Regulators in 30 different states recently joined together with the Commodities Futures Trading Commission and filed an unprecedented federal lawsuit and enforcement action against a company accused of operating a large-scale precious metals fraud scheme.

Full Article →Stefan Gleason

Stefan Gleason is President of Money Metals Exchange, a precious metals dealer recently named “Best in the USA” by an independent global ratings group, and current winners of Bullion Dealer of the Year (E-Commerce)

A graduate of the University of Florida, Gleason is a seasoned business leader, investor, political strategist, and grassroots activist. Gleason has frequently appeared on national television networks such as CNN, FoxNews, and CNBC and in hundreds of publications such as the Wall Street Journal, The Street, and Seeking Alpha.

What Biden and Trump SHOULD Have Been Asked

Tuesday night’s presidential debate between Donald Trump and Joe Biden won’t go down as a great moment in the annals of American democracy. That much both camps, as well as independent observers of the chaotic spectacle, can agree upon.

Full Article →Beware These Faulty “Inflation Protected” Investments

The Federal Reserve last week reiterated its commitment to an unprecedented inflation-raising campaign – specifically, the Fed aims to push the inflation rate above 2% for an extended period.

Full Article →Will Markets Melt Down If No One Concedes the Election?

As pundits weigh in daily on who has the edge in this year’s political horse race, investors want to know how the election will affect their pocketbook.

Full Article →China Unloads Dollars as Gold Tests Support

Holders of low-yielding U.S. dollar-denominated debt instruments should be quite concerned about the prospect of losing purchasing power. The Chinese government apparently is.

Full Article →Terrified Pension Funds Turn to Gold

The agency tasked with backing up pension programs, the Pension Benefit Guaranty Corporation, is itself underfunded and could quickly become insolvent in the event of a rise in pension failures.

Full Article →The New ‘Red Peril’ Represents a Golden Opportunity

China may be actively swaying voters in the run up to November’s election – and they’re NOT pro-Trump. The Chinese Communist Party is playing a long game. Even as conflicts with the administration of President Donald Trump escalate on multiple fronts, Chinese officials are looking ahead to a post-Trump world order.

Full Article →Silver Might Be Overextended – But It’s STILL Cheap

Investors who are eying a multi-year silver bull run ahead should view any decent pullback from here as a buying opportunity.

Full Article →Has Fed Popped Poison Cork Too Soon?

The dramatic ascent of precious metals markets this summer reflects what could be just the start of a longer-term decline and fall in the Federal Reserve Note’s value and status.

Full Article →Opportunists know that artificially suppressed markets represent hidden value – and that under our inflationary monetary system, prices of precious metals will inevitably rise over time in terms of depreciating Federal Reserve Note dollars.

Full Article →With silver breaking out decisively to the upside, endangered bears are running for cover. Fundamentally, the character of both the silver and gold markets has changed this year’s rally. Retail bullion buying is not only back; it’s going through the roof!

Full Article →The torrid rally in the silver market reached a major milestone this morning as prices hit $21/oz, closing above $20 for the first time since 2016. Even bigger moves are likely still to come…

Full Article →Summer doldrums? Not for precious metals markets! In early July, gold and silver each broke out to fresh multi-year highs. The yellow metal is within striking distance of new all-time highs and the headline-worthy figure of $2,000/oz.

Full Article →Many retail businesses including grocery stores and fast food restaurants have been wrangling with a national coin shortage. Some say we need to pay in exact change or use alternative payment methods such as credit cards.

Full Article →In a volatile trading environment for equities, a big move in one direction tends to beget a big move in the other. We’ve already seen a big move lower earlier this year – and a subsequent move higher that was nearly equal in magnitude.

Full Article →Gold prices have been trading within a well-defined $100 range over the past two months. Gold’s chart shows strong support at $1,675/oz and a zone of resistance at $1,750-$1,775. A breakout above the trading range could quickly send gold prices to $1,900/oz

Full Article →Whereas previous financial crises were marked by a surge in bank failures, hardly any have gone under so far in 2020. The Federal Deposit Insurance Corporation (FDIC) reports that only 1% of FDIC-insured banks are on the “problem list” for financial weakness.

Full Article →Just when it seemed as though we were on a path to reopening and gradually returning to normalcy… just when the prospects of panic-induced social unrest seemed to be behind us… America’s cities erupted into flames.

Full Article →The Virus, the economic lockdowns, and the multi-trillion-dollar rescue efforts of central bankers have dominated markets over the past three months – but as lockdowns gradually lift and the 2020 election draws nearer, investors will begin to focus more on political developments.

Full Article →The silver market is on the move. In fact, it’s finally moving out ahead of other precious metals and showing some real leadership. The question for investors now is whether the recent rally in silver is fleeting or sustainable

Full Article →Foodflation is registering at the checkout lines of your local grocery store – and in a bigger way than has been seen in decades. Many bullion dealers are also struggling despite surging demand for their products…

Full Article →Gold and silver markets are inching closer to embarking on new uplegs. Silver outperformed last week and appears to have the momentum behind it to lead a fresh precious metals breakout.

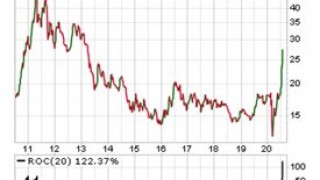

Full Article →Monster Mining Gains Look Good for PMs

For the first time in a very long time, mining stocks are showing leadership. That has profound implications for precious metals markets.

Full Article →What’s Next? Trillion-Dollar Coins?

The massive set of stimulus measures rolled out last month by the Treasury Department and Federal Reserve has left many Americans wanting more… and politicians scheming for new ways to dole out additional trillions in cash.

Full Article →Is This the End of Physical Cash?

Whether it’s the People’s Bank of China or the U.S. Federal Reserve, central bankers are keen on giving themselves more power to manipulate economic outcomes.

Full Article →Precious Metals and the Coronavirus

The metals markets are being pulled in multiple directions simultaneously like never before. The global virus-triggered economic freeze has caused industrial demand for all commodities to crater.

Full Article →All Economic Recovery Models Will Be Wrong Too

All medical projection models are being proven wrong. And investors should be skeptical of any particular projection models for the economy or financial markets. They will all be wrong to some extent.

Full Article →Crashing Markets And the Next Great Inflation

Before investors jump on the deflation bandwagon, they should carefully consider the monetary and political forces that could be deployed to reverse a whiff of deflation.

Full Article →Stefan Gleason

Stefan Gleason is President of Money Metals Exchange, a precious metals dealer recently named “Best in the USA” by an independent global ratings group, and current winners of Bullion Dealer of the Year (E-Commerce)

A graduate of the University of Florida, Gleason is a seasoned business leader, investor, political strategist, and grassroots activist. Gleason has frequently appeared on national television networks such as CNN, FoxNews, and CNBC and in hundreds of publications such as the Wall Street Journal, The Street, and Seeking Alpha.