Gold Price ‘Unmoved’ by Catalonia, Down 7 Months in 12 as US Stocks Up in 11 Ahead of the Fed

Bullion.Directory precious metals analysis 01 November, 2017

Bullion.Directory precious metals analysis 01 November, 2017

By Adrian Ash

Head of Research at Bullion Vault

Gold popped to 1-week highs at $1280 per ounce in Asian trade overnight as the Caixin PMI survey said Chinese manufacturing activity held near stall-speed in October.

Bullion prices then retreated to stand unchanged for the week so far at $1273 as European stock markets followed Wall Street higher towards fresh all-time records, and private-sector US data put October’s jobs growth well ahead of analyst forecasts.

Ex-Catalan governor Carles Puigdemont refuses to attend tomorrow’s court hearing in Spain over charges of rebellion, his lawyer said Wednesday, but will answer questions instead from Belgium where he has fled.

Colleagues of Puigdemont today returned from Belgium to boos and shouts of “Prison!” from a small group of pro-Spanish protesters at Barcelona’s El Prat airport.

“Tensions in Catalonia have not attracted safe haven flows to gold,” says a note from Swiss bank and London bullion market-maker UBS, “which is in line with the limited impact on other markets as well.”

“Gold [also] seems to be seeing little benefit from safety flows on the back of Special Counsel Robert Mueller’s investigation,” says refining and finance group MKS Pamp of alleged Russian government links to Donald Trump’s 2016 election campaign.

Despite last month’s unofficial Catalan referendum and declaration of independence, the gold price in Euros added only 0.4% in October, edging 5 Euros higher per ounce today to EUR1096 per ounce.

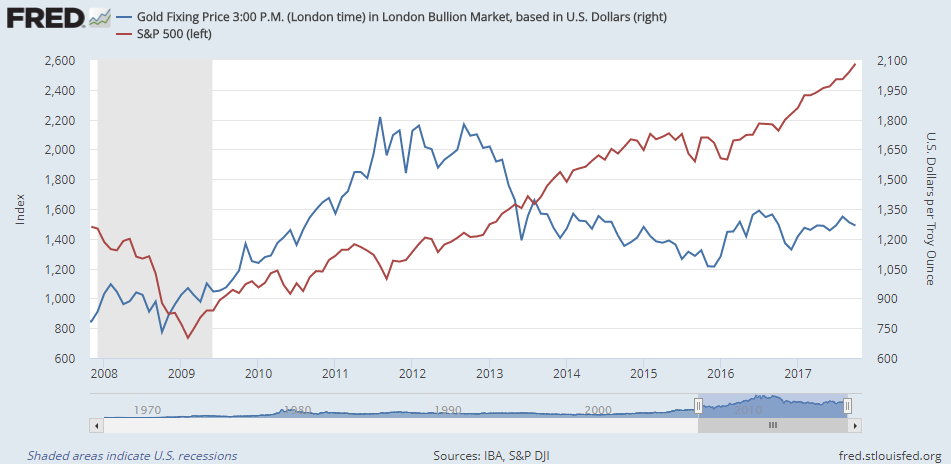

Gold priced in Dollars fell 1.3% in October, its 7th monthly drop of the last year.

New York’s S&P500 index of stocks in contrast rose 2.2%, its 11th monthly gain of the last year and its 7th new all-time record monthly closing high in succession.

“Asian interest today was again rather muted [but] Shanghai saw a heightened premium [to global quotes for London settlement] around $9 per ounce” – back in line with the historical average.

With only 1.5% of bets on US interest-rate futures now expecting any change at Wednesday’s US Federal Reserve decision, “All eyes will be on President Trump’s nomination for the Federal Reserve Chair,” MKS goes on.

“Should [existing Board member] Jerome Powell get the nod, we are likely to see near-term Dollar weakness that should underpin a move higher for bullion.”

Choosing Powell “could lead to some consolidation in the Dollar [and] offer some relief to gold,” agrees UBS.

“However, headwinds linger for now,” it adds, pointing to this week’s debate in Congress on Trump’s US tax reforms plus the December Fed meeting on interest rates, now 96.7% certain to see a hike to a ceiling of 1.50% according to data from derivatives exchange the CME.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply