China announced an increase in its official gold reserves in November. It was the first reported increase after a 6-month pause, and it appears it wasn’t a one-off event.

And by the way, the Chinese have a lot more gold than they admit.

Goldman Sachs Forecasts Huge Shift in Gold Prices

Gold’s already had six fantastic years – dare we hope for the bull run to continue? Goldman Sachs weighs in, forecasting another two years of growing gold prices (at least). Here’s why Goldman thinks the bull run may just be getting started…

Full Article →Gold Topped – But Did Silver?

Given today’s decline in gold, it appears that we took profits pretty much right at the top on Friday – at least in the case of gold – but… Was that the final short-term top? To clarify, we had gone long on Jan. 2, and I then moved the profit-take level for gold higher – to $2,733 on Jan. 3.

Full Article →Sound Money Would Check Government More Than DOGE Can

Many Americans are rooting for Donald Trump and his appointees to succeed in their herculean task of slowing or reversing government growth. There is much discussion about how runaway big government might be stopped. But there hasn’t yet been talk about how to keep it that way.

Full Article →ETF Gold Holdings Increase in December – First Time Since 2019

For the first December since 2019, gold-backed ETFs globally reported net inflows of gold. Asian funds drove the global increase in ETF gold holdings to close out 2024. On the year, ETF gold holdings dropped modestly by 6.8 tons, but assets under management rose 26 percent to a record high of $271 billion thanks to skyrocketing gold.

Full Article →Just How Good Was Gold in 2024?

Gold was one of the best-performing asset classes in 2024, outgaining the red-hot U.S. stock market. People who follow financial news know that gold had a great year. Despite its typical apathy toward gold, even the mainstream was forced to sit up and take notice. But you may not realize just how well gold did.

Full Article →British Royal Mint Using Electronic Waste to Produce Jewelry

How awesome would it be to dig around in your garbage can and find gold? Well, that’s pretty much what the British Royal Mint is doing. No, you won’t find mint employees dumpster diving, but they have developed a process to turn electronic waste into gold and silver jewelry.

Full Article →Wall Street Banks: Expect the Gold Rally to Continue

Analysts at major Wall Street banks expect the gold bull rally to continue into 2025. And mainstream analysts tend to think the year will remain free from any kind of significant economic chaos or crisis. Gold had a tremendous 2024, setting multiple records and closing the year with a 26.5 percent gain – one of the best-performing assets last year.

Full Article →Is Selling Gold Right Now a Mistake?

Producer prices came in hotter than expected in November. This came on the heels of a CPI report showing price inflation is sticky. With inflation worries mounting, investors sold gold. Wait. People sold an inflation hedge with increasing signs of inflation? Yes. You read that correctly.

Full Article →The Hardest Retirement Math Is Also the Most Crucial

Inflation – we’re all tired of hearing about it, plenty tired of thinking about it, too. But we have to consider exactly how big a difference inflation makes in our future cost of living. And it seems like nobody knows exactly how to figure out how much today’s dollars will be worth tomorrow…

Full Article →The Secret Connection Between Bitcoin and Gold Prices

Bitcoin’s record ascent beyond $100k captured headlines worldwide. But what does this so-called digital gold have to do with the real thing? If you take a closer look, it’s plain to see that the forces driving the crypto market higher are very similar to those driving the gold market…

Full Article →How Will Trump’s Tariffs Affect Your Finances?

Trump’s Tariffs Are Coming. President-elect Donald Trump loves them. I’m not just saying that. He has literally said that he “loves” tariffs. He’s spent the last couple weeks promising steep tariffs on day one of his presidency. Here’s how much that will cost us…

Full Article →Central Bank Gold Buying Surged in October

After rebounding in September, central bank gold buying surged in October, doubling the 12-month average. Central banks added a net 60 tonnes of gold to reserves in October, the highest monthly total year-to-date, according to data collected by the World Gold Council.

Full Article →Red States Are Taking Action Against Dollar Devaluation

Lawmakers in the Lone Star State are so fed up with dollar devaluation that they’re taking matters into their own hands. Outlining a bold proposal to reinvent money – and it’s certain to have the Federal Reserve in an uproar. Here’s the opening shot in the battle of Texas versus the Fed…

Full Article →Latest Gold Survey Found Something Very Interesting

Despite two volatile weeks, $3,000 gold in 2025 is starting to seem inevitable. Meanwhile, everyday Americans are finally starting to catch on to gold’s role in diversifying their savings. Then we investigate the increasingly popular opinion that leaving the gold standard was the worst decision our nation ever made. Could we go back?

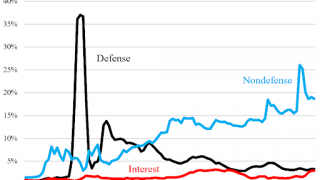

Full Article →The Jaw-Dropping Math Of Federal Government Spending

Trump’s bold economic vision seeks to return the nation to a golden age of economic opportunity. But nearly every economist will tell you that tariffs raise prices. Trump has vowed to put tariffs in place. Prices will go up – so what’s the point? Cutting $2 trillion from the federal budget may not be feasible

Full Article →U.S. National Debt Blows Past $36 Trillion

It took 118 days to add another trillion dollars to the national debt. That’s just under 16 weeks. On Thursday, Nov. 21, the national debt officially blew past $36 trillion. To be exact, it hit $36,034,994,586,981.97. You might be thinking, “Didn’t we just eclipse $35 trillion? Yes. It was on July 26, just under four months ago.

Full Article →Elon Musk Targets the Fed

Elon Musk offered to include Ron Paul in the Department of Government Efficiency (DOGE) – a presidential advisory commission headed by Musk and Vivek Ramaswamy. DOGE is tasked with finding waste, fraud, and abuse in the federal government and making recommendations for how to eliminate it.

Full Article →Musk’s Wrecking Ball and Your Financial Future

Discover how the Department of Government Efficiency’s bold plans could reshape your financial future. With huge cuts to government spending, will inflation subside? Will prices finally fall? Or will Bidenomics prices stick around even longer? Some are scared Trump could include Social Security cuts in efforts to reduce government wastage…

Full Article →Could Rapid Growth of AI Boost Gold Demand?

According to a report by the World Gold Council, the answer is yes. Gold’s excellent conductivity and its malleability make it an important component in the manufacture of electronic devices. Gold can be formed into extremely thin wires, making the metal ideal for use in small computer chips.

Full Article →What Separates Smart Gold Owners from Speculators?

Gold sold off after Trump’s victory and the red wave – but why? What changed, even before the President-Elect takes office? There are plenty of explanations, but they’re mostly fact-free hand-waving. So what’s going on? In the short-term, same as all markets, sentiment drives gold. Greed and fear, to paraphrase Warren Buffett.

Full Article →Turns Out Silver IS an Asset for Diversification and Hedging Risk

This is the conclusion of a new report by Toronto-based Capitalight Research Inc. commissioned by the Silver Institute: “Institutional investors seeking to strengthen their portfolios through diversification should consider the compelling benefits of investing in silver.” The report focuses on increased fragility in the geopolitical environment.

Full Article →UAE to Usher in “Asian Century” for Gold

The United Arab Emirates is poised to usher in an “Asian Century” for gold to challenge dollar dominance, according to a report published by the Dubai Multi Commodities Centre (DMCC). The UAE leapfrogged the United Kingdom to become the world’s second-largest gold trade hub in 2023.

Full Article →Inflation Fire Not Extinguished Yet, Far From It

We’ve been through a lot over the last four years – and some things have gotten better. Some things are getting worse again. Inflation has been smoldering for months now, so why is the Fed suddenly fanning the flames? It’s a good question to ask, and we all want something hopeful to look forward to… but…

Full Article →Inflation Not Likely to Go Away

Gold and silver futures speculators began selling contracts in anticipation of a Trump victory. Thus far, the selling continues after his win. The markets may have simply been overbought after big moves higher in October. However, the impact of the election cannot be discounted.

Full Article →Biden Administration Kicks Off 2025 With Another Big Deficit

After running the third-largest budget deficit in history in fiscal 2024, the Biden administration kicked off fiscal 2025 in a similar manner. The federal government ran a $257.45 billion budget shortfall to start the new fiscal year, with revenue down and spending up, according to the latest statement from the Department of Treasury.

Full Article →How Much Will It Cost to Make America Great Again?

With Trump’s election victory and a GOP-controlled Congress, significant economic changes are on the horizon. While these policies aim for long-term prosperity, they come with significant short-term costs. Here’s a discussion of just how much these plans will affect your finances…

Full Article →What a Week in Gold! Wait, It’s Just Tuesday…

Gold plunged by almost $80 yesterday… And it doesn’t look like the decline is going to end (!) anytime soon. Sure, there will be corrections, but the bearish train appears to have finally left the station, as I’ve been expecting it too previously. Gold broke below its rising support line, which is a strong sign that the trend has changed.

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.