Yes – Inflation is Bad – But is the Alternative Something Far Worse?

Bullion.Directory precious metals analysis 07 November, 2024

Bullion.Directory precious metals analysis 07 November, 2024

By Peter Reagan

Financial Market Strategist at Birch Gold Group

Of course, governments rarely do.

That’s not too much of a surprise, though, when you realize that one of the more fascinating ideas that establishment economists (which is the kind that you’re most likely to see on TV) keep putting forth is the idea that a little inflation is actually a good thing.

And you may be saying, “Wait a minute! A good thing that my prices are going up and that my paycheck doesn’t go as far at the grocery store?”

To which they reply, “Yes, that’s a good thing.”

The next question that you may ask (after you pick up your jaw from the floor) is…

How is inflation good?

After all, doesn’t inflation mean that lower and middle income consumers have a harder time making ends meet?

Yes, it does, but those economists aren’t looking at that. They’re looking at abstractions, metrics that are easy to quote and have much less meaning for the everyday person. Metrics like Gross Domestic Product (GDP).

As I’ve talked about before, GDP isn’t the same thing as reality. It’s a measurement of “the market value of the goods and services produced by labor and property located in the United States.”

Whether or not those goods or services are actually beneficial. And since GDP measures “market value” of those goods and services, GDP goes up when prices go up.

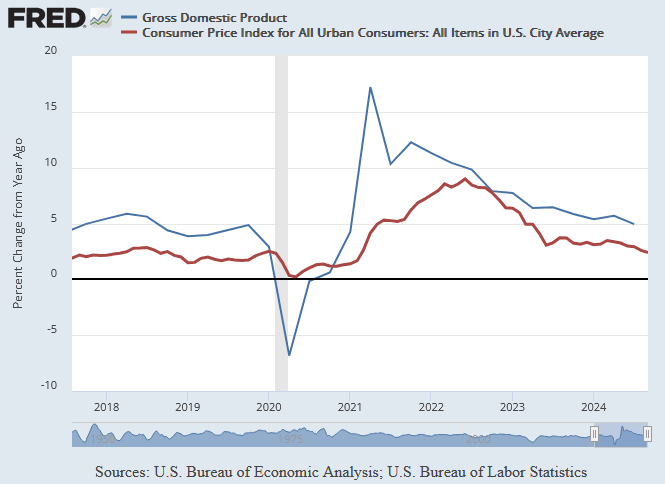

See for yourself:

Note how the lines tend to rise and fall together? That’s called correlation – and it’s clear that higher inflation is closely correlated with higher GDP.

Keep in mind that the government collects taxes based on the nominal value of assets. When inflation drives prices up, asset prices and grocery prices, the government collects larger capital gains taxes on assets and more sales tax on groceries.

When inflation goes up, GDP goes up – and tax revenues go up, too!

Is it starting to make sense why the government might be less concerned about inflation than you and me?

That’s one major argument in favor of inflation.

The second? A little inflation is good for the economy because it encourages people to spend rather than to save. Matt Egan for CNN writes,

Although deflation might sound amazing to consumers (who doesn’t like discounts?), in practice falling prices cause people to delay buying stuff.

After all, why spend $300 on a grill today if you think it’ll be cheaper in a few weeks? And those delays can force prices to fall further, causing even more delays. Rinse and repeat.

Oh, no! People actually saving for their futures depresses the economy!

And the worst possible thing that could happen is your purchasing power actually increases:

The biggest concern voiced by Zandi and others is that zero inflation is uncomfortably close to deflation, the falling-price environment that freaks out economists and central bankers alike.

That’s right, lack of inflation “freaks out central bankers.” You heard it here first!

It’s pretty clear that they don’t look at “the economy” the same way you and I do…

But that’s not even the worst part!

Even after the annual inflation rate has slowed, prices don’t decrease.

They keep going up. Just not as fast.

Inflation may increase the price of items (or decrease how much you’re getting for your dollar by way of shrinkflation), but reducing inflation doesn’t mean that you get that lost purchasing power back.

It’s gone, and you still have to live with the horrible consequences even while politicians pretend that everything is fine. As Chris Pandolfo writes for Fox Business,

Allianz chief economic adviser Mohamed El-Erian said Sunday that while inflation is cooling, what that means is the rate of price increases has slowed. It does not mean, he explained on CBS’ “Face the Nation,” that prices will eventually decrease to levels seen before inflation spiked in 2022 in the aftermath of the COVID-19 pandemic.

When discussing scenarios that the Federal Reserve will go over in their meetings, the question came up, “‘Where’s the scenario where those prices actually come down?’ asked host Margaret Brennan.”

“Yeah, and that’s what everybody’s expecting, but it’s not going to happen.” El-Erian replied.

Decreasing inflation doesn’t mean decreasing prices. It just means your purchasing power evaporates more slowly.

Now, we could make inflation go away. But the logical first step in that direction is just too “radical” for serious consideration.

At least for mainstream economists.

Inflation is bad, but no inflation is somehow worse?

Now, knowing that people are suffering from the effects of inflation, what would be the first thing that you would think should be done?

I’ve heard it put this way: If you’re in a hole and you want to get out, the first thing that you should do is to stop digging!

It makes sense, right? Stop doing the things making the situation worse so that you can, then, move in a different direction to improve things. Egan again writes,

Judy Shelton, whom Trump unsuccessfully nominated to the Federal Reserve Board in 2020, has long argued that a zero-inflation target would help everyday Americans who are hurt when their paychecks fail to keep up with prices.

This seems like a great idea to me! (Most Birch Gold customers would agree.)

But I’m not a central banker.

I don’t have the Wall Street background or the ivy league diplomas you need to be taken seriously by real central bankers…

Anyway, they have a response:

However, mainstream economists and Fed watchers caution that a zero-inflation target at the Fed would be dangerous.

A central bank could focus on preserving your purchasing power – but it’s just too risky.

Too risky for who, though?

I mean, it’s pretty clear the folks at the Fed don’t talk to everyday Americans very often. Their meetings are top-secret events, held in special shielded rooms to prevent spying and eavesdropping. They don’t even release their meeting notes for several weeks after the meeting is over.

The message they’re sending is pretty clear:

- We know what’s good for you better than you do

- Your opinion and your experience don’t matter

- Everything we do is for the greater good (even if you don’t understand how)

- Gripe all you want about inflation – it’s better than the alternative

- Trust us

Personally, I believe trust has to be earned. Looking back over the last 75 years, the Fed has done such a great job at making inflation happen they’ve exceeded their 2% goal! Average inflation during that period: 3.6% That’s 80% over their target.

And that lost purchasing power? It’s gone forever.

Your own radical solution to permanent inflation

Even if we give the Fed the benefit of the doubt, their “for the greater good” argument doesn’t necessarily apply to individuals.

What’s best for all of us can be bad for some of us.

They aren’t looking out for you. For your best interests, for your hopes and dreams. That means you have to!

And how can you do that?

Simple: By making your own personal economy largely a no-inflation zone by investing in inflation-resistant investments. That way your purchasing power isn’t subject to the whims of the unelected bureaucrats and their secret meetings.

I believe that diversification with physical precious metals is the best way to opt out of the Fed’s wealth-destruction game. For most customers of Birch Gold Group, a precious metals IRA makes this even simpler (why pay taxes when you don’t have to?).

Most Americans, especially those whose net worth is mostly tied to a paycheck, need inflation protection. You’ve worked hard for your money!

Why should you let the Fed rob you, even if it’s for “your own good”?

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply