An insight into when silver should be considered over gold

Bullion.Directory precious metals analysis 18 May, 2022

Bullion.Directory precious metals analysis 18 May, 2022

By Peter Reagan

Financial Market Strategist at Birch Gold Group

Both are time-honored safe haven investments. Economists widely agree that both gold and silver share many virtues: Easily accessible and redeemable, highly liquid, historically used as money, intrinsically valuable and free of counterparty risk.

The parallels lead some to call silver “poor man’s gold.”

That’s not a helpful description, however. There are enough differences between gold and silver to lay to rest the idea that silver is just gold’s pale little brother.

Here’s how editor Justin Verghese distinguished the two.

Gold is the safer investment and a more accurate gauge of both inflation and market sentiment. It will track the latter two closer than silver because it is primarily a safe-haven protection against loss, whether from crashing markets or corrosive inflation.

While gold is used for plenty of industrial purposes, it’s mostly used in extremely small quantities – the World Gold Council reports that so far this year, just 7% of gold’s demand comes from industrial applications. Financial demand from central banks, institutional and individual investors is vastly more important.

Gold is purchased as a safe-haven, and even if industrial and manufacturing demand decline from economic stress, gold’s price barely notices. Gold is likely to outperform anyway because its primary source of demand isn’t due to its conductivity. In other words, gold is a strongly anti-cyclical asset, tending to rise when the economy staggers.

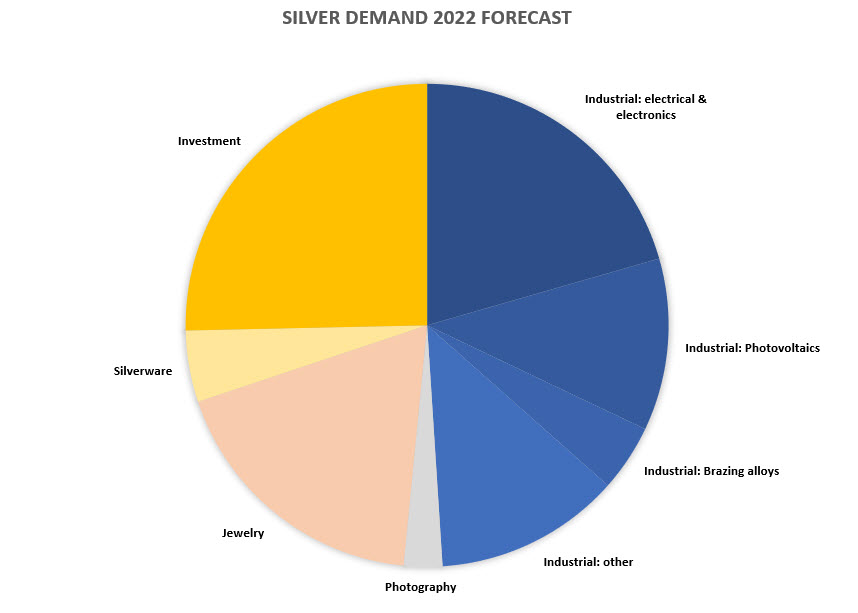

Silver is quite different, and not just because its price per ounce is lower. Silver, like gold (and by extension commodities generally), makes for an excellent inflation hedge. However, silver’s primary source of demand is industrial applications. Here’s the overall demand picture for silver, based on data from the Silver Institute:

Industrial uses in shades of blue to distinguish them from other sources of demand. Data source

Only one quarter of silver’s customers are investors purchasing physical bars and coins. The majority of silver’s demand comes from manufacturers, with jewelry as a strong third-place demand source. What do manufacturing and jewelry have in common? Both sectors are strongly pro-cyclical, growing alongside the economy. Industrial uses are “more vulnerable to recession and pressures affecting manufacturing companies.”

This is what can cause silver’s price to pull in both directions. In times of economic downturns, investment demand soars but industrial demand plummets. Silver sometimes tracks the price of gold in these cases, but not as tightly as some would hope. Volatility plays a strong role in the silver market, as well. Verghese explains why:

The silver market is much smaller than the gold market, and as it’s more thinly traded than gold, silver can demonstrate far greater volatility, or price swings, than its glittering counterpart. For instance, historically, the grey metal has frequently leapt nearly 15 per cent in a single day, for example.

Gold simply doesn’t display that level of volatility. And even during times when everyone is pointing out the potential opportunity of “undervalued silver”, this kind of volatility can’t be ignored.

So it might be most accurate to treat silver as a riskier hedge than gold. It will introduce some of gold’s safety properties to your savings, albeit in a more volatile manner. Verghese comes down as pro-silver:

Market experts and economists always recommend investing in a risk-free low valued asset like silver. It is so because neither your money will be blocked nor the value of silver will depreciate. Commodity analysts widely reiterate that the same amount of money buys you a lot more silver than gold, and silver has the potential to offer more profit.

The two metals share the same tangible asset strengths compared to stocks and bonds. In a sense, we could think of silver as a tangible-asset alternative to pro-cyclical stocks, while gold is a tangible alternative to the traditional safe-haven asset class of government bonds.

Ultimately, we don’t have to pick just one. Diversifying your savings between physical gold and silver, as well as other asset classes, may be the recipe for success.

Bonds fail to protect as they have throughout history, what about gold?

Today, the oft-recommended 60/40 stock/bond portfolio is punishing its fans, and the latest analysis by Verdad’s team shows us why.

In theory, the 60/40 portfolio isn’t a terrible idea: Stocks provide high risk/high return potential, and low-risk bonds deliver safe but unexciting returns. The two asset classes tend to be negatively correlated, meaning the move in opposite directions. When bonds fall, stocks rise – and vice versa. For decades, the standard-issue financial advice was:

- Invest 60% in the S&P500 and 40% in government bonds

- Contribute monthly

- Rebalance regularly

- Retire wealthy

So much for theory… Since the beginning of the year, stocks are down some 15%, the bond market seemed eager to leap off the same cliff. U.S. bonds are down some 11% so far this year, with long-term Treasuries down 18% (as of April 30). The far-from-hysterical WSJ called this the “Worst Bond Market Since 1842.” bond market is in its worst state since 1842. The hapless American who followed the off-the-shelf asset allocation advice wakes up to a “conservative” savings down nearly 9% (so far).

So what’s going on? Why have bonds failed in their wealth-preservation role?

Unsurprisingly, it’s the Treasury’s intrinsic link to the Federal Reserve. For all its alleged safe-haven benefits, the Treasury bond is still subject to both the Fed’s whims and the general state of the U.S. economy. Let’s turn to the Verdad team for more details.

Verdad’s in-depth analysis can be summarized with a brief sentence:

The Fed was too slow to react to inflation – and now is raising interest rates while economic growth is slowing.

The Fed’s hiking cycle is too little and too late. Higher interest rates are supposed to cool down an overheated economy – but they have the same chilling effect on a stagnant, or shrinking economy, too… Today, economic growth is slumping, but inflation is nowhere near contained.

As the report outlines, the 60/40 allocation fails during periods of stagflation, such as the one we are in right now. There are many other concerns. As has been said over and over, the Fed has no way out of this self-created mess. Rising rates will collapse the bond market and bring about a recession, while pulling back on the policy will bring on an extended period of double-digit inflation.

Verdad’s analysts conclude:

Gold looks like an attractive hedge if past is prelude.

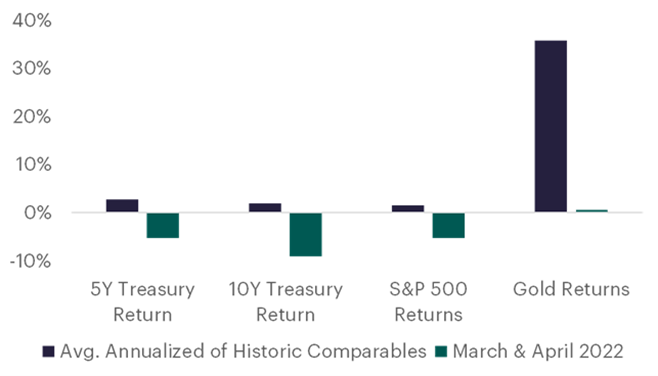

They studied four comparable historical periods where the Fed had left interest rates too low for two long, and compared investment returns in following periods:

They conclude their report with a suggestion:

When stagflation strikes, the stock-bond approach to diversification fails… it makes sense for investors to shift toward shorter-duration credit and to substitute some of their safe-haven asset exposure to gold, which has historically performed well in these environments. The past month has been no exception to this observation. Gold has outperformed Treasurys by a wide margin.

Harvard economist warns of severe recession

When the Federal Reserve began its hiking cycle, recessionary concerns were mild for most. Now, they’re knocking on the door. Kenneth Rogoff, a Harvard economics professor, said in a recent interview that runaway inflation is much more difficult to rein in that Fed officials would like to admit.

The only method the Fed has is raising interest rates. Yet every hike brings the economy closer to a recession. The general consensus is that, with the highest inflation and the fastest pace of rising inflation in decades, the Fed would need a massive hiking cycle to normalize it. According to Rogoff, this is simply not feasible:

I don’t think they’ll go that far. My best guess is they fall short. They raise interest rates to 3-3.5, and we’re left with a very soft economy and still inflation.

The more inflation soars, the harder it is to contain, explained Rogoff. And, right now, the Fed’s only tool are interest rate hikes, which can only be used sporadically and are expected to have a minimal positive impact. Some believe that even the slower hiking cycle that Rogoff has outlined will be more than enough to trigger a recession.

It’s certainly a tailor-made environment for gold, as Rogoff went on to say that the Fed’s lackluster showing is only one of many things that spell disaster. Rogoff said that growth slowdowns and rising prices will become a worldwide phenomenon and in turn worsen the same phenomenon on the domestic front.

Furthermore, Rogoff said that high inflation will hammer the stock market and clamp down on the absurdly high profit expectations that tech stocks (and tech stock investors) have become dependent on.

Rogoff seems to think a severe recession is the Fed’s best-case scenario – and a stock market meltdown is inevitable. It’s odd to hear this perspective from the co-author of This Time Is Different: Eight Centuries of Financial Folly, who told us:

Every few decades, the economy’s major players develop bulletproof confidence in the efficiency of markets and the health of the economy. Known as “this-time-is-different syndrome,” this unrealistic optimism afflicted bankers, investors and policy makers before the 1930s Great Depression, the 1980s Third World debt crisis, the 1990s Asian and Latin American meltdowns, and the major 2008-2009 global downturn. Conditions differed, but the same mindset – a dangerous mix of hubris, euphoria and amnesia – led to each of these collapses. In each case, decision makers adopted beliefs that defied economic history.

Will this time really be different? Don’t bet your future on it!

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply