Foodflation is registering at the checkout lines of your local grocery store – and in a bigger way than has been seen in decades. Many bullion dealers are also struggling despite surging demand for their products…

Full Article →Stefan Gleason

Stefan Gleason is President of Money Metals Exchange, a precious metals dealer recently named “Best in the USA” by an independent global ratings group, and current winners of Bullion Dealer of the Year (E-Commerce)

A graduate of the University of Florida, Gleason is a seasoned business leader, investor, political strategist, and grassroots activist. Gleason has frequently appeared on national television networks such as CNN, FoxNews, and CNBC and in hundreds of publications such as the Wall Street Journal, The Street, and Seeking Alpha.

Gold and silver markets are inching closer to embarking on new uplegs. Silver outperformed last week and appears to have the momentum behind it to lead a fresh precious metals breakout.

Full Article →Monster Mining Gains Look Good for PMs

For the first time in a very long time, mining stocks are showing leadership. That has profound implications for precious metals markets.

Full Article →What’s Next? Trillion-Dollar Coins?

The massive set of stimulus measures rolled out last month by the Treasury Department and Federal Reserve has left many Americans wanting more… and politicians scheming for new ways to dole out additional trillions in cash.

Full Article →Is This the End of Physical Cash?

Whether it’s the People’s Bank of China or the U.S. Federal Reserve, central bankers are keen on giving themselves more power to manipulate economic outcomes.

Full Article →Precious Metals and the Coronavirus

The metals markets are being pulled in multiple directions simultaneously like never before. The global virus-triggered economic freeze has caused industrial demand for all commodities to crater.

Full Article →All Economic Recovery Models Will Be Wrong Too

All medical projection models are being proven wrong. And investors should be skeptical of any particular projection models for the economy or financial markets. They will all be wrong to some extent.

Full Article →Crashing Markets And the Next Great Inflation

Before investors jump on the deflation bandwagon, they should carefully consider the monetary and political forces that could be deployed to reverse a whiff of deflation.

Full Article →Covid-19 Financial Doomsday – The Time Is Nigh

We appear to be entering the sort of scenario that doomsday preppers have been warning about for years. A pandemic is spreading death and panic around the world. Markets are crashing. Store shelves are emptying…

Full Article →During turbulent times like these, markets can be melting down one day… and zooming higher the next. Gold may serve as a fantastic safe-haven asset one day… but get hammered by futures traders the next.

Full Article →Silver’s Coiling Like a Spring

The Dollar Index is now facing some significant resistance in the 99-100 zone. If the buck turns lower from here, that should help hard asset prices continue to recover

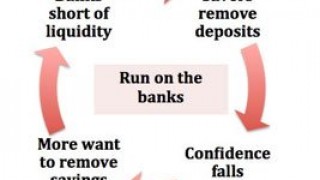

Full Article →THIS Is What a Run on the Bank for Precious Metals Looks Like…

Put simply, available inventories are failing to keep up with demand largely from the automotive industry. According to Refnitiv GFMS, the palladium market will be under-supplied by 883,000 ounces this year.

Full Article →Central Bankers Try to Avert Coronavirus Crash

The emerging coronavirus pandemic is already crimping global commerce. In response, the S&P 500 has put in two weeks’ worth of declines since making new highs to start the year.

Full Article →Precious Metals Set to Keep Powering Ahead

Precious metals got off to an explosive early start to 2020 as tensions between the U.S. and Iran drove safe-haven buying. The question for investors is whether the fundamental picture now looks promising or fleeting.

Full Article →Yes, China Is a Currency Manipulator…

The U.S. Treasury announced Monday that China is no longer on a list of countries deemed to be “currency manipulators.” The timing was awfully convenient and besides, nobody actually believes China has stopped manipulating the value of its yuan versus the U.S. dollar.

Full Article →Metals Outlook For 2020 – Key Fundamentals and Technicals

Precious metals markets enter the New Year with some impressive upside momentum. Are gold and silver poised to deliver big gains in 2020?

Full Article →Inflation Threat Looms in 2020 as Fed Ramps Up Stimulus

The Federal Reserve left its benchmark interest rate unchanged as expected last week. However, Fed Chairman Jerome Powell made news with some of his most dovish remarks to date – stating flatly that he won’t hike rates again until inflation moves up significantly

Full Article →U.S. Sanctions Boost Alternative Currency Demand

The Fed’s “weak dollar” policy looks like it may come back to bite, as the Federal Reserve Note steadily loses credibility as world reserve currency.

Full Article →Gold ETFs Surge… But is There Any Actual Gold?

There is good reason to be skeptical of whether all these “gold” vehicles actually hold physical metal sufficient to back their market capitalizations on a 1:1 basis. Some of them very well might; others almost certainly don’t.

Full Article →Supply Crunch Coming as Silver Miners Scale Back

Silver miners forced to adapt and shift focus and capital into adding gold production rather than boosting silver output

Full Article →What to Do NOW in Case of a Future Banking System Breakdown

Monetary Madness Puts U.S. Dollar Holders in Jeopardy Bullion.Directory precious metals analysis 12 Novemberber, 2019 By Stefan Gleason President of Money Metals Exchange Why? Because the banking system may not […]

Full Article →Monetary Madness Puts Dollar in Jeopardy

They may not call it “Quantitative Easing,” but in September Federal Reserve officials launched a massive new campaign of liquidity injections that will expand their balance sheet by hundreds of billions of dollars. This was all prompted by trouble in the overnight lending “repo” market, where a lack of liquidity caused interest rates to spike to multiples of the Fed funds rate.

Full Article →Warren Charts Wealth-Raiding Warpath to White House

One of Warren’s signature campaign promises is to impose a “wealth tax.” It would introduce a dangerous new concept into the tax code – namely that the government gets to tax not just capital gains on investments, but also the market value of investments and other household assets taken together.

Full Article →Will War Drums, Inflation Fears Ignite Gold and Silver Markets?

Few investors are positioned to cope with the rising risk of war in the Middle East. Few are prepared for the prospect of persistently higher energy prices and higher inflation. Even fewer are taking steps to insulate their portfolios from future black swan events

Full Article →A “Looming” Recession Is a Golden Opportunity

It’s the most widely anticipated recession in history. The recession hasn’t arrived yet – and may not do so anytime soon – but the mainstream media still can’t stop talking […]

Full Article →Will Silver’s Surprising Summer Surge Continue?

Just a few weeks ago, silver naysayers told us we’d have to wait months, or even years, before the market made a big move. Now they are eating their words! The white-hot metal surged past $18.50/oz this morning to reach its highest level in more than two years.

Full Article →U.S. Dollar to Lose Stature in Global Race to Devalue

Last Monday, the Treasury Department labeled China a “currency manipulator” for depressing the yuan’s exchange rate. It isn’t clear whether that designation will have anything more than a symbolic effect.

Full Article →Negative Interest Is Coming for Your $$$…

The world is in the midst of one of the strangest asset bubbles of all time. Instead of being fueled by the hope of bigger and bigger gains, it is being driven by a resignation to incurring lower and lower… and ultimately negative, yields on capital.

Full Article →Stefan Gleason

Stefan Gleason is President of Money Metals Exchange, a precious metals dealer recently named “Best in the USA” by an independent global ratings group, and current winners of Bullion Dealer of the Year (E-Commerce)

A graduate of the University of Florida, Gleason is a seasoned business leader, investor, political strategist, and grassroots activist. Gleason has frequently appeared on national television networks such as CNN, FoxNews, and CNBC and in hundreds of publications such as the Wall Street Journal, The Street, and Seeking Alpha.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.