“FedCoin,” Dollar Abandonment May Signal the End of Global Reserve Status

Bullion.Directory precious metals analysis 14 May, 2021

Bullion.Directory precious metals analysis 14 May, 2021

By Peter Reagan

Financial Market Strategist at Birch Gold Group

These “Fedcoins,” according to The Economist, “are a new incarnation of money. They promise to make finance work better but also to shift power from individuals to the state, alter geopolitics and change how capital is allocated.”

The same piece also reveals the increased level of support for digital money: “Over 50 monetary authorities, representing the bulk of global GDP, are exploring digital currencies.”

But perhaps more importantly, “Fedcoins” could signal the beginning of an abandonment of the U.S. dollar, as The Economist highlights:

They could alter geopolitics, too, by providing a conduit for cross-border payments and alternatives to the dollar, the world’s reserve currency and a linchpin of American influence.

Right now, the U.S. dollar occupies only 59.02% of the total global currency reserves, according to the International Monetary Fund.

But as the total reserve increased by 3.57% from Q3 to Q42020, the U.S. dollar’s share of that reserve shrunk to an all-time low (and has been steadily dropping since 2016). That means the dollar’s hegemony as global reserve currency is waning.

And that is incredibly important. The dollar’s role as a global reserve currency over the decades has allowed the U.S. to issue a historically-unprecedented amount of debt, and even sustained the dollar’s value against other currencies.

Before we go further, let’s explain exactly what we’re discussing.

What is a global reserve currency?

Investopedia has a terse but useful definition:

Currency maintained by central banks and other major financial institutions to prepare for investments, transactions, and international debt obligations, or to influence their domestic exchange rate. A large percentage of commodities, such as gold and oil, are priced in the reserve currency, causing other countries to hold this currency to pay for these goods.

Here’s what that means:

- “Maintained by central banks and other major financial institutions” means a lot of people want to hold dollars.

- “Influence their domestic exchange rate” means that some nations actually hold dollars as part of their central bank reserves (the same way they hold gold). Want a stronger local currency? Buy more. Want a weaker currency to make your exports cheaper? Sell dollars.

- “A large percentage of commodities” means that anything priced in dollars gets paid for in dollars, no matter where you are.

- “Causing other countries to hold this currency” means the U.S. dollar functions as an intermediate currency in international transactions. If a textile mill in Pakistan wants to buy cotton from an Egyptian farm, the deal gets negotiated and paid in U.S. dollars. This reduces exchange rate risk between the two parties and encourages both importers and exporters to have dollars in their banks for future transactions.

Now, these are all very good reasons for global companies, central banks, and virtually everyone to have at least some U.S. dollars.

And where do they get those dollars? The U.S. government’s debt: Treasury bills and notes. There’s been a massive, global demand for dollars for over 60 years. Even better, from the federal government’s point of view, because all these institutions need dollars, they usually roll the debt forward. When their bonds mature they use the proceeds to buy more bonds.

That would be like your credit card company telling you, every month, “Don’t worry about your balance, pay us later.” For years. For decades. In a sense, the U.S. has charged a massive amount it’s really never had to pay off.

As we’ve seen above, though, that global dollar demand is waning. At the worst possible time, too, just when the supply of U.S. dollars is at a record high.

(That’s probably one reason we’ve seen the dollar’s strength vs. other currencies fading over the last few years.)

But that’s not the worst that can happen…

How global reserve currency empires crumble

If the U.S. dollar loses its status as global reserve currency, the economic future for the U.S. isn’t going to look pretty.

And history shows us exactly what this process looks like. The same thing happened to the U.K.’s pound sterling after World War I.

Professor Avinash Persaud of Gresham College, a former currency strategist, takes us through this scenario. Quotes below are from his lecture.

Before:

If your currency is a reserve currency, you can pay for things by writing cheques, which nobody cashes. This is exactly what the US has done in recent years. National expenditure has exceeded national income by more than 20% over the last five years.

Writing checks that nobody cashes is shorthand for issuing debt. When the U.S. wants to spend money, there’s a ready market for U.S.-issued IOUs, just like we discussed above.

The U.S. can, in a sense, do what it wants on the global stage. Lots of nations and corporations are anxious of upsetting the U.S. because they can effectively be locked out of global markets. Furthermore, the U.S. can spend as much as it wants.

And that’s great! So long as it lasts forever…

After:

There will be an avalanche of checks coming home to be paid when the dollar begins to lose its status. Of course excessive debt in your own currency is also spelled inflation. [Emphasis added]

We will have to wait and see if that “avalanche of checks” shows up. Regardless, one thing is certain, inflation is rising fast, so it’s possible Professor Persaud may end up being correct.

To make matters worse, certain Fed officials that deal with inflation daily appear to be “running cover” for the fact inflation is starting to heat up.

Wolf Richter identified some of these officials, “such as Fed Vice Chairman Richard Clarida who came out this morning in droves and said they were ‘surprised’ by the red-hot CPI inflation.”

But Wolf also added a key point: “There was nothing to be surprised about.”

We aren’t surprised either. In fact, we’ve been reporting on the potential for rising inflation, and each report seems to get more dire.

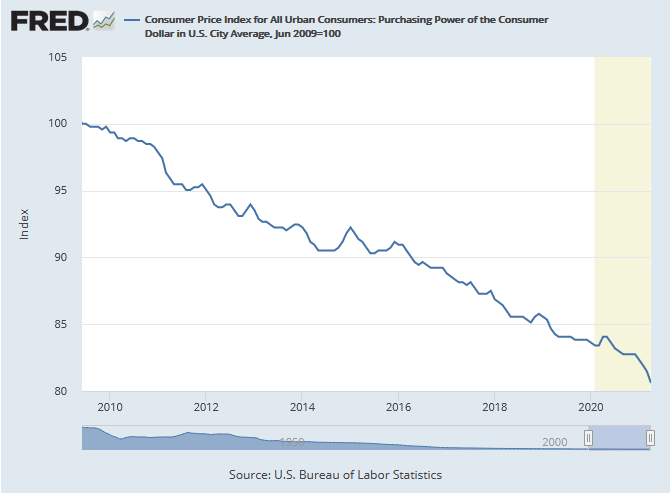

Adding fuel to the fire, the dollar’s purchasing power keeps tanking:

At some point, various reports that you can file away in the back of your mind turn into warnings that are hard to ignore.

Maybe it’s time to listen and consider heeding the warning.

Consider doing what central banks do

It might surprise you to learn that central banks have been buying gold in large quantities even as prices were soaring last year:

Indeed, central banks now hold $2 trillion in gold, around 35,000 tonnes, according to Ryan Giannotto, director of research at gold-based ETF GraniteShares.

Do you know why central banks hold gold? Because it’s an internationally-recognized and accepted store of value. Gold is fungible, much easier to transport than other commodities (which is why there was never a “copper standard” or a “cotton standard”), doesn’t go bad in storage, and no one can suddenly decide to make more. Gold in a central bank vault can’t be hacked.

A lot of individuals have taken a cue from central bank attitudes toward gold: “Its status as a safe-haven in times of economic crisis, together with its tendency to profit from a weaker U.S. dollar, has driven investors into the market in droves” writes Saloni Sardana.

So perhaps it’s time to consider doing what the central banks do, and shift a portion of your assets into physical gold (and silver)? Precious metals have been a proven store of wealth for thousands of years.

In times of instability, they have been viewed by many as a safe haven, used to preserve wealth and add security to an otherwise uncertain financial future. That’s probably why central banks want to own lots and lots of gold; because it seems like the safest bet when the present looks doubtful and the future looks grim.

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply