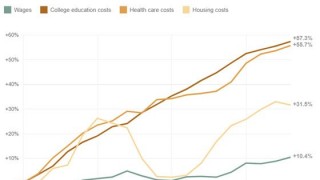

Is it a temporary blip… or the beginning of a long-term trend? That’s the key question facing consumers, investors, and retirees when it comes to inflation.

Full Article →Stefan Gleason

Stefan Gleason is President of Money Metals Exchange, a precious metals dealer recently named “Best in the USA” by an independent global ratings group, and current winners of Bullion Dealer of the Year (E-Commerce)

A graduate of the University of Florida, Gleason is a seasoned business leader, investor, political strategist, and grassroots activist. Gleason has frequently appeared on national television networks such as CNN, FoxNews, and CNBC and in hundreds of publications such as the Wall Street Journal, The Street, and Seeking Alpha.

Strong demand for bullion products amid tight market conditions and unprecedented “stimulus” measures from Washington have lots of people asking lots of questions. Here we will answer a few of the most pressing questions currently on the minds of precious metals investors.

Full Article →Is Bitcoin Losing its Luster?

Prices for the cryptocurrency have slid from a high of over $64,000 on April 14th to under $48,000 in trading this past weekend. The 25% sell-off would be akin to a crash in the S&P 500. But for crypto markets, that kind of volatility is fairly routine.

Full Article →Will Biden’s ‘Green Reset’ Be Great For Silver?

As top officials around the world convene this week for a “climate summit,” President Joe Biden’s administration is planning the most radical expansion of government’s role in the economy since FDR’s New Deal.

Full Article →The Next Key Level for Gold

Gold rallied last week toward the top of a down-trending channel that has been in force since prices peaked last summer. A breakout attempt in early January failed. The gold market subsequently slumped to a potential double-bottom low in March around $1,675/oz.

Full Article →Central Banks Ramp Up Gold Buying

Ignore what central bankers are saying; instead, watch what they are doing. While they poo-poo gold or pretend it doesn’t exist, global central banks have been quietly but aggressively accumulating gold bullion for several years now. The Central Bank of Russia, for example, has been a consistent buyer of gold.

Full Article →What Skyrocketing Home Prices Say About Inflation

Housing costs are skyrocketing. The median sales price of existing homes has spiked 16% over the past 12 months – the fastest pace in 15 years. The real estate market is being pressured not only by a low inventories of houses listed for sale, but also by rising prices for construction materials.

Full Article →Rarely do markets move straight up or straight down. The stock market has, however, essentially moved straight up since the March 2020 mini-crash. As the market moves higher, an increasing number of “analysts” are calling for even higher equity prices.

Full Article →What Biden’s Infrastructure Push Means For Silver

The federal government is spending and redistributing newly created cash so rapidly, it’s becoming difficult to keep track of which trillions are going where. This week, President Joe Biden will pitch a $3 trillion “green” infrastructure package. That’s on top of the $1.9 trillion economic “relief” bill he recently signed into law.

Full Article →The Globalist Push for Central Bank Digital Currency is Ramping Up…

On Monday, Federal Reserve Chairman Jerome Powell spoke at a virtual “Innovation Summit” hosted by the Bank for International Settlements, the central bank for central banks around the world. Powell aimed his remarks specifically at digital currencies.

Full Article →Silver Setting Up for a BIG Move Following Fed

Precious metals markets traded into an important technical juncture ahead of Wednesday’s Federal Reserve policy announcement. Bank of America analysts stated that this week’s meeting is “one of the most critical events for the Fed in some time.”

Full Article →Supporters of the World Economic Forum’s all-encompassing Great Reset agenda are eyeing BIG changes for the global monetary system. Plans that might once have been dismissed as pure speculation or conspiracy theories are now being openly pushed by people who occupy the highest levels of power.

Full Article →Energy Metals Leading the Charge

What’s driving these “energy” metals? Besides ongoing currency depreciation and the risks of higher inflation, which will help boost all hard assets over time, rising demand for electricity in general and electric vehicles in particular.

Full Article →Silver Situation Update

In the last two weeks, there has been a greater awakening about the silver story – its growing industrial uses, its growing investment demand, and the pre-existing bullish posture of the silver market itself.

Full Article →How Precious Metals Generate Positive Real Returns

One of the most bullish backdrops for precious metals is an environment of negative real interest rates – that is, when bonds and cash yield less than the inflation rate. […]

Full Article →WILD Silver Market Swings… What Next?

As extreme market conditions drive tremendous volatility in silver spot prices, buyers are exerting unprecedented pressures on retail physical bullion products.

Full Article →Biden Will Preside Over Another Financial Crisis

As Treasury Secretary Yellen together with her protégé Jerome Powell at the Fed prepare to pursue “weak dollar” policies and coordinate globally with other central planners, investors may find that the world’s strongest currencies are physical precious metals.

Full Article →What’s Next For Internet Censorship?

On Wednesday, the Democrat-controlled U.S. House of Representatives voted to impeach President Donald J. Trump for a second time – this time with just a few days left in his term. It was a mostly symbolic rebuke. Financial and precious metals markets barely budged on the news.

Full Article →New Tightness Looms on Minted Gold & Silver

It’s happening again. Even before the conflagration occurred in Washington DC last week, retail demand for gold and silver had been rising sharply since late last year.

Full Article →2021: Time For a Portfolio Reset?

If global elites have their way, 2021 will be the year of the “Great Reset.” They believe now, after the coronavirus and lockdown policies have inflicted a heavy toll on the public, is the perfect opportunity to implement their technocratic vision.

Full Article →Outlook 2021: Dollar Debasement Ahead!

In a year that was marred by a global pandemic and a wave of economic restrictions that crippled many small businesses, financial markets proved to be resilient. Of course, that resilience owes in no small part to the unprecedented outpouring of stimulus from Congress and the Federal Reserve – and more stimulus is on the way.

Full Article →Fed Recommits to Misleading Public About Inflation

Did the Federal Reserve just usher in the next phase of the U.S. dollar’s decline? On Wednesday, the central bank recommitted to leaving its benchmark interest rate near zero for the foreseeable future. Fed officials also vowed to keep pumping cash into financial markets.

Full Article →Globalists Poised for a “Great Reset” – Any Role for Gold?

Although the apparent results of the 2020 election are still being contested, members of the global ruling elite are already looking forward to a post-Trump era in American politics – and a post-vaccine world economy.

Full Article →Pro-Gold Fed Nominee Blocked

It was only after he entered politics that President Donald Trump began to fully grasp the bias, dishonesty, and fakeness that runs throughout the so-called mainstream media – but gold bugs and sound money advocates have long known to distrust the reporting of establishment news sources.

Full Article →Gold Climbs Following Election Results, Then Retreats

Gold prices closed Friday at a 7-week high above $1,950/oz… But with news today of a vaccine breakthrough, gold has fallen back below its breakout point. It is now retesting support in the $1,865 range and could consolidate for a few more weeks

Full Article →After The Election… Inflation!

If Congress, the Senate, and the President can’t come to terms on another fiscal stimulus package, then the burden will fall squarely on the shoulders of the Federal Reserve to ramp up new monetary stimulus schemes.

Full Article →A New World Monetary Order Is Coming

Under a monetary order where electronic digits representing currency can be created out of thin air in unlimited quantities, the best hedge is the opposite – tangible, scarce, untraceable wealth held off the financial grid.

Full Article →Three Unstoppable Forces Set to Drive Silver Prices

The threat of economically crippling lockdowns, the promise of unending monetary stimulus, and the uncertainty of game-changing political outcomes – this is the “new normal” for investors.

Full Article →Stefan Gleason

Stefan Gleason is President of Money Metals Exchange, a precious metals dealer recently named “Best in the USA” by an independent global ratings group, and current winners of Bullion Dealer of the Year (E-Commerce)

A graduate of the University of Florida, Gleason is a seasoned business leader, investor, political strategist, and grassroots activist. Gleason has frequently appeared on national television networks such as CNN, FoxNews, and CNBC and in hundreds of publications such as the Wall Street Journal, The Street, and Seeking Alpha.