It looks like we just saw the first small “boom” in a controlled demolition on the markets.

Bullion.Directory precious metals analysis 18 April, 2023

Bullion.Directory precious metals analysis 18 April, 2023

By Przemysław K. Radomski

Founder of GoldPriceForecast.com

The only reason it’s “controlled” is because the prices are likely to fall in a specific pattern (in tune with how they declined previously) and not crumble instantly.

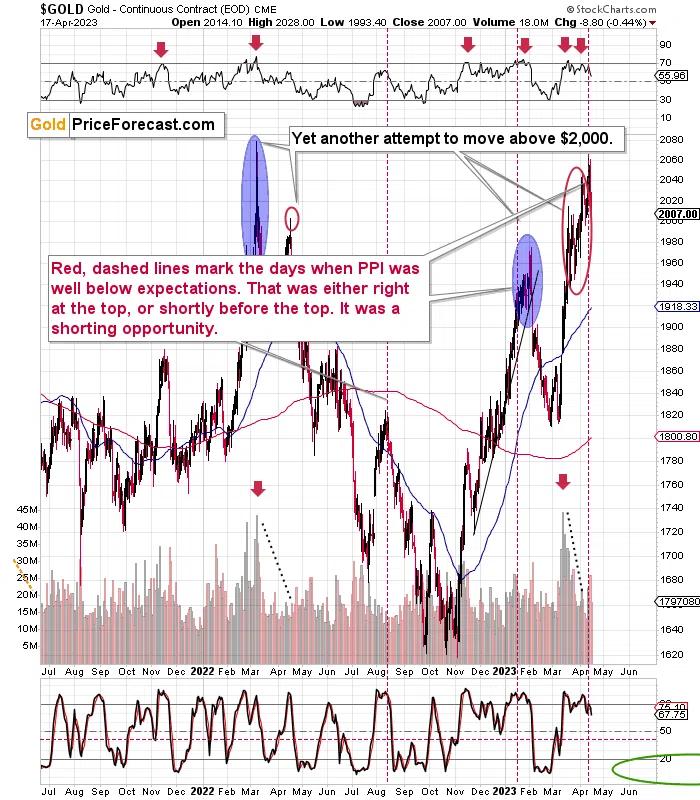

The gold price closed slightly above the $2,000 level, but it did pierce it on an intraday basis yesterday.

Is the breakout above this level fully invalidated? Not yet. However, the intraday slide suggests that it will be invalidated any day (or hour) now.

Just like gold, junior miners paused at an important support level. In their case, it was the previous 2023 high.

Please note that the current immediate-term decline is the biggest one that we’ve seen since early March. Things are already different in this market, and it spells trouble for the bulls – lots of trouble.

As I wrote yesterday, gold’s decline has a lot to do with the USD Index’s rally.

After all, they are strongly negatively correlated, and that’s been the case for about a year now.

As the USDX soared back above the recent lows, thus invalidating the breakdown, and flashing a major buy signal, gold declined.

Since the USDX already flashed the major buy signal, the situation in gold and junior miners is less uncertain than it seems at first glance. Looking just at the charts and recent price moves of the latter suggests that we might or might not see another decline. However, the clear buy indication from the USDX indicates that the major decline in the precious metals sector is already underway.

Now, this isn’t to say that there will definitely be no more bumps on this road. No. In fact, it’s common to see a daily or two-day pause or small rebound right after gold tops. That pause is then followed by a huge slide that takes most people by surprise.

Also, while the USD Index flashed a buy signal, the euro flashed a sell signal.

It invalidated its small breakout above the previous highs, and it seems that the analogy that I described on Friday worked once again.

Namely, the double-top pattern (where the second top is higher) accompanied by the RSI close to 70 is something that led to major declines in the past years. It seems that we just saw this pattern once again.

Therefore, the implications are even more bearish for the precious metals market than they might seem at first. The indications coming from the forex market are truly profound.

The general stock market, on the other hand, did pretty much nothing yesterday.

It most likely continues to form the right shoulder of a relatively broad head and shoulder pattern.

What’s bearish about it (for PMs) is that junior miners declined even without the stock market’s help.

All in all, it looks like the next big move lower is here, but I wouldn’t be surprised to see a daily or two-day pause here before the slide really picks up (and takes most by surprise).

I can’t guarantee it, but it does look like the waiting time for this slide to start is over.

Przemyslaw Radomski

Przemyslaw K. Radomski, CFA, has over twenty years of expertise in precious metals. Treating self-growth and conscious capitalism as core principles, he is the founder of GoldPriceForecast.com

As a CFA charterholder, he shares the highest standards for professional excellence and ethics for the ultimate benefit of society and believes that the greatest potential is currently in the precious metals sector. For that reason it is his main point of interest to help you make the most of that potential.

This article was originally published here

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply