Investors continued to pour into the Chinese gold market in March as prices surged to new records.

Bullion.Directory precious metals analysis 21 April, 2025

Bullion.Directory precious metals analysis 21 April, 2025

By Mike Maharrey

Journalist, analyst and author at Money Metals Exchange

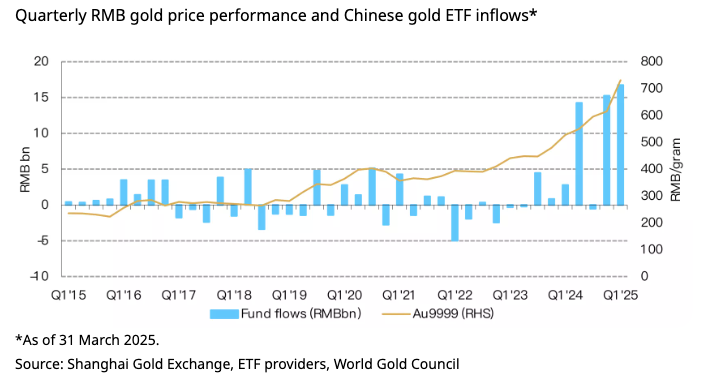

China ranks as the world’s largest gold market. The price of gold climbed 8.4 percent in yuan terms in March. It was the strongest month for the yellow metal since March 2024.

The RMB gold price recorded its strongest Q1 since 2002 when the Shanghai Gold Exchange (SGE) was established.

According to the World Gold Council, “Geopolitical tensions and Trump’s unpredictable trade policies increased gold’s appeal as a safe-haven asset. A weaker dollar and higher gold ETF investments pushed up prices further.”

The fact that gold was up 9.9 percent in dollar terms – more than in yuan terms – last month revealed this dollar weakness.

The rising gold price has created headwinds for the Chinese wholesale gold market. This largely reflects demand for gold jewelry. Price-sensitive consumers have slowed their purchases.

However, there was a rebound in wholesale demand in March as reflected by a 33-tonne month-on-month increase in withdrawals from the SGE.

Gold withdrawals from the SGE totaled 120 tonnes last month. According to the World Gold Council, this primarily reflected an increase in seasonal demand, and jewelers and banks restocked after the Chinese New Year holiday.

Wholesale demand at 336 tonnes in the first quarter was down 36 percent year-on-year, primarily reflecting soft demand due to higher prices.

“The record-shattering gold price hampered gold jewelry demand, a major factor in SGE gold withdrawals, although it did boost gold investment.”

Gold investment has primarily shown up in a surge in ETF demand.

ETFs are a convenient way for investors to play the gold market, but owning ETF shares is not the same as holding physical gold.

Chinese ETFs reported record gold inflows of 23 tonnes totaling ¥16.7 billion ($2.3 billion) in Q1.

According to the WGC, “The unprecedented gold price surge, shaky confidence in other domestic assets, as well as growth concerns stemming from escalating trade conflicts with the U.S., all contributed to strong Q1 flows.”

Investor demand for gold ramped up even more during the first two weeks of April. Preliminary data indicates another 29 tonnes of gold poured into Chinese gold-backed funds, eclipsing the Q1 total. Assets under management (AUM) exploded by 25 percent in those two weeks.

Chinese demand for gold has been so strong over the last few weeks that the government has allocated additional gold import quotas for commercial banks.

Up until last month, gold imports have been rather tepid. They virtually came to a halt in January only 17 tonnes reported. That was the lowest monthly level since February 2021, as imports were hampered by COVID restrictions.

February imports picked up, rising to 76 tonnes.

It will be interesting to see the March numbers when they are reported.

Looking ahead, World Gold Council analyst Ray Jia expects gold investment demand to remain strong, primarily driven by the escalating trade war.

“The global gold price strength, boosted by a restructuring of the world trade order and world market volatility, will provide further support.”

A pilot program that allows insurance funds to invest in gold should also support Chinese demand. To date, four insurance companies have joined the SGE. They executed their first trades of gold contracts the very next day.

According to Jia, “Their participation should sustain long-term investment demand for gold in China, especially amid ongoing economic and trade uncertainties.”

High prices will likely continue to put pressure on gold jewelry demand, but Jia suggested safe haven buying could offer a cushion.

Mike Maharrey

Mike Maharrey is a well-known author, journalist, financial analyst and writer at Money Metals Exchange, one of our top-rated US dealers and two-times winner of Bullion Dealer of the Year

He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida. Mike also serves as the national communications director for the Tenth Amendment Center and the managing editor of the SchiffGold website.

This article was originally published here

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply