Debt Ceiling Resolution: Crisis, or Chaos?

Bullion.Directory precious metals analysis 21 April, 2023

Bullion.Directory precious metals analysis 21 April, 2023

By Peter Reagan

Financial Market Strategist at Birch Gold Group

By June of this year, that number is likely to increase by one, and that means the U.S. debt is poised to skyrocket after it happens.

But what if things don’t go according to plan? That’s what we’re going to examine briefly in this article.

We’ll start by taking a gander at the summary of “what will get the U.S. to June” as published by the Committee for a Responsible Federal Budget, since the U.S. has already reached the debt ceiling back in January:

At that point, the Treasury Department will begin using accounting tools at its disposal, called “extraordinary measures,” to avoid defaulting on the government’s obligations, which Secretary Yellen indicates should allow for continued borrowing until at least early June. At the point of exhaustion of those measures, absent a new agreement to either raise or suspend the debt ceiling, the Treasury will be unable to continue paying the nation’s bills and the U.S. will default.

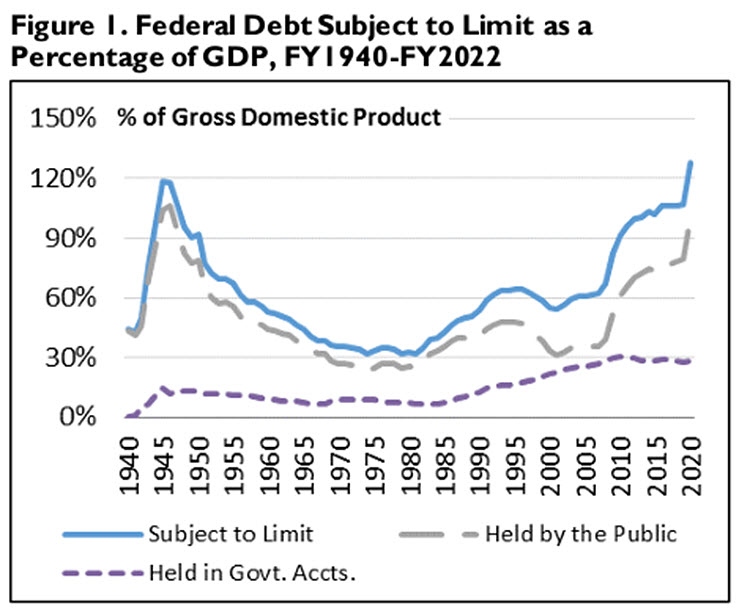

For a deeper perspective, you can also see how the Federal debt that is subject to the debt ceiling relates to GDP on the Congressional Budget Office chart below:

You’ll note that the debt hasn’t been this “out of whack” in proportion to the gross domestic product since 1945, when the U.S. was financing the global war against the Axis powers during World War II.

By itself, that isn’t a good sign.

That’s history, though – what’s going to happen next?

I think there are two ways it could play out…

Will we have a crisis? Or will we have chaos?

This Wall Street Journal article summarized the GOP’s proposal to resolve the current stand-off:

Mr. McCarthy laid out House Republicans’ demands for agreeing to a debt-limit increase: They want Congress to place limits on federal spending, claw back [unspent] Covid-19 aid and require Americans to work to receive federal benefits. Those measures will be paired with a debt-limit increase that will last into next year, Mr. McCarthy said.

That doesn’t sound unreasonable. Freezing government spending at last year’s levels is pretty rich, quite frankly, considering the $6.27 trillion budget. The McCarthy proposal also would only bump the debt ceiling up by $1.5 trillion – which would force the government to make some difficult choices about where to spend.

Reclaiming unspent pandemic funds for a pandemic that’s over? That’s a no-brainer.

Insisting on work or some kind of social contribution by those who are getting government handouts? I’m okay with that.

In fact, this proposal seems a whole lot more generous than I expected!

What’s the response from the left?

Here’s what the Times had to say:

“A speech isn’t a plan, but it’s clear that extreme MAGA Republicans’ wish lists will impose devastating cuts on hardworking families, send manufacturing overseas, take health care and food assistance away from millions of people, and increase energy costs – all while adding trillions to the debt with tax cuts skewed to the superwealthy and corporations,” Andrew Bates, a White House spokesman, said on Monday.

At a news conference in Washington, Senator Chuck Schumer, Democrat of New York and the majority leader, was more blunt.

“If Speaker McCarthy continues in this direction,” he said, “we are headed to default.”

Are they even speaking the same language?

What’s more disturbing is Senator Schumer’s “blunt” response threatening default. That’s a big, big threat. President Biden has completely refused any discussion or negotiation, and his “all or nothing” strategy has set the two sides, fiscal responsibility versus massive spending, on a collision course.

What’s likely to happen? Well, Mike Shedlock described the last two times Republicans attempted to impose responsible spending on the White House. Here are the possible outcomes:

Republicans went to the brink with prioritization twice before. Neither time resulted in chaos. National parks and some nonessential services were closed.

Both times resulted in Republican capitulation and humiliation.

Then, in order, I expect

– A compromise with Republicans getting most of what they want

– Capitulation or near-capitulation by Democrats

– Capitulation or near-capitulation by Republicans

– A default with chaos resolved within two days

– Longer chaos.

Let’s hope for a compromise that limits debt and government growth at least a little.

A capitulation by Democrats might save the nation from a debt trap.

A capitulation by the GOP would set the nation up for a completely unsustainable debt burden that the nation would eventually be forced to default on (probably through hyperinflation).

What about the “chaos,” though?

What happens if there’s no deal by June?

On top of the fact that the Fed has recently predicted a recession to start at the end of this year, the possibility also remains that the debt limit won’t be increased by June.

If the GOP and President Biden don’t reach an agreement in time, then the possibility of the U.S. defaulting on its debt arises. As of right now, neither party has reached an agreement yet, and time is running out.

Thanks to the drama that happens every time the debt ceiling is reached, weird conceptual stuff like issuing a trillion dollar coin has re-entered the national conversation, despite the idea being soundly rejected in 2013.

This coin would theoretically be issued to pay down debt so the U.S. could pay its bills. Practically, issuing such a coin could also cause markets to panic if it were issued.

The fact that it is even being discussed right now should make anyone of sound mind pause and think about the potential consequences to their retirement savings.

But things could get much worse if the U.S. defaults on its debts, or even if the threat of doing so gets published in the media, according to the Committee for a Responsible Federal Budget:

A default, or even the perceived threat of one, could have serious negative economic implications. An actual default would roil global financial markets and create chaos, since both domestic and international markets depend on the relative economic and political stability of U.S. debt instruments and the U.S. economy. […]

A Moody’s Analytics report released in September 2021 estimated that a default could have similar macroeconomic consequences to the Great Recession: a 4 percent Gross Domestic Product (GDP) decline, nearly 6 million lost jobs, and an unemployment rate of 9 percent. In addition, Moody’s predicted a $15 trillion loss in household wealth, with stocks dropping by as much as one-third at the depths of the selloff.

The White House Council of Economic Advisers (CEA) has warned that the macroeconomic effects stemming from default – or even getting too close to one – can last months or even years.

That’s right – even a near miss can have severe consequences. And they’d make the recession that the Fed predicted at the end of this year drastically more severe.

The good news is, there is one solution that could help should either one or both of those scenarios plays out…

Gold shines brighter when crisis strikes

The last time Congress failed in its fiscal responsibility related to the debt ceiling was in 2011. The standoff went on too long, and the resulting crisis panicked the markets. Kitco summarized what happened:

The last time the debt ceiling debate significantly impacted markets was in August 2011, when Republicans and Democrats could not agree and ended up raising the ceiling just hours before the deadline.

As a result, risk assets had a negative reaction as the U.S. dollar sold off, stocks sank, and credit spreads widened. Also, Standard & Poor’s ended up downgrading the United States’ long-term credit rating from AAA to AA+… Gold ended up climbing in August and September 2011, breaching $1,900 an ounce for the first time and hitting a record high at the time of $1,910 an ounce.

During the 2011 debt ceiling crisis, gold rose 16% in six weeks (August 1 – September 16) while stocks dropped.

This is first-hand proof that now is a good time to learn more about physical precious metals like gold and silver. As you can see on the graph above, gold has already proven itself to be a good hedge historically against any kind of crisis, whether it’s self-inflicted (like the current debt ceiling standoff) or a true black swan (like the Covid pandemic panic).

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply