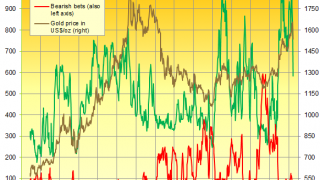

GOLD PRICES headed for their lowest weekly close in 4 in London on Friday, erasing the last fortnight’s gains to trade at $1676 per ounce as stock markets also fell in Asia, the UK and the Americas.

Full Article →Monster Mining Gains Look Good for PMs

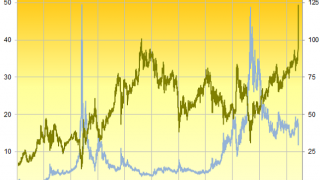

For the first time in a very long time, mining stocks are showing leadership. That has profound implications for precious metals markets.

Full Article →Gold prices headed for their highest US Dollar month-end since November 2012 as European stock markets fell after the 19-nation Eurozone’s central bank followed the US Federal Reserve in announcing no new major stimulus or aid

Full Article →What’s Next? Trillion-Dollar Coins?

The massive set of stimulus measures rolled out last month by the Treasury Department and Federal Reserve has left many Americans wanting more… and politicians scheming for new ways to dole out additional trillions in cash.

Full Article →Is This the End of Physical Cash?

Whether it’s the People’s Bank of China or the U.S. Federal Reserve, central bankers are keen on giving themselves more power to manipulate economic outcomes.

Full Article →Nobody in Washington even wants to know exactly where the Fed’s trillions go anymore. The rest of us, however, can make a pretty good guess just by watching CNBC.

Full Article →Gold Steady as Crude Sinks to 21-Year Low

GOLD steadied Monday as stock markets retreated from last week’s gains and US crude oil prices fell to new 21-year lows despite the Trump White House pushing some states to relax Covid Crisis lockdown

Full Article →“The outlook for gold shows a more bullish trajectory than the 2009-2012 cycle” says a research note from Canadian financial services group and bullion dealers Scotiabank.

Full Article →Precious Metals and the Coronavirus

The metals markets are being pulled in multiple directions simultaneously like never before. The global virus-triggered economic freeze has caused industrial demand for all commodities to crater.

Full Article →All Economic Recovery Models Will Be Wrong Too

All medical projection models are being proven wrong. And investors should be skeptical of any particular projection models for the economy or financial markets. They will all be wrong to some extent.

Full Article →As cracks appear in the COMEX story, it is starting to look like a lot of speculators who hold paper gold and hope to redeem that for actual bars could be disappointed.

Full Article →With businesses and Americans defaulting on their rent and other obligations only days into the collapse, the problem is clear: Few have any savings…

Full Article →Elon Musk Stuns Scientists as He Buys RemoveDEBRIS Project, Beginning New Gold Rush. Musk announced by a video-link conference Tuesday he was planning a mission to capture asteroid (52768) 1998 OR2

Full Article →If for some inexplicable reason you’re still waiting to acquire the silver (or gold) you hope to purchase, the question right now is, “How lucky to you feel?”

Full Article →It appears that while bars may exist in the U.S., too few are categorized as “registered” and therefore can’t be released for purposes of making delivery. Prices may have to go higher before the owners are willing to part with actual physical bars.

Full Article →GLD Sees Heaviest Investor Inflow Since 08 Financial Crisis

Global stock markets slipped, while the US Dollar returned to rising – suggesting a new dash for cash after a 4-session break – after President Donald Trump abruptly abandoned his ambition to return American life to normal by Easter

Full Article →GOLD PRICES headed for their strongest weekly gain since late 2008 on Friday, adding more than 8.2% as the rebound in global stock markets faded despite governments and central banks unleashing record financial aid

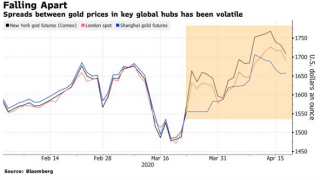

Full Article →GOLD PRICES fractured worldwide, with dealing spreads widening sharply while the US derivatives market spiked $100 per ounce above global market reference point after Boris Johnson put UK into official coronavirus lockdown.

Full Article →Gold Jumps on Fed’s Third Easing

GOLD PRICES jumped Monday, reaching 3-session highs above $1525 per ounce as government bond prices rose but world stock markets and commodities fell yet again after the US Federal Reserve made its 3rd unscheduled emergency policy change of March 2020 so far, aimed at “supporting the economy” amid the Covid-19 shutdown.

Full Article →GOLD prices in London, heart of the world’s wholesale bullion markets, again tried to rally above $1500 per ounce on Friday, while global stock markets bounced together with industrial metals and major government bond prices as the death-toll from novel coronavirus rose past 10,000

Full Article →“Silver is nature’s finest germ killer. Simply by being silver, this most precious metal’s elemental properties are toxic to pathogenic microorganisms while simultaneously being non-toxic to healthy cells and probiotic bacteria. “

Full Article →The disconnect between paper prices for precious metals and demand in the bullion markets has never been clearer as nervous investors are frantically buying coins, rounds, and bars.

Full Article →Crashing Markets And the Next Great Inflation

Before investors jump on the deflation bandwagon, they should carefully consider the monetary and political forces that could be deployed to reverse a whiff of deflation.

Full Article →Covid-19 Financial Doomsday – The Time Is Nigh

We appear to be entering the sort of scenario that doomsday preppers have been warning about for years. A pandemic is spreading death and panic around the world. Markets are crashing. Store shelves are emptying…

Full Article →Stocks have long been priced for perfection and suddenly conditions are looking far from perfect. The coronavirus may be the pin which pricks the latest Fed-blown bubble.

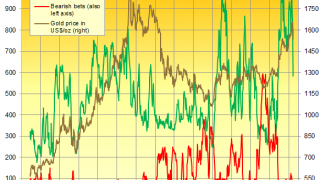

Full Article →During turbulent times like these, markets can be melting down one day… and zooming higher the next. Gold may serve as a fantastic safe-haven asset one day… but get hammered by futures traders the next.

Full Article →A futures contract is not an asset with intrinsic value. It is nothing more than a wager on the price of the metal on a particular future date. There is ultimately a winner and a loser for each wager.

Full Article →The Final Curtain for Silver and Gold Eagles

The Silver and Gold Eagles, considered to be the most popular bullion coins in the world, will finally be getting a face lift… or least a “tail” lift.

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.