Precious Metals Market Report

Friday 21 July, 2017

Fundamentals and News*

Gold Doldrums Spur ‘Moneyball’ Tactic From ETF Seeking Edge

Frank Holmes is no Billy Beane, but he’s trying to replicate in an exchange-traded fund what the baseball manager did with an underdog team in the movie “Moneyball.”

In the 2011 film based on Michael Lewis’s book, Beane of the Oakland Athletics used quantitative analysis to find underrated players, with a budget that was just a fraction of biggermarket franchises such as the New York Yankees. Beane’s team went on to post a record 20game winning streak in 2002. Holmes, chief executive officer of U.S. Global Investors Inc., is hoping to do something similar with his firm’s newly-launched ETF to lure investors into gold equities at a time when money is exiting in droves.

After gold surged through the first five months of 2017, investors are souring on the metal and mining ETFs as Federal Reserve officials signal their willingness to tighten monetary policy. The retreat in bullion was highlighted by a record $3.2 billion outflow last quarter from VanEck Vectors Gold MinersETF, the largest such fund linked to producers. With mining equities trailing the broader market, fund managers are considering the unconventional to stand out.

“There’s a harder case to be made today than a quarter or two ago” in bringing in new investors into gold-mining equities, Matthew Korn, an analyst at Barclays Plc in New York, said in a telephone interview. “I hear that, I see that among my clients. There’s this sense that you have a Fed that’s operating fairly hawkishly. If that’s kind of the prevailing view, it’s harder to want to go and buy gold stocks.”

Attracting new money into gold assets has been a big challenge after investors have been burned by the gyrations in bullion prices. In the decade-long bull run that took prices of the precious metal to a record in 2011, companies including Barrick Gold Corp., the world’s largest producer, rushed to ramp up output to meet rising demand for the metal, accumulating debt as they expanded. As prices reversed and the metal languished in a bear market for years, investors hit the exit, leaving many miners unable to service their obligations and forcing them to cut cost to survive

(*source Bloomberg)

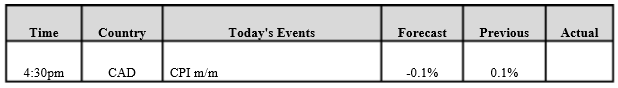

Data – Forthcoming Release

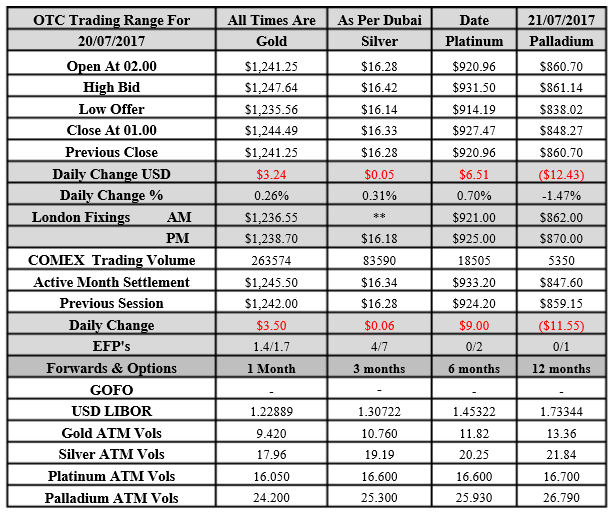

Technical Outlook and Commentary: Gold

Gold for Spot delivery was closed at $1244.49 an ounce; with gain of $3.24 or -0.26 percent at 1.00 a.m. Dubai time closing, from its previous close of $1241.25

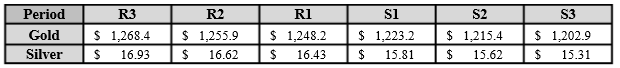

Spot Gold technically seems having resistance levels at 1248.2 and 1255.9 respectively, while the supports are seen at $1223.2 and 1215.4 respectively.

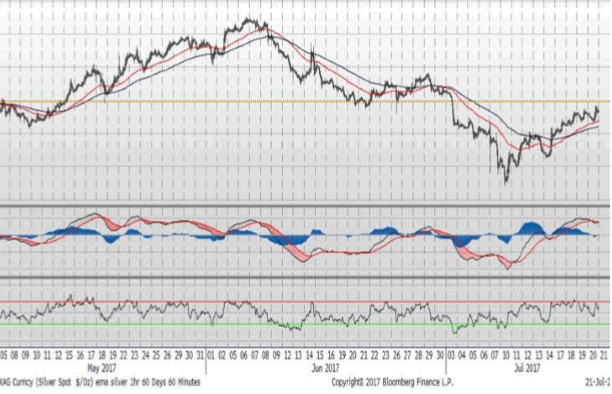

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $16.33 with gain of $0.05 or 0.31 percent at 1.00 a.m. Dubai time closing, from its previous close of $16.28

The Fibonacci levels on chart are showing resistance at $16.43 and $16.62 while the supports are seen at $15.81 and $ 15.62 respectively.

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply