Talking heads and politicians laud the “resilience” of American consumers.

Bullion.Directory precious metals analysis 20 September, 2024

Bullion.Directory precious metals analysis 20 September, 2024

By Mike Maharrey

Journalist, analyst and author at Money Metals Exchange

They managed to keep spending despite rapidly rising prices thanks to post-pandemic price inflation.

But these pundits and politicos rarely talk about how Americans have weathered the inflationary storm. When you look at the big picture, it’s not a story of resilience but one of desperation.

In a nutshell, Americans blew through their savings and now they’re running up their credit cards.

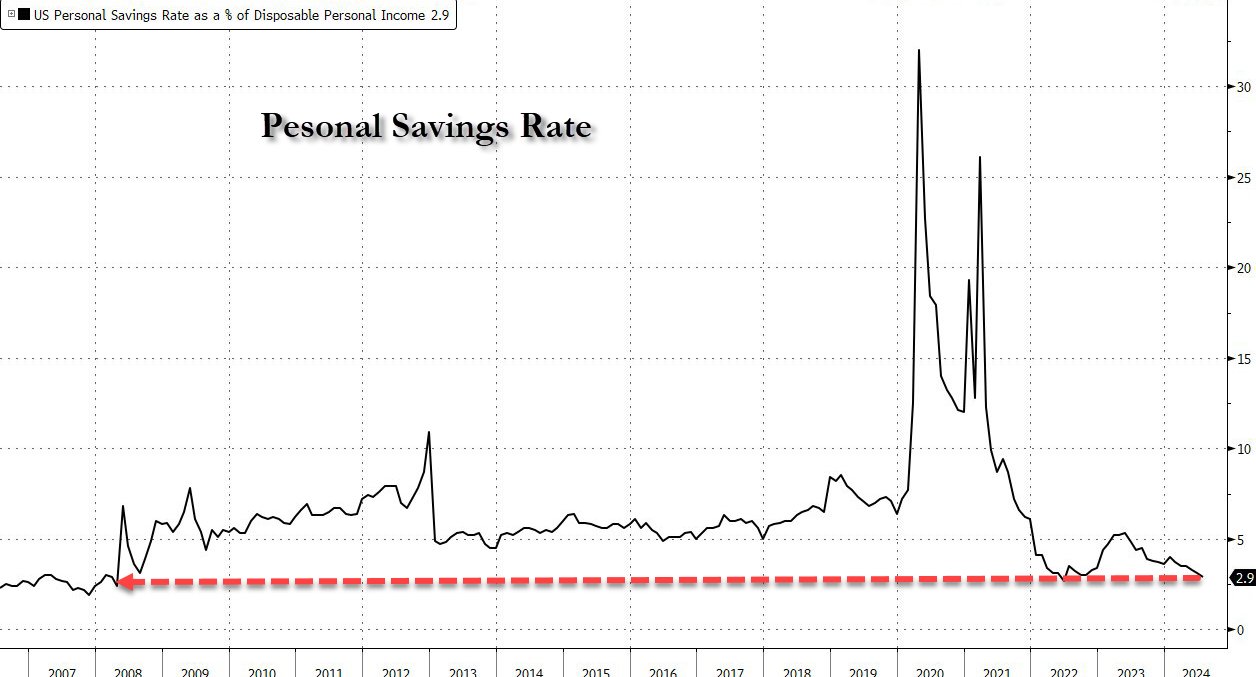

The personal savings rate plummeted in July, dropping to 2.9 percent. That was down from 3.1 percent the prior month. It was the lowest savings rate since the COVID crash.

The current savings rate is roughly in the same ballpark as it was just before the Great Recession, as you can see from this graph courtesy of ZeroHedge.

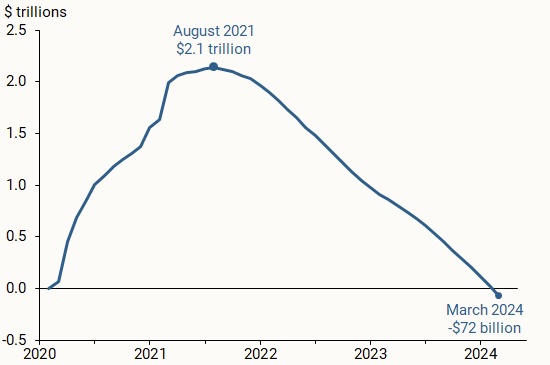

With most people locked down in their homes receiving government stimulus checks, savings spiked during the pandemic.

With most people locked down in their homes receiving government stimulus checks, savings spiked during the pandemic.

Now it’s all gone.

According to the San Francisco Federal Reserve, Americans have blown through all of the $2.2 trillion in excess savings accumulated during the pandemic years. Excess savings are now $72 million below pre-pandemic levels.

“Households drew down their excess savings at an average pace of $70 billion per month since September 2021, although this drawdown accelerated to about $85 billion per month since last fall relative to the average pace for the entire period.”

Now what?

Enter Visa and Mastercard.

With savings depleted, consumers turned to credit cards.

Americans not only saved money during the pandemic, but they also used their stimulus checks to pay down credit card balances. Revolving credit dipped below $1 trillion during the pandemic period.

But as prices started rising in the wake of COVID, Americans turned to plastic. Revolving debt currently stands at a record of $1.36 trillion.

And Americans continue to use credit cards despite interest rates as high as 28 percent. In July, non-revolving credit, primarily made up of credit card balances, surged by 9 percent ($10.6 billion).

Some pundits claim that increasing credit card debt is a good sign. They claim American consumers are “confident” and therefore willing to buy on credit. But spending patterns tell a different story. Citigroup recently noted that more and more consumers are using credit cards to pay for “basic needs,” and there has been a notable slowdown in “non-vital” purchases.

In other words, people are using credit cards with 28 percent interest rates to pay for groceries.

This isn’t the behavior of a “resilient” consumer. These are desperate consumers trying to keep pace with rising prices.

This is a looming problem for a country that depends on consumers buying stuff to keep plodding along. What happens when Americans hit their credit card limits?

Something to keep in mind as you hear government officials and their cheering section in the media trumpeting the “soft landing” narrative.

Mike Maharrey

Mike Maharrey is a well-known author, journalist, financial analyst and writer at Money Metals Exchange, one of our top-rated US dealers and two-times winner of Bullion Dealer of the Year

He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida. Mike also serves as the national communications director for the Tenth Amendment Center and the managing editor of the SchiffGold website.

This article was originally published here

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply