This is the conclusion of a new report by Toronto-based Capitalight Research Inc. commissioned by the Silver Institute: “Institutional investors seeking to strengthen their portfolios through diversification should consider the compelling benefits of investing in silver.” The report focuses on increased fragility in the geopolitical environment.

Full Article →Mike Maharrey

Mike Maharrey is a well-known author, journalist, financial analyst and writer at Money Metals Exchange, one of our top-rated US dealers and two-times winner of Bullion Dealer of the Year

He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida. Mike also serves as the national communications director for the Tenth Amendment Center and the managing editor of the SchiffGold website.

UAE to Usher in “Asian Century” for Gold

The United Arab Emirates is poised to usher in an “Asian Century” for gold to challenge dollar dominance, according to a report published by the Dubai Multi Commodities Centre (DMCC). The UAE leapfrogged the United Kingdom to become the world’s second-largest gold trade hub in 2023.

Full Article →Biden Administration Kicks Off 2025 With Another Big Deficit

After running the third-largest budget deficit in history in fiscal 2024, the Biden administration kicked off fiscal 2025 in a similar manner. The federal government ran a $257.45 billion budget shortfall to start the new fiscal year, with revenue down and spending up, according to the latest statement from the Department of Treasury.

Full Article →Presidents and Debt: The Worst of the Worst

We’re currently cursed to the tune of $35.9 trillion and counting. To make matters worse, the size of the debt is exacerbating the debt. Uncle Sam paid $1.13 trillion in interest expense in fiscal 2023. In fiscal 2024, the federal government paid more for interest expense than national defense and Medicare.

Full Article →India Repatriates More Gold From UK for ‘Safe Keeping’

India has brought more of its gold home. Last spring, the Reserve Bank of India repatriated 100 tons of gold, moving it from the UK to vaults within India’s borders. According to a report by the New Indian Express, the RBI recently moved another 102 tons of gold home.

Full Article →As Things Change, Some Things Will Stay the Same

The votes are counted, and the results are in! Donald Trump will occupy 1600 Pennsylvania Avenue for the next four years. The GOP will also control both houses of Congress. Much will change in the next four years. But it’s also important to consider the things that will almost certainly stay the same…

Full Article →Gold & Silver Best-Performing Investment Assets in 2024

Gold and silver have been on a tremendous run in 2024. In fact, they are the two best-performing assets this year. As of the end of October, silver was up by 42.4 percent, and gold was up by 33.7 percent. This compares to a 24 percent gain in the NASDAQ, the best-performing stock index.

Full Article →Retail Stores Closing at Pace Not Seen Since Pandemic

While President Biden and talking heads in mainstream media talk about the amazing robust economy, retail stores are closing at a frenetic pace. According to Coresight Research, 6,189 stores have already closed in 2024. That puts retail store closures at the fastest pace since 2020, when government shutdowns decimated the retail sector.

Full Article →Third Quarter Gold Demand Breaks Record

Gold demand set a third-quarter record, driving the price to a series of record highs. Including over-the-counter (OTC) sales, gold demand came in at 1,313 tons in Q3, a 5 percent year-on-year increase. Gold averaged a record $2,474 an ounce in the third quarter. That represented a 28 percent year-on-year increase.

Full Article →The Universe Seems to Know the Dollar is in Trouble.

Eerily Symbolic: Treasury Seal Falls Off Podium as Yellen Is Asked About Dollar’s Status! The universe seems to know the dollar is in trouble. During a recent news conference, a reporter asked Treasury Secretary Janet Yellen, “How concerned are you about the potential impact of the dollar’s status as the world reserve currency?” And the seal fell off…

Full Article →Major International Bank Joins Chinese Payment Global System

HSBC Hong Kong announced it will formally join China’s Cross-Border Interbank Payment System (Cips). The move is yet another body blow to dollar dominance. According to the Financial Times, it will give “the world’s biggest player in trade finance a key role in Beijing’s push to expand use of the renminbi.”

Full Article →Gold Long-Term Returns Better Than You Thought!

Gold is typically seen as a store of value. Over time, investors expect its price to keep pace with inflation. We find gold’s returns are tightly correlated with the general price level as measured by the consumer price index. Using this assumption, the long-term expected return for gold generally ranges between zero and 1 percent. However…

Full Article →Poland Now Holds More Gold Than Great Britain

According to National Bank of Poland Governor Adam Glapiński, the county holds 420 tons of gold “on behalf of all Poles,” noting that Poland “has thus entered the exclusive club of the world’s largest gold reserve holders.” Only 10 countries hold more gold than Poland – Poland now holds more gold than Great Britain.

Full Article →Credit Card Spending Tanked in August; Are We Tapped Out?

How close are Americans to hitting their credit card limits? Based on the latest consumer credit data from the Federal Reserve, they may be getting closer. American consumers have been yo-yo-ing between slowing credit card spending and going on spending sprees. But in August, credit card balances contracted significantly.

Full Article →Gold Boost from “Debasement Trade”

Gold is being boosted by a “debasement trade,” and according to JPMorgan analysts, this dynamic “may have legs.” According to a team of JPMorgan strategists led by Nikolaos Panigirtzoglou, the gold price has climbed above what should be expected, given these factors.

Full Article →Gold Topples Euro…

According to Bank of America, gold has overtaken the euro to become the world’s second-largest central bank reserve asset. With the central bank gold buying spree over the last several years, along with the rapid rise in price in 2024, the yellow metal now makes up about 16 percent of total reserve assets, just ahead of the euro.

Full Article →Zimbabwe Already Devaluing New Gold-Backed Currency

Well, that didn’t take long. In April, Zimbabwe introduced a gold-backed currency in an effort to stabilize the country’s financial system. Less than six months later, the Reserve Bank of Zimbabwe has already devalued the new money. I hate to say, “I told you so,” but, well, I told you so.

Full Article →Americans Have Spent Their Pandemic Savings (and Then Some)

Talking heads and politicians laud the “resilience” of American consumers. They managed to keep spending despite rapidly rising prices thanks to post-pandemic price inflation. But they rarely talk about how Americans have weathered the inflationary storm. When you look hard, it’s not a story of resilience but one of desperation.

Full Article →Russians Using Gold to Skirt Sanctions

According to the Russian website Russia’s Pivot to Asia, Russian businesses are buying physical gold in Russia and then transporting it to Hong Kong via courier. There, the gold is sold, and the cash is deposited into the bank accounts of Chinese suppliers to pay for goods and services.

Full Article →Nassim Taleb: People Not Seeing Real De-Dollarization

Nassim Taleb, best known for his book The Black Swan, said on X that “people are not seeing the real de-dollarization in progress.” He pointed out that global transactions are still generally labeled in dollars “as an anchor currency. But central banks (particularly BRICS) have been storing, that is putting their reserves, in Gold.”

Full Article →ING Bank: This Gold Rally Is Just Getting Started

ING Bank has revised its short and midterm gold price forecast higher, saying the gold rally is “just getting started.” The Dutch financial group cites the prospect of a Federal Reserve rate-cutting cycle, geopolitical risks, and uncertainty going into the presidential election as potential catalysts to drive gold to new record highs.

Full Article →Chinese Silver Demand Surges; Is This a Calculated Move?

Gold demand in China has been strong this year, reflecting a broader movement of the yellow metal from the West to the East. But the Chinese aren’t just accumulating gold. They have also been hoarding silver in recent months. Is China deliberately driving up the price of silver to drain the West’s resources?

Full Article →Paper Money Not a Fix for Central Bank Digital Currency (CBDC)

There has been quite a bit of pushback against central bank digital currencies. But in the scramble to block CBDCs, some people seem to have forgotten that there is a more fundamental problem: government-issued paper fiat is the parent of a CBDC, and whether it is in physical or digital form, fiat currency isn’t real money.

Full Article →$1 Million Gold Bars for the First Time Ever!

For the first time ever, a 400-ounce bar of gold is worth $1 million. We hit the $1 million gold bar milestone on Friday when the price of gold topped $2,500 for the first time. The price of gold is up about 22 percent on the year and has set several new records along the way.

Full Article →Surging Silver Demand Depleting Global Inventories

Rapidly increasing industrial and military demand for silver is depleting global inventories, and the rate may well accelerate quickly. Silver demand has outstripped supply for three straight years and the Silver Institute projects another market deficit this year.

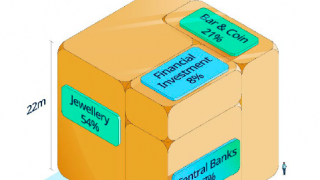

Full Article →Many Countries Now Turning to “Stateless Currency” Gold

Many central banks are opting for a “stateless currency” – gold. That’s how a recent article published by Nikkei Asia put it, noting that “central banks are diversifying away from the dollar and yuan.” Central banks globally added a net 483 tons of gold through the first six months of this year, 5 percent above the record of 460 tons in H1 2023.

Full Article →The idea is pretty simple. The U.S. Treasury could mint a $1 trillion platinum coin, deposit it at the Federal Reserve, and then the federal government could write checks against that asset. Voila! Budget problem solved. Now, it may sound a little bit like creating money out of thin air… That’s because it is.

Full Article →I Thought Gold Was a Safe Haven! Why Did It Tank With Stocks? It was a bloody Monday in the stock market as analysts digested the dreary jobs report released Friday and suddenly discovered the rot in the economy’s foundation. So, What Happened to Gold?

Full Article →Mike Maharrey

Mike Maharrey is a well-known author, journalist, financial analyst and writer at Money Metals Exchange, one of our top-rated US dealers and two-times winner of Bullion Dealer of the Year

He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida. Mike also serves as the national communications director for the Tenth Amendment Center and the managing editor of the SchiffGold website.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.