Consumer sentiment can be misleading.

Bullion.Directory precious metals analysis 9 April, 2015

Bullion.Directory precious metals analysis 9 April, 2015

By Christopher Lemieux

Senior Analyst at Bullion.Directory; Senior FX and Commodities Analyst at FX Analytics

Various media outlets broke the news on the near-decade high in the Bloomberg index and summarized the reading as “Americans viewed the US economy in a favorable light and said it was a better time to spend,” according to the Bloomberg article.

But, do all Americans view it in a favorable light?

No, not exactly.

Those Americans in the lower income bracket, making between $25-40,000 per year actually saw a decline in sentiment. According to FRED, the personal income per capita was $46,146 in 2014.

So, those making less are less excited. The Midwest also did not see any sentiment gains as it suffers from the bursting of the shale bubble.

The leading sentiment income bracket were those making at least $100,000 per year. Well, why wouldn’t they be cheery?

These individuals are more likely to hold assets, such as equity or homes. They have benefited the most since the recession.

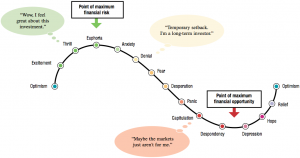

Sentiment tends to be at its highest just as markets are about to roll over. The investor cycle is similar to how people feel during hard economic times. It takes a great deal of time for people to adjust to economic hardships, psychologically, that they tend to become optimistic too late in the cycle:

Here is the S&P 500 index (SPX) that markets current Bloomberg CCI and the University of Michigan consumer sentiment index and the last time they hit current levels, coincidentally enough were in early 2007.

Click Here a 50 year historical chart of the University of Michigan consumer sentiment index. Notice the last time it was at current levels.

Note: The University of Michigan Sentiment in January through March in 2007 were 93.5, 93.3 and 93.2, respectively. January through March 2015 were 93.5, 95.7, 95.5, respectively. Are you seeing a trend here?

Consumer sentiment rapidly increased in mid-to-late 2006 and peaked out in March 2007. It then rapidly deteriorated as the financial meltdown kicked off.

The same paradigm exists. It began to rapidly rise in late 2014, mirrored 2007 highs, are could likely peak with a catalyst.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Leave a Reply