With the US Dollar breaking higher, gold sentiment has plunged to near record low levels

Bullion.Directory precious metals analysis 26 September, 2014

Bullion.Directory precious metals analysis 26 September, 2014

By Terry Kinder

Investor, Technical Analyst

Acting Man, one of my picks for best investing blogs, recently published an excellent article on gold sentiment. In it, they point to the Hulbert Gold Newsletter Sentiment Index (HGNSI) as one measure of just how negative gold sentiment has turned:

As it turns out, the current level of the HGNSI stands at nearly minus 47%, which happens to be the second-highest bearish sentiment expression in 30 years (the highest was recorded in June 2013).

The HGNSI has been a good contrary indicator for the gold price. When the newsletter writers are very bearish on the gold price, that’s exactly the time to buy, rather than follow their recommendations to sell gold.

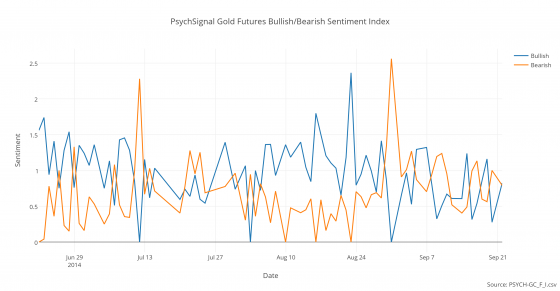

Another measure of gold sentiment is PsychSignal’s Gold Futures Bullish/Bearish Sentiment Index.

Follow the bouncing ball of gold sentiment with PsychSignal’s Gold Futures Bullish/Bearish Sentiment Index

Note: For an interactive view of PsychSignal’s Gold Futures Bullish/Bearish Sentiment Index click here.

Acting Man notes that SentimentTrader, like the HGNSI, also paints a grim picture of gold sentiment:

A similar picture is indicated by Sentimentrader’s industry group sentiment table, which shows that gold and energy stocks are currently at the maximum bearish level they can reach by this measure…

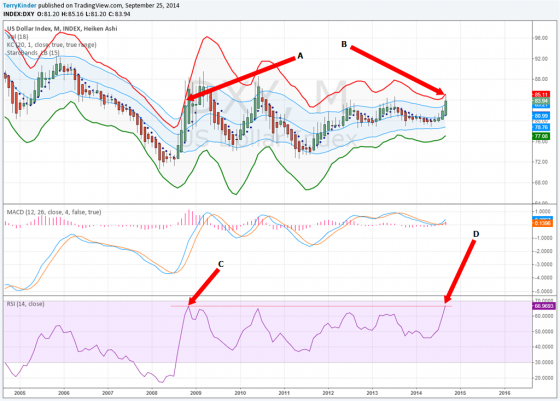

Another important factor affecting gold sentiment has been recent US Dollar strength. We discussed some of the challenges facing the US Dollar from a technical perspective in US Dollar Technicals. While the DXY did finally manage to push above $85.00, it may have some difficulty staying there.

A higher US Dollar has pushed gold sentiment lower. But the dollar faces some challenges to stay above $85.00

Looking at the chart above there are four points of interest:

A) The last time the US Dollar Index (DXY) touched the red Starc + (plus) band, the dollar price reversed after a few months. Eventually the dollar fell to a little over $74.00;

B) This month the DXY price touched the red Starc + band again. It could, of course, touch the band next month too. However, short of the dollar entering a major new bull market, it is likely the dollar will reverse lower within a few months as it did back in 2008;

C) RSI for the DXY climbed to near 66.5 back in 2008;

D) RSI has topped 67 this month. You would have to go back to 2002 for a higher RSI reading for the DXY.

Anything is possible, but how probable is it that the dollar will resume the 1990’s to early 2000’s bull market, given the state of the US economy, government debt levels, etc.?

Acting Man concludes their comments on gold sentiment with:

Gold looks technically quite weak, and whether the slight divergences that are still in evidence at the moment are meaningful remains to be seen. However, since sentiment has reached extremes in both gold and the dollar, a short term trend change is likely quite close.

Note here that an average of the most important sentiment surveys shows the bullish consensus on the US dollar to be at 87% at present, which is in fact a record high. Investors are even more bullish on the dollar today than they were at its highs in 2000 and 2001.

The comparable statistic for gold is at 18% bulls, which is not a record low, but definitely among the lowest readings on record (most of the lowest bullish sentiment readings in gold were produced in 1998/99 and 2013).

Once a rebound gets underway, its technical quality and the evolution of the fundamental and sentiment backdrop will have to be assessed to see whether it is just another short term blip or something more. As Dan Popescu noted, it is certainly possible that gold violates the support levels of 2013 (given that it is only a little over 30 dollars above them), but such a break is not likely to be sustained in the short term in light of the current sentiment backdrop.

The contrast between awful gold sentiment at 18% gold bulls versus 87% dollar bulls is stunning. It has been a long, hard slog lower for the gold price. There are valid reasons to be bearish on gold, but the extremes in gold sentiment and dollar bullishness also give good reason to pause and re-evaluate the current situation.

When everyone is piling into one side of the boat, you might want to consider whether or not it is time to move to the other side.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply