Gold Bullion ‘Appeals as Insurance’ as ECB Avoids the ‘T’ Word, US ‘Risks Outright Deflation’

Bullion.Directory precious metals analysis 21 July, 2017

Bullion.Directory precious metals analysis 21 July, 2017

By Adrian Ash

Head of Research at Bullion Vault

Asian stock markets closed the day lower for a small weekly gain, while European shares held flat to trade 1% below last Friday’s finish.

Commodity indices held 1.3% higher from last weekend, with silver up 2.7% – almost twice gold’s week-on-week rise against the Dollar – at $16.42 per ounce.

Priced in the Euro, gold bullion was unchanged Friday AM from the same time last week at €1071 per ounce price, holding flat following yesterday’s “no change” decision on negative rates and €60 billion per month of QE bond buying from the European Central Bank.

Eurozone central-bank chief Mario Draghi “wants to avoid the ‘T’ word – tapering – if [he] can,” says FX strategist Steven Barrow at Chinese-owned bullion and investment bank ICBC Standard.

“[But] the ECB obviously has the intention to reduce these [QE bond] purchases to zero in time.”

Major government bond prices edged higher again Friday however, pushing the yield offered by 10-year US Treasury debt down towards 4-week lows at 2.24%.

Gold bullion’s 4-month low versus the Dollar of early July coincided with 10-year T-bond yields hitting their highest level since March at 2.40%.

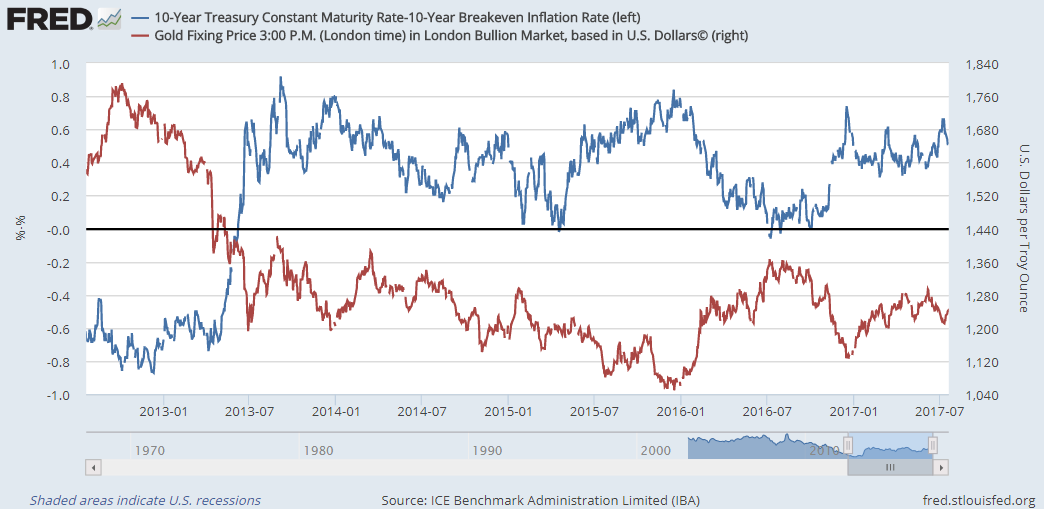

Adjusted for market-based inflation expectations, 10-year US yields have risen sharply since last July’s 3-year low, just below zero.

Gold priced in Dollars has retreated almost 10% from its 2-year high hit that same day.

“If inflationary pressures are indeed ebbing in the US economy,” says this week’s Global Strategy note from Albert Edwards at French investment and bullion market-making bank Societe Generale, “this begs the question…

“If the third-longest [economic growth] cycle in US history cannot produce a cyclical uplift in wages and prices, what on earth will happen in the next recession?

“Investors might give some thought to the fact that we are now just one recession away from Japanese-style outright deflation!”

“Any large disappointment in the [global economic] growth story will lead to an increase in gold prices,” said Dominic Schnider at Swiss bank and London bullion market maker UBS’s Wealth Management division in Hong Kong today.

“The appeal of gold as an insurance asset is greater today than it was at the beginning of the year.”

“That gold is holding around these levels we find encouraging,” says his UBS colleague in London, precious metals analyst Joni Teves.

“It suggests to us that gold continues to be viewed as a [portfolio] diversifier and this should help keep the market supported overall.”

This week’s liquidation of giant exchange-traded gold vehicle the SPDR Gold Trust (NYSEArca:GLD) ended on Thursday, keeping the ETF’s gold backing unchanged at 5-month lows of 816 tonnes.

Gold prices in Shanghai rose versus the Yuan on Friday, but Chinese premiums over global quotes fell, dropping towards $7.50 per ounce above London – the smallest incentive to new imports into the world’s No.1 consumer nation since early June’s 7-month peak in Dollar prices.

“Momentum indicators are bullish,” says the latest daily technical analysis from London bullion clearing bank Scotia Mocatta’s New York office, “and [is] biased to the upside as long as gold closes above the 200-day [Moving Average]” now at $1230 per ounce.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Leave a Reply