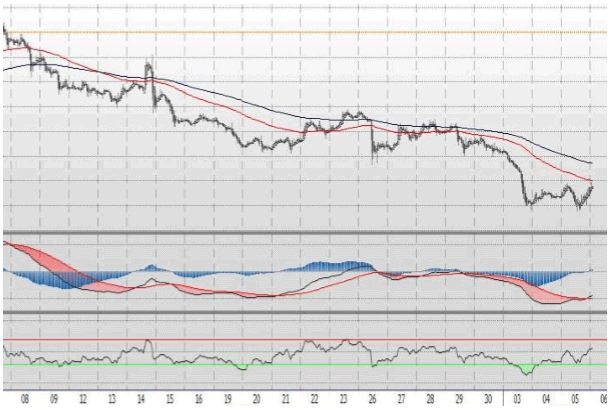

Technical Outlook and Commentary: Gold

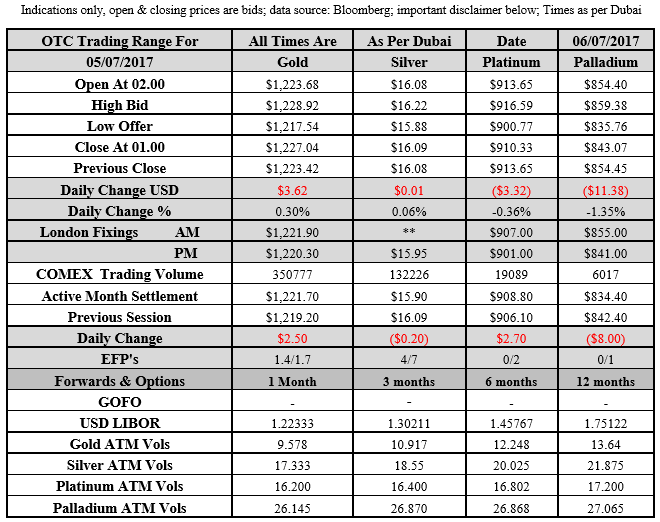

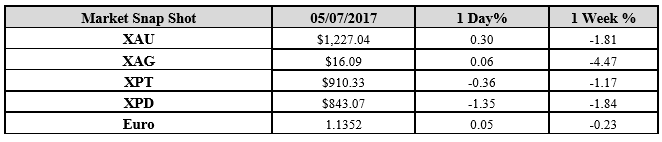

Gold for Spot delivery was closed at $1227.04 an ounce; with gain of $3.62 or 0.30 percent at 1.00 a.m. Dubai time closing, from its previous close of $1223.42

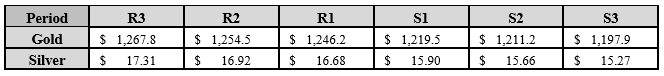

Spot Gold technically seems having resistance levels at 1246.2 and 1254.5 respectively, while the supports are seen at $1219.5 and 1211.2 respectively.

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $16.09 with gain of $0.01 or 0.06 percent at 1.00 a.m. Dubai time closing, from its previous close of $16.08.

The Fibonacci levels on chart are showing resistance at $16.68 and $16.92 while the supports are seen at $15.90 and $ 15.66 respectively.

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Leave a Reply