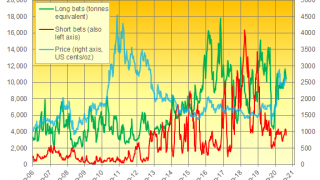

SILVER surged Monday morning towards 8-year highs at $30 per ounce after “the call-to-arms” on Reddit brought record new interest to precious metals

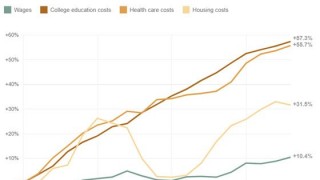

Full Article →Potentially Catastrophic Inflation Surge Slips Under Radar (Until Now)

You’ve read about housing market bubbles, stock bubbles, and even credit bubbles. But the next bubble you’re about to discover could be even more dangerous, and may have even more far-reaching consequences.

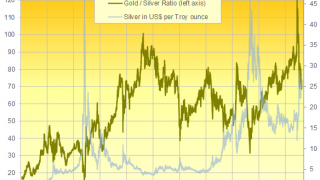

Full Article →GOLD PRICED in terms of sister metal silver fell near its cheapest in 4 years in London’s bullion market Friday, despite rising near 3-week highs of its own in the aftermath of silver’s dramatic jump after users of the Reddit chatroom called on other readers to buy shares in the cheaper precious metal’s largest ETF trust.

Full Article →Does America REALLY Have a Retirement Crisis?

Because no matter what the headlines say, tangible physical assets can act as a hedge against inflation and diversification helps protect your savings no matter which direction the stock market heads. Take the steps you need to keep your retirement on track with a “sleep well at night” savings strategy.

Full Article →Biden Will Preside Over Another Financial Crisis

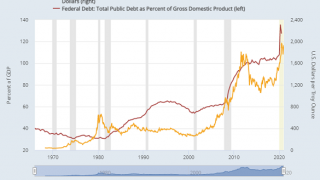

As Treasury Secretary Yellen together with her protégé Jerome Powell at the Fed prepare to pursue “weak dollar” policies and coordinate globally with other central planners, investors may find that the world’s strongest currencies are physical precious metals.

Full Article →Demand for Physical Bullion Surges…

America will face an increasingly authoritarian federal government ruling over a largely apathetic populace… Gold bugs aren’t betting on bridges being built any time soon – demand for physical metal ratcheted up to a new all-time high in January.

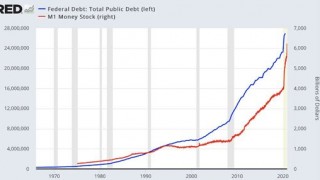

Full Article →The recent explosion of money printing and debt-funded spending by the U.S. in response to the Covid-19 pandemic has sparked a renewed interest in the key role gold and silver play in hedging against systemic risks.

Full Article →Anyone who owns precious metals, mining shares or metals’ ETFs knows the drill. First, gold and silver begin to establish an uptrend on the charts. Analysts (like us) start writing about how prices are getting ready to make an upside run…

Full Article →Investors Prepare for the Incoming Regime…

Last year provided extraordinary challenges to Americans as well as people around the world. Hundreds of thousands of deaths were attributed to the Chinese coronavirus. The economic carnage and the attendant death and suffering along with the loss of civil liberties was grossly underreported.

Full Article →What’s Next For Internet Censorship?

On Wednesday, the Democrat-controlled U.S. House of Representatives voted to impeach President Donald J. Trump for a second time – this time with just a few days left in his term. It was a mostly symbolic rebuke. Financial and precious metals markets barely budged on the news.

Full Article →New Tightness Looms on Minted Gold & Silver

It’s happening again. Even before the conflagration occurred in Washington DC last week, retail demand for gold and silver had been rising sharply since late last year.

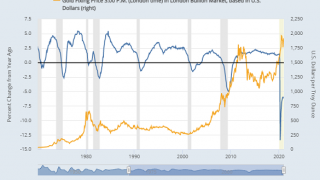

Full Article →GOLD PRICES fell Friday in London even as infections, deaths and economic lockdowns in the winter wave of Covid-19 worsened worldwide and new US data said the world’s largest economy shed jobs last month rather than expanding as Wall Street expected.

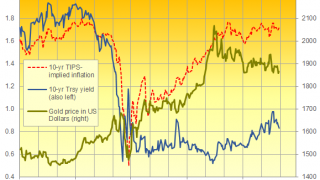

Full Article →GOLD PRICES slipped further on Thursday, extending yesterday’s 2.1% plunge from new 9-week highs even as US interest rates lagged inflation forecasts by a wider margin – usually a driver of higher gold prices – and US President Donald Trump was condemned worldwide for inciting angry supporters to storm the Capitol in a violent and failed attempt to stop Democrat Joe Biden taking over at the White House in 2 weeks’ time.

Full Article →2021: Time For a Portfolio Reset?

If global elites have their way, 2021 will be the year of the “Great Reset.” They believe now, after the coronavirus and lockdown policies have inflicted a heavy toll on the public, is the perfect opportunity to implement their technocratic vision.

Full Article →Outlook 2021: Dollar Debasement Ahead!

In a year that was marred by a global pandemic and a wave of economic restrictions that crippled many small businesses, financial markets proved to be resilient. Of course, that resilience owes in no small part to the unprecedented outpouring of stimulus from Congress and the Federal Reserve – and more stimulus is on the way.

Full Article →Released today, the Sound Money Index is the first index of its kind and uses 12 different criteria to determine which states maintain the most pro- and anti-sound money policies in the nation.

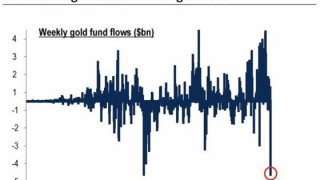

Full Article →Alarming Developments in GLD ETF…

The world’s largest gold exchange traded fund (ETF) seems to be having a lot of trouble when it comes to accounting. There’s little good reason to put any trust in GLD’s parade of CFOs or in shady HSBC bankers.

Full Article →Fed Recommits to Misleading Public About Inflation

Did the Federal Reserve just usher in the next phase of the U.S. dollar’s decline? On Wednesday, the central bank recommitted to leaving its benchmark interest rate near zero for the foreseeable future. Fed officials also vowed to keep pumping cash into financial markets.

Full Article →Danger Ahead as Markets Detach from Fundamentals

Americans may start the New Year without certainty as to who will be sworn in as president on Inauguration Day. President Donald Trump and his supporters can’t find courts willing to consider their evidence of widespread voter fraud. Trump is not likely to concede.

Full Article →Gold Slips on US Vaccination Start

GOLD PRICES fell even against a weak US Dollar on Monday as Asian and European stock markets rose amid widening hopes for a vaccine-led economic recovery while the UK and EU agreed to a last-gasp extension to Brexit trade talks.

Full Article →What Happens When Confidence Falls Apart?

While we may never know how deep and wide the political elites’ effort to gain control over our government goes, it appears to be vast. Although it’s still unknown whether fraud altered the overall election outcome, the evidence of fraud is real.

Full Article →Many investors see gold and silver ETF outflows as negative signs. But I view it as a Mr. Market’s last big effort to “shake the tree,” causing as many people as possible to fall off the galloping bull and head for cover.

Full Article →Globalists Poised for a “Great Reset” – Any Role for Gold?

Although the apparent results of the 2020 election are still being contested, members of the global ruling elite are already looking forward to a post-Trump era in American politics – and a post-vaccine world economy.

Full Article →Confidence Erodes in U.S. Institutions… Is the Dollar Next?

The U.S. election system, once sacrosanct, is losing the trust of half the country. Which half will depend on the outcome of Donald Trump’s efforts in the courts to demonstrate widespread fraud.

Full Article →There is little doubt that when we return to safer pastures, gold’s attractions will be reduced…[but] what we are seeing at the moment is a market in which some participants can’t decide whether now is the time to get out, or whether there is more upside ahead.

Full Article →Pro-Gold Fed Nominee Blocked

It was only after he entered politics that President Donald Trump began to fully grasp the bias, dishonesty, and fakeness that runs throughout the so-called mainstream media – but gold bugs and sound money advocates have long known to distrust the reporting of establishment news sources.

Full Article →GOLD PRICES fell within $5 per ounce of a 4-month low in London trade Thursday, retreating to $1853 even as world stock markets fell together with long-term interest rates and commodity prices amid tighter anti-Covid restrictions plus a surprise jump in US jobless benefit claims.

Full Article →Money Metals Capital Group announced today that a consortium of capital providers have dramatically stepped up their financial backing for Money Metals’ industry leading program to provide low-interest loans to Americans wishing to borrow against their own gold and silver.

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.