Precious Metals Market Report

Friday 16 June, 2017

Fundamentals and News*

Gold Climbs From Three-Week Low as Investors Weigh Fed Rate Path

Gold advances from lowest close in almost three weeks as investors assess probability of future U.S. interest rate hikes after Federal Reserve raised borrowing costs for third time in six months Wednesday.

Bullion for immediate delivery +0.2% to $1,263.26/oz by 1:43pm in Singapore: Bloomberg generic pricing

Precious metal -0.5% Wed. to $1,260.86, lowest close since May 25

Bloomberg Dollar Spot Index little changed after -0.2% Wed.

Policy makers maintained outlook for one more hike in 2017 and set out some details for how they intend to shrink $4.5 trillion balance sheet this year

“Despite the Fed’s decision to raise rates and commit to a path of interest rate normalization, there remain concerns about the outlook for inflation, and future rate hikes,” John Sharma, an economist at National Australia Bank, says in email

With Fed stating that its committee is monitoring inflation developments closely, markets interpreted this as sign future rate rises will be more measured, which should support gold: Sharma

NOTE: Yellen Doubles Down on Bet Hot Job Market Stokes Inflation

“If the market starts pricing in the end to the current hiking cycle, this would remove a major headwind for gold and allow prices to breach the stubborn $1,300 threshold in a sustained move higher,” Suki Cooper, an analyst at Standard Chartered, writes in June 15 note

NOTE: Mueller Said to Examine Whether Trump Sought to Slow Flynn Probe

In China:

Bullion of 99.99 percent purity -0.5% to 277.88 yuan/gram on Shanghai Gold Exchange, fifth decline in six days

On Shanghai Futures Exchange: o Gold for Dec. -0.5% to 280.35 yuan/gram o Silver for Dec. +0.2% to 4,063 yuan/kg

In other precious metals:

Spot silver +0.6% to $16.9970/oz

(*source Bloomberg)

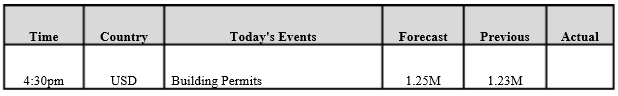

Data – Forthcoming Release

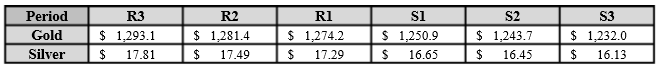

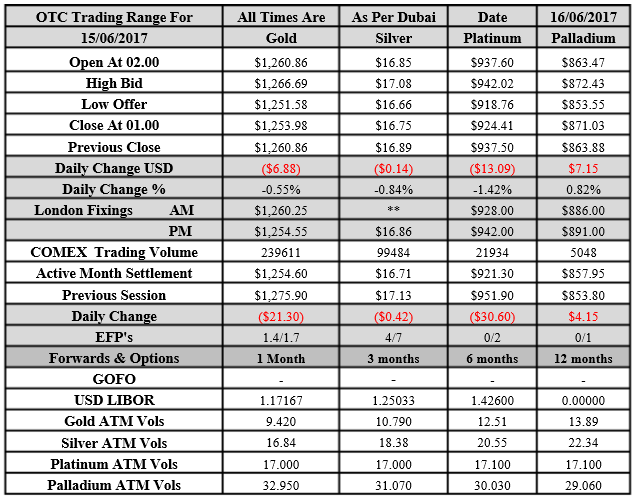

Technical Outlook and Commentary: Gold

Gold for Spot delivery was closed at $1253.98 an ounce; with loss of $6.88 or –0.55 percent at 1.00 a.m. Dubai time closing, from its previous close of $1260.86

Spot Gold technically seems having resistance levels at 1274.20 and 1281.40 respectively, while the supports are seen at $1250.90 and 1243.70 respectively.

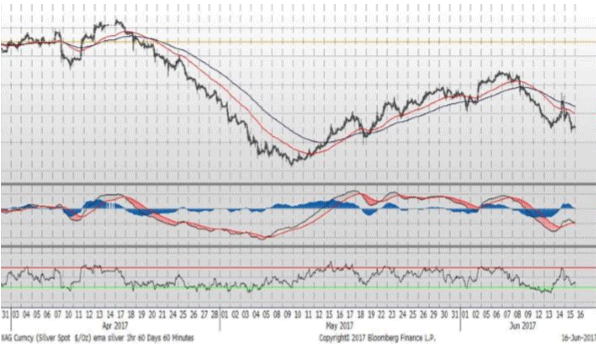

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $16.75 with LOSS of $0.14 or -0.84 percent at 1.00 a.m. Dubai time closing, from its previous close of $16.89

The Fibonacci levels on chart are showing resistance at $17.29 and $17.49 while the supports are seen at $16.65 and $ 16.45 respectively.

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply