The total debt owed by the United States federal government has reached incredible levels.

Bullion.Directory precious metals analysis 10 May, 2024

Bullion.Directory precious metals analysis 10 May, 2024

By Peter Reagan

Financial Market Strategist at Birch Gold Group

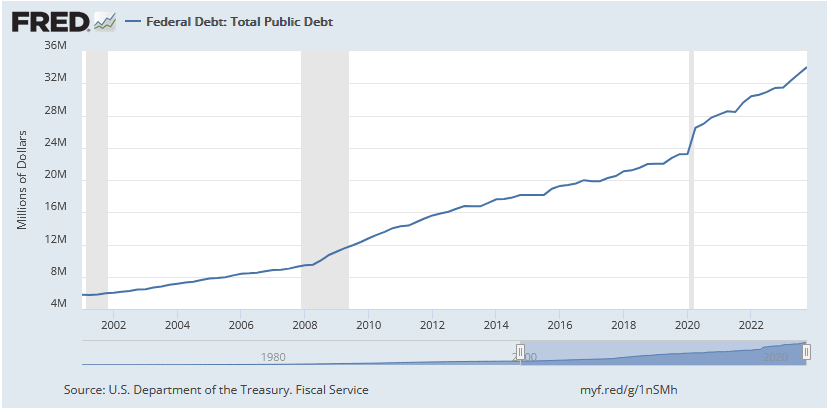

Look at the official chart and pay attention to how fast total debt has risen since the turn of the century:

In the year 2000, total government debt was ‘only’ $5.7 trillion.

Ah, the good old days…

The nation’s debt has grown more than $5.7 trillion since President Biden took office!

Let me put it another way:

- It took the federal government 224 years, the Louisiana Purchase, the Civil War and two World Wars to rack up the first $5.7 trillion in red ink

- And then it took the Biden administration just three years to rack up the last $5.7 trillion!

I apologize for going on and on about this but I honestly cannot believe it.

It’s hard to call this an apples-to-apples comparison, though, because for the majority of those first two centuries, the dollar’s value was based on a defined quantity of gold or silver.

Well, obviously that cannot be the case any more! Based on my back-of-the-envelope estimate, there’s only $16.1 trillion in gold in the world (based on current prices). The ONLY way to create such an astonishing mountain of debt was to divorce the currency from any intrinsic value.

It’s almost a magic trick.

Think about it…

Once, a dollar was 3/4 oz of silver, or 1/2 oz for a $10 coin. People had to go and dig that precious metal out of the ground, refine it and stamp it. That’s a lot of work.

Then, the dollar became a paper certificate exchangeable for the equivalent weight of gold or silver. That’s just more convenient.

Finally, the dollar became just the paper itself.

It’s like money from nothing!

And to be clear, this “money from nothing” magic trick has been working since Nixon ended the last vestiges of the gold standard just over 50 years ago.

But you know how sleight-of-hand works, right?

It depends on deception.

And every time you do the same trick, the audience is one step closer to figuring out that it’s not really magic after all…

This exact same magic trick that’s been supporting both the federal government and the U.S. dollar for five decades just isn’t working as well as it used to.

The end of magical debt thinking

Writing for Project Syndicate, economist and author Kenneth Rogoff recently summarized the insane mentality that drives the current debt situation:

For over a decade, numerous economists – primarily but not exclusively on the left – have argued that the potential benefits of using debt to finance government spending far outweigh any associated costs. The notion that advanced economies could suffer from debt overhang was widely dismissed, and dissenting voices were often ridiculed.

Just so we’re clear, “debt overhang” is defined as a “debt burden so large that an entity cannot take on additional debt to finance future projects, dissuading current investment.”

A debt overhang makes it impossible to do anything other than pay back the debt.

That’s what makes it dangerous.

The people who “widely dismissed” the very idea that a whole nation could suffer from a debt overhang are a lot quieter now.

Rogoff explains why:

The tide has turned over the past two years, as this type of magical thinking collided with the harsh realities of high inflation and the return to normal long-term real interest rates. A recent reassessment by three senior IMF economists underscores this remarkable shift. The authors project that the advanced economies’ average debt-to-income ratio will rise to 120% of GDP by 2028, owing to their declining long-term growth prospects. They also note that with elevated borrowing costs becoming the “new normal,” developed countries must “gradually and credibly rebuild fiscal buffers and ensure the sustainability of their sovereign debt.”

That’s another way of saying, “What got us here won’t get us there.”

The federal government printed its way into this debt mountain – it cannot print its way out. See, they’ve done the magic trick too many times.

The audience caught on.

Now we ALL know there’s no magic. Nothing but a rapidly-growing pile of IOUs.

The question becomes, does the government have time to learn a new magic trick?

“The United States has about 20 years left”

Cole Walmsley of Gaiter Capital wrote an entire essay on X to summarize the conundrum facing the U.S. right now. The whole thing’s worth a read, but here are the highlights:

The U.S. Treasury, which is part of the U.S. Federal Government, has to sell new debt to new investors to pay off the old debt from old investors. This is because of 1) the constant budgetary deficits and 2) the debt from years past coming due.

Remember, the debt is made up of two big chunks: This year’s deficit, and all the other deficits racked up over the decades.

The U.S. Federal Government has been in a budgetary deficit in 49 of the last 53 years, with the last surplus year being in 2001.

But yet, even in that 2001 “budgetary surplus” year, the total debt amount increased.

Why?

Because a whole bunch of debt from years past came due.

He does a good job of putting the concept of “a trillion” into perspective, too:

Trillion is just a word. Let’s make sure we note the significance.

A *billion* seconds ago was 1993 (31 years ago).

A *trillion* seconds ago was 30,000 B.C.

And then multiply that trillion by 34.7.That’s the scale of the United States debt bill.

Finally, Walmsley exposes the shell game at the heart of the federal government’s balance sheet:

The U.S. Treasury always has to have buyers of its debt, because if they don’t, they won’t be able to pay off 1) their deficit spending and 2) the old debt coming due (and the interest on the debt). If they fail to pay those off, the Government would default and collapse.

Well, then, who buys all the U.S. Government debt?

Key point: The largest buyer and owner of the U.S. Federal Government debt is THE U.S. FEDERAL GOVERNMENT THEMSELVES.

Approximately one third of all U.S. government debt is “owed” to another government department!

You know, this would be hilarious if it wasn’t our Social Security he’s talking about…

So how long can this farce last?

We have a couple of answers.

First, the Wharton School of Business explained why the United States is running out of time to recover from the teetering mountain of debt:

We estimate that the U.S. debt held by the public cannot exceed about 200 percent of GDP…

Larger [debt-to-GDP] ratios in countries like Japan, for example, are not relevant for the United States, because Japan has a much larger household saving rate, which more-than absorbs the larger government debt.

Under current policy, the United States has about 20 years for corrective action after which no amount of future tax increases or spending cuts could avoid the government defaulting on its debt whether explicitly or implicitly (i.e., debt monetization producing significant inflation). Unlike technical defaults where payments are merely delayed, this default would be much larger and would reverberate across the U.S. and world economies.

Japan has a debt-to-GDP ratio of about 260% made possible by the savings habits of Japanese households!

Here in the U.S. we save about 3.2% of our income right now – while in Japan, the savings rate averages 13.2% (and has been as high as 62%!)

Obviously, American households aren’t saving anywhere near enough money to support federal government deficits, even if they wanted to.

(We already pay taxes! Why should we give the White House even more of our money?)

In fact, the “end” could truly be drawing near… In his book This Time Is Different: Eight Centuries of Financial Folly, coauthored with Carmen Reinhart, Rogoff identified dozens of sovereign debt crises.

Every one unfolded the same way, at about the same time – all for the same reason.

The government’s irresistible urge to keep spending until it becomes obvious to everyone, even elected officials, that IOU is another way of saying, “You’re screwed.”

Now you know how much a trillion really is and why the U.S. won’t take Japan’s path to managing its debt.

Now you know the magic trick supporting the global financial system is just an accounting con.

So let’s talk about how we can move past the magical thinking, into the clear light of reality…

Real assets, real value

If you want to secure your retirement in the face of insane debt spending on the part of the Biden Administration, then it’s time to consider alternative options.

Unlike the vague promise of the dollar, physical precious metals like gold and silver are tangible physical assets you can hold in your hand. They can’t be replaced, canceled or inflated away.

The Founding Fathers knew this – and that’s why they tried to make certain our nation would never fall into the same trap that destroyed so many proud nations in the past. But they couldn’t save the nation.

That doesn’t mean we can’t save ourselves.

Make sure you’ve sheltered at least some portion of your savings with real safe-haven assets that you can hold in your hand. No amount of economic or government insanity can destroy gold and silver.

Empires rise and fall like tides on the beach of history. Gold and silver simply endure.

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply