Central Bank and Over-the-Counter Buying Pushed Gold Demand to Record Levels in Q2. Gold demand was up 4 percent to 1,258 tons in the second quarter, the highest level on record since the World Gold Council started compiling data. Demand for gold was strong in the second quarter despite record gold prices.

Full Article →Mike Maharrey

Mike Maharrey is a well-known author, journalist, financial analyst and writer at Money Metals Exchange, one of our top-rated US dealers and two-times winner of Bullion Dealer of the Year

He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida. Mike also serves as the national communications director for the Tenth Amendment Center and the managing editor of the SchiffGold website.

On July 26, the national debt blew past $35 trillion for the first time. We are now cursed with a debt of $35,001,278,179,208.67. This milestone will likely raise some eyebrows, but nobody will do anything about it. And sadly, most people don’t care.

Full Article →The 2024 Summer Olympics kicked off over the weekend. Thousands of athletes from all over the world have converged on Paris with one goal in mind. Win silver! Now, you’re probably thinking, ‘Umm… Mike, they’re going for gold.’ And technically, you’re correct. But did you know that gold medals are mostly made from silver?

Full Article →How will the upcoming presidential election impact the gold market? Biden has dropped out of the presidential race. It appears Kamala Harris has the inside track to the Democratic Party nomination, but that isn’t a foregone conclusion. Polling currently shows Trump and the Republicans holding an edge, but we are a long way from November…

Full Article →On July 16, a jury convicted Senator Bob Menendez (D-N.J.) on 16 counts, including wire fraud, bribery, and extortion. At least he accepted bribes that would retain their value. Let me be clear: you really shouldn’t take bribes. But if you do (don’t), get it in gold.

Full Article →The federal government ran another big deficit in June, as the national debt inches closer to $35 trillion. $35 trillion USD. Trillion with a ‘T.’ That’s an unfathomable number. It’s meaningless to most people. We simply can’t comprehend a number that big.

Full Article →Gold-backed exchange-traded funds (ETFs) reported net inflows of gold for the second straight month in June. With European funds leading the way, net gold holdings by ETFs globally increased by 17.5 tons last month. May was the first month of positive flows into ETFs in 12 months.

Full Article →I’ve written a lot about the fact that silver appears to be underpriced given both technical factors and the supply and demand dynamics. Platinum may be even more undervalued, hovering around $1,000 an ounce. To put that into perspective, platinum hit an all-time high of $2,213 an ounce in March 2008…

Full Article →How do you safely and securely move billions of dollars worth of gold? Very quietly. De Nederlandsche Bank (the Dutch central bank) did just that, moving over 220 tons of gold coins and bars over 45 miles of public highway. Officials spent four weeks shuttling gold and cash from a vault in Haarlem to the new Cash Centre in Zeist.

Full Article →Investors are also gobbling up gold in Thailand for many of the same reasons. A Thai gold dealer said he has never seen such strong demand for gold during a period of rising prices. “At this price, people should be selling but everybody is buying. People are actually fighting to buy. The local consumers are very smart.”

Full Article →People like Paul Krugman keep saying Americans don’t realize how good they have it. Janet Yellen recently said she doesn’t experience sticker shock when she goes to the grocery. The White House spokesperson tells us how great the economy is. Inflation is coming down! Meanwhile, the rest of us are struggling to pay the bills…

Full Article →As war wages across their eastern border, Poles seek safety. And they’re finding it in gold. Russian troops stormed across the Ukrainian border on Feb. 24, 2022. It was Fat Tuesday; a day Poles typically line up for jelly-filled donuts called pączki. Instead, they lined up to buy gold.

Full Article →Even Bank of America is now talking about $3,000 gold. According to a report released by the big bank, gold prices could potentially hit $3,000 an ounce in the near term as the Federal Reserve begins cutting interest rates and rising debt drives economic uncertainty.

Full Article →You know gold is doing well when the mainstream sits up and takes notice. The mainstream financial pundits specifically, and the media in general, are typically apathetic about gold at best. More often than not, they’re downright antagonistic. The problem is that gold isn’t good for the regime.

Full Article →A few weeks ago, gold sold off on news that the People’s Bank of China didn’t add any gold to its reserves in May. At the time, I called it a “kneejerk reaction,” and said the news wasn’t “a particularly good reason to sell gold.” Before the news, China had bought gold for 18 straight months. However…

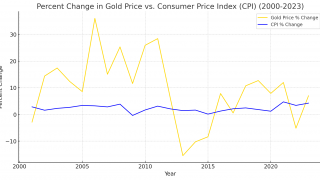

Full Article →Since mid-2021, we lived through the worst price inflation since the 1970s. CPI peaked in June 2022 at 9.1 percent. During this inflationary period, a lot of people sold gold as evidenced by the rangebound price through most of 2023. Was selling a good move?

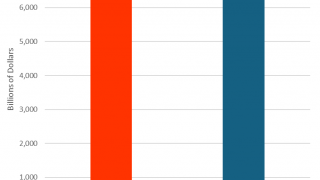

Full Article →Most people don’t understand the enormity of the national debt, the amount of government spending, or the size of the monthly deficits. As a result, they come up with all kinds of absurd “solutions” to the problem. Whenever I talk about the national debt and government spending, somebody says, “We just need to tax the rich more.”

Full Article →We’ve reported on young Chinese investors buying gold beans and gold flying off convenience store shelves in Korea. Gold demand in India recently surged during an important festival season. And now we have a gold-buying spree in Vietnam. Banks reported long lines as customers queued up to take advantage of lower gold prices…

Full Article →Gold-backed exchange-traded funds (ETFs) reported net inflows of gold for the first time in 12 months in May. Funds based in Europe and Asia led the way as total gold holdings by ETFs globally rose by 8.2 tons. ETFs globally now hold 3,087.9 tons of gold.

Full Article →The Federal Reserve was sold as a way to “provide the nation with a safer, more flexible, and more stable monetary and financial system.” That’s not what the central bank does. In fact, the Fed destabilizes the monetary system by constantly interjecting itself into it, tinkering with interest rates, and creating money out of thin air

Full Article →The Reserve Bank of India recently brought a little over 100 tons of gold home from the UK. According to a Times of India report, moving 100 tons of gold over 4,000 miles was “a massive logistical exercise, requiring months of planning and precise execution.” The process required specialized aircraft and detailed security arrangements.

Full Article →Last month, Zimbabwe officials introduced a gold-backed currency in an effort to stabilize the country’s economy. At the time, I warned that a gold-backed currency would be a great step, but that it wasn’t going to solve Zimbabwe’s problems unless the government changed its ways. So far, things don’t look good.

Full Article →If you listen to government officials and central bankers talk about price inflation, you might think they don’t have the foggiest idea of what caused it. It might have been supply chain problems, or perhaps it was Putin’s fault. Maybe greedy corporations are jacking up prices. Or it could be that consumer expectations are driving prices higher…

Full Article →Could the world REALLY be creeping closer to a monetary gold standard? Steve Forbes sees signs that it is. In a recent article published by Forbes Magazine, Steve Forbes wrote that it may seem hard to believe, but the world is “beginning to lurch toward a gold-based monetary system.”

Full Article →Are the central bankers at the Federal Reserve just winging it? It sure seems that way if you step back and take a long view of their decision-making. Fed officials project this aura of authority. You might imagine them as hyper-intelligent experts in the field of economics and finance making carefully calculated monetary policy decisions… but.

Full Article →All that glitters isn’t gold. Silver also has quite a shine lately. While gold has gotten the headlines, silver has had a solid bull run over the last several months. In fact, the white metal has outperformed gold in this gold bull market. Last week, silver charted an 11 percent gain, cracking $30 an ounce for the first time in over a decade.

Full Article →Could we see $27,000 gold? That seems far-fetched but financial analyst and investment banker Jim Rickards makes the case that it could happen. Gold charted a big rally in recent months, hitting a new all-time high of over $2,400 an ounce last month. Even with the higher prices, gold demand has remained robust.

Full Article →Bars of gold are flying off the shelves in South Korean convenience stores. This is yet another example of the movement of gold from West to East. Korea’s largest convenience store chain, CU, has teamed up with Korea Minting and Security Printing Corporation (KOMSCO) to offer customers fingernail-sized gold bars.

Full Article →Mike Maharrey

Mike Maharrey is a well-known author, journalist, financial analyst and writer at Money Metals Exchange, one of our top-rated US dealers and two-times winner of Bullion Dealer of the Year

He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida. Mike also serves as the national communications director for the Tenth Amendment Center and the managing editor of the SchiffGold website.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.