The precious metals market moved slightly higher yesterday.

Bullion.Directory precious metals analysis 11 September, 2024

Bullion.Directory precious metals analysis 11 September, 2024

By Przemysław K. Radomski

Founder of GoldPriceForecast.com

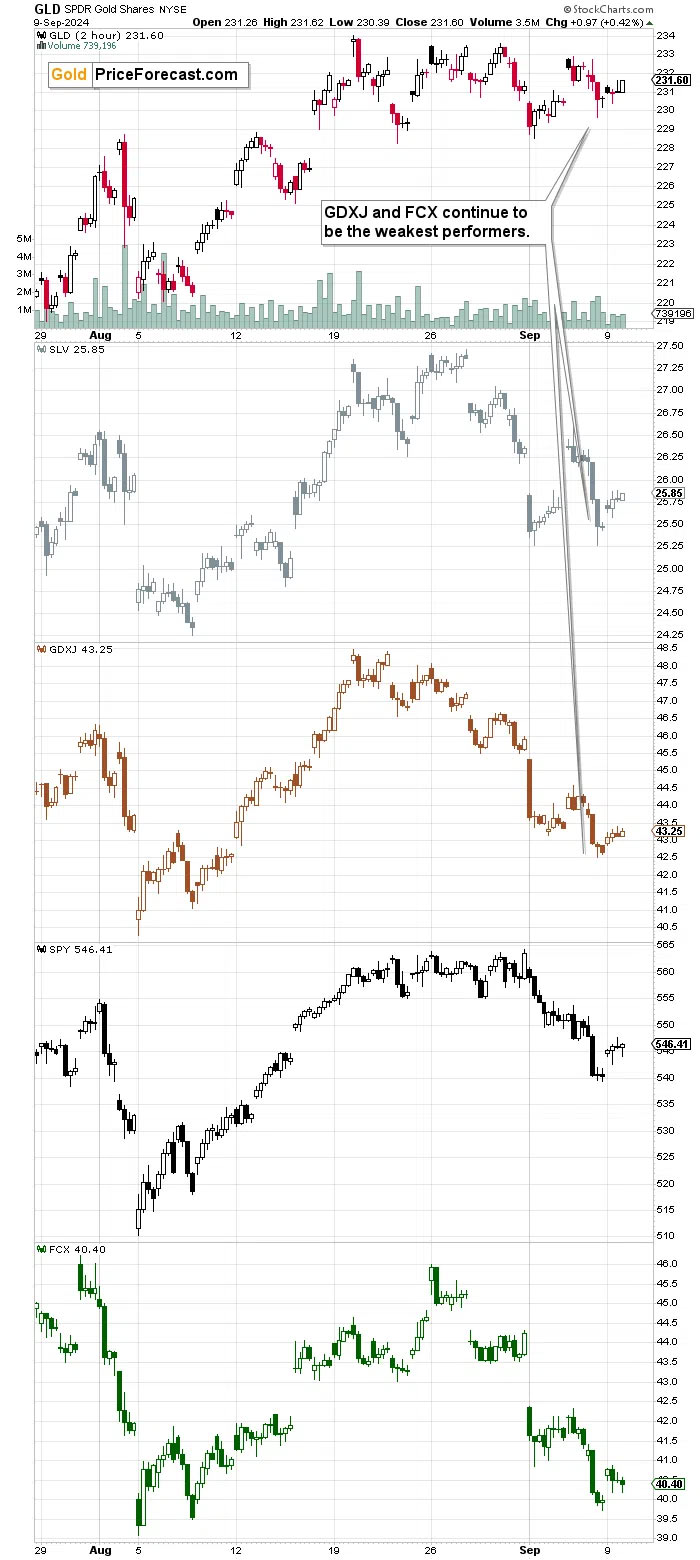

But the move up was too small to change anything, especially in the case of the GDXJ and FCX.

The moves higher have indeed been tiny in those two – they were barely noticeable.

I previously wrote that the support lines for the GDXJ cross today at about $40, which could trigger a rebound.

Will it happen? It’s not clear. The GDXJ is still relatively far ($3.25) from the above-mentioned target, and gold is not down significantly in today’s pre-market trading (it’s basically flat), so this level might not be reached today. However, since the triangle-vertex-based reversal points can work on a near-to basis, we could see a move to $40 soon, anyway – tomorrow, for example. The markets might be waiting for the CPI data to move in a more visible way.

And even if GDXJ declines to $40 at a later date, it would still meet two support lines and the 50% Fibonacci retracement there, so it would still be likely to trigger a rebound (not necessarily a huge one, though).

But these are all short-term phenomena – the medium-term trend remains bearish regardless of the quick declines and rebounds. But I discussed it more thoroughly yesterday, so I don’t want to repeat myself today.

What I do want to emphasize is that the situation in the stock market continues to develop in line with the general bull and bear market cycles theme.

It seems that the most recent rally in stocks was the “return to “normal”” stage. Fear comes next. It’s not here yet, but this is to be expected.

Perhaps the Fed’s rate cut would disappoint investors who expect two rate cuts, and this would trigger declines. This might lead to more sales from investors who get scared of the decline that followed the rate cut, as they will (at that time) assume that a rate cut didn’t trigger a rally but a decline.

To anyone familiar with the fact that markets move on expectations, it would be obvious, but most people (not professionals) are not familiar with it. People tend to think about things in a very simplified manner – rates are cut, so stocks (and gold) have to rally.

This reminds me of a situation in 2008 when Bernanke tried to prevent the market’s decline with a 0.75% cut, and the markets plunged anyway, because the investors expected an even bigger cut.

I’m not saying the market has to slide based on the above scenario, but it seems to be one of the likely outcomes.

The situation in tech stocks points to significant declines as well due to the analogy to the 2021 top.

The starting point of this analogy is the huge-volume session that we saw in early 2021 and also earlier this year (marked with red arrows).

That was the local top, but not the final one. After a relatively small decline, stocks continued to rally, and then they formed the top when the RSI moved to extremely overbought levels (marked with orange arrows) without a spike in volume.

We then saw a decline below the 50-day moving average (blue), which was followed by another move back above it, but not to or above the previous top (marked with black arrows).

This means that we could be seeing a significant decline in tech stocks in the following weeks and months. This would correspond to the above-mentioned scenario for the S&P 500.

The above would, in turn, lead to declines in the precious metals market, most profoundly in the case of junior mining stocks.

Back in 2022, the decline in stocks didn’t trigger a slide in the mining stocks, but this was the time when Russia invaded Ukraine, so it’s no wonder that gold (and thus mining stocks) rallied. Miners declined in the following months, anyway, and the decline was huge.

Without the start of another big war, it’s highly likely that miners will slide along with tech stocks and other stocks – especially given that the USD Index is likely to rally in the following weeks and months.

Przemyslaw Radomski

Przemyslaw K. Radomski, CFA, has over twenty years of expertise in precious metals. Treating self-growth and conscious capitalism as core principles, he is the founder of GoldPriceForecast.com

As a CFA charterholder, he shares the highest standards for professional excellence and ethics for the ultimate benefit of society and believes that the greatest potential is currently in the precious metals sector. For that reason it is his main point of interest to help you make the most of that potential.

This article was originally published here

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply