2019 Gold Prices ‘Target $1400’ as US Jobs Data Miss Forecast, Yield Curve Un-Inverts

Bullion.Directory precious metals analysis 03 April, 2019

Bullion.Directory precious metals analysis 03 April, 2019

By Adrian Ash

Head of Research at Bullion Vault

UK gold prices in Pounds per ounce fell back to unchanged for 2019 to date beneath £980 as Sterling rallied hard following Prime Minister Theresa May moved to compromise on Brexit, opening talks with opposition Labour Party leader (and career ” Marxist“) Jeremy Corbyn and accepting that Parliament might vote to ask the European Union for another extension to Article 50 later today.

Euro gold prices also neared 2-week lows, trading down to €1147.50 as the single currency rose against the Dollar amid better economic data from the 19-nation currency zone.

US employers added 25% fewer jobs than analysts forecast in March, new data from the private-sector ADP Payrolls estimate said today.

That came after February saw US durable goods orders beat forecasts in today’s data releases.

“We’re expecting a rally in gold prices to really kick off in the fourth quarter,” said Neil Meader of specialist analysts Metals Focus on Tuesday, launching the consultancy’s new Gold Focus 2019 in London and predicting a Q4 peak of $1400.

Pointing to continued low interest rates worldwide, the risk of a “correction” in stock markets, “a whole range of tail risks” from geopolitics, and also to possible US Dollar weakness, the longer-term picture for gold looks strong because “US Federal debt is on an unsustainable path,” Meader went on.

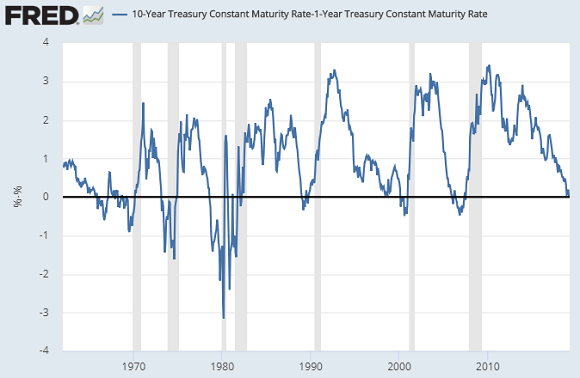

The spread between 10-year and 1-year US Treasury rates widened to 0.11 percentage points this morning, the steepest since last Tuesday saw the yield curve “invert” – with shorter-term rates above long-term rates – for the first time 2007.

“Looking specifically at the difference in yield between Treasuries maturing in one year and those maturing in 10 years,” said research from the Dallas branch of the Federal Reserve earlier in 2019, ” every US recession during the past 60 years has been preceded by a yield-curve inversion, and every significant, sustained inversion but one has been followed by a recession.

“In the single exception, during the mid-1960s, the economy’s growth slowed sharply, but fiscal stimulus prevented a downturn.”

Analysts at US investment bank Goldman Sachs claimed last week that a better indicator is the 10-minus-2 year yield – now flattening around 15 basis points as longer-dated Treasury prices hold firm, keeping yields low – because of “international spillovers” from ongoing zero-rate and QE money creation policies outside the United States.

“As a result, the curve inversion signal could be less powerful for recessions than in the past, since long dated yields across regions have become more correlated.”

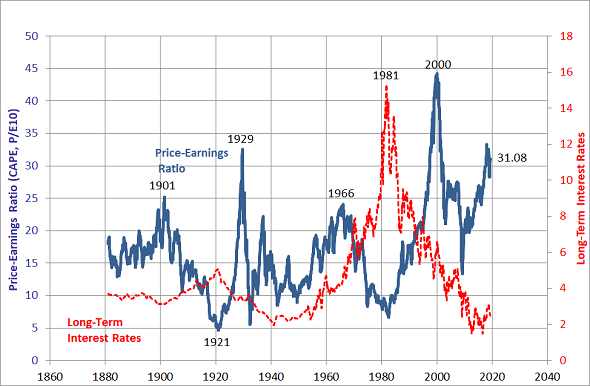

But alongside last month’s yield-curve inversion, US equity prices “are also at historically unsettling levels” says Meader of Metals Focus, with the S&P500 index of US corporations now moving above 31 times cyclically-adusted earnings.

That puts the long-term price/earnings ratio sharply higher than its 50-year average of 20 or its 100-year average of 17 times net income.

Retail sales across the 19-nation Eurozone beat analyst forecasts for February, new figures said today, rising 2.8% from a year earlier.

March then brought further expansion for the single currency union’s services sector, Markit PMI surveys also said.

Italy’s government deficit edged down to 2.0% of GDP in Q4, revised data said.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply