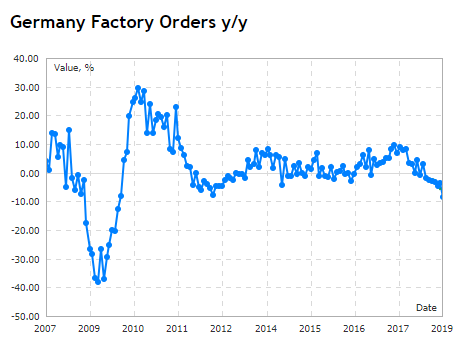

Gold Bullion Flatlines with Equities as Euro Falls on Germany’s Worst Factory Data in 10 Years, Brexit Rolls On

Bullion.Directory precious metals analysis 04 April, 2019

Bullion.Directory precious metals analysis 04 April, 2019

By Adrian Ash

Head of Research at Bullion Vault

Asian stock markets were mixed and European equities also held flat overall as the Dollar rallied against both the Euro and Sterling.

“Gold pulling back from the highs it made recently is completely to be expected with the rally in risk assets,” says Tom Holl, portfolio manager in natural resources at giant asset-management group Blackrock, speaking to Bloomberg today.

But “investors should focus”, he added, on how gold rallied despite US Dollar strength during the sharp drop in global equity markets late in 2018

Despite a call to make leaving with ‘no deal’ illegal passing by 1 vote in the House of Commons overnight, ” Hard Brexit is increasingly possible because we don’t know what the alternative is,” said European Commission vice president Jyrki Katainen today.

“Have [lawmakers] accidentally made [a hard Brexit] more likely?” asks pro-Leave newspaper The Daily Mail.

“Anxiety in EU circles is growing about Dublin’s readiness for a no-deal scenario,” adds the Financial Times, “when Brussels would require extensive checks on cross-border trade between Ireland and the UK.”

Sterling fell over half-a-cent from Wednesday’s new high for this week near $1.32, helping the UK gold price in Pounds per ounce tick up to £982.

London’s FTSE100 share index also slipped, losing 0.5% by lunchtime and breaking its post-2016 referendum pattern of rising when Sterling falls, boosting earnings for the index’s global corporate constituents.

The Euro also retreated from new highs for the week, slipping from $1.1250 after new Germany data said the Eurozone’s largest economy saw factory orders sink by 8.4% in February from the same month last year.

Italy’s “populist” coalition government of left and rightwing lawmakers is pushing to take control of Rome’s central-bank gold bullion reserves, the Wall Street Journal reports, rejecting both Bankitalia and the European Central Bank’s repeated defense of “independence” from politicians and any move to use it for budgetary financing.

“Let’s see the final form of this gold repatriation law,” says Romania’s central bank chief Mugur Isărescu meantime, convening a meeting at the BNR to defend its “credibility” after Bucharest’s Senate backed a move to demand that 95% of the European Union member’s gold bullion is stored at home, rather than at the Bank of England in London – heart of the global wholesale market.

Today’s cross-party Brexit discussions at 10 Downing Street will include the idea of “confirmatory” referendum, said Shadow Brexit secretary Sir Keir Starmer as he went into the meeting.

Asking the British electorate to confirm what form Brexit takes is a “perfectly credible” idea, said ruling Conservative Party finance minister Philip Hammond on TV news last night, contrasting it with “some [other] ideas…which are not deliverable, they are not negotiable.”

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Leave a Reply