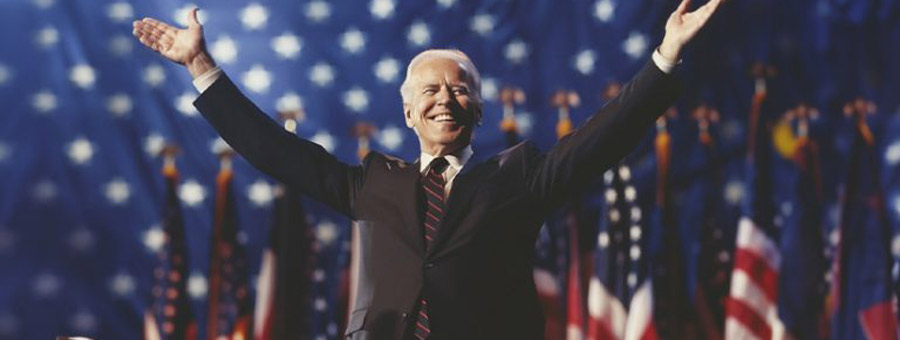

President Biden’s decision to participate in the Ukraine-Russia conflict back in February 2022 has taken a new and dangerous turn this year.

Bullion.Directory precious metals analysis 26 April, 2024

Bullion.Directory precious metals analysis 26 April, 2024

By Peter Reagan

Financial Market Strategist at Birch Gold Group

Let’s begin…

In the February 28th, 2022 issue of Matt Levine’s Money Stuff column for Bloomberg, Levine wrote about the sanctions placed on Russia:

the U.S., the European Union, the U.K., Switzerland, Singapore and other countries announced harsh sanctions against Russia for its unprovoked invasion of Ukraine. There are a lot of these sanctions – banning Russian flights through European airspace, limiting Russian banks’ access to the SWIFT interbank messaging system, etc. – but the most drastic might be U.S., U.K. and EU bans on any transactions with the Russian central bank. The bulk of Russia’s foreign reserves are held in the form of securities, deposits at other central banks and deposits at foreign commercial banks. A ban on transactions with Russia’s central bank means that it can’t sell those securities or access those deposits. Its foreign currency reserves turned out to be mostly useless.

As is the case with most geopolitical conflicts, there is always a lot more to the story than gets reported in the mainstream media (Russian, U.S., or otherwise). For example, some of the history behind the current conflict actually dates back to 2014.

Nonetheless, the bottom line is that the financial sanctions placed on Russia in 2022 were supposed to have a severe impact on Russia’s economy.

Unfortunately, for President Biden and NATO allies…

Russia shrugs off brutal sanctions

If the sanctions placed on Russia in 2022 had their intended effect, Russia’s economy would’ve been wrecked, set back 30 years or more. It would’ve become a third-world country by now.

But that hasn’t happened. Russia has prospered despite those sanctions.

A revealing NPR interview shed light on some of the economic impacts, as of December 2023:

Russia has been hit with huge economic sanctions since it invaded Ukraine nearly two years ago. But the Russian economy has remained strong, defying many economists’ expectations.

Alexandra Prokopenko, a fellow at Carnegie Eurasia Center, explained:

Economic growth in Russia in 2023 is likely to exceed 3%. It is – in terms of figures, I mean, it’s great. It’s more than the economy of the United Kingdom or of Germans’ economy. So what’s behind these figures is that over a third of this growth is attributed to the war economy, where defense-related industries are flourishing at double-digit rates.

Now, it makes sense that war would boost military and defense-related industries. But Russia’s economy also doesn’t appear to be suffering much.

In fact, according to Bloomberg, Russia’s economy is actually at risk of overheating.

Even left-leaning think tanks can’t do much more than wag their fingers and exclaim “just you wait”:

Russia’s economy is now stable both in spite of and as a result of Western sanctions…

Russia’s economy could begin to see major challenges in the next year-and-a-half, think tank researchers write.

Just like Bidenomics! “Sure, it’s not working yet, but it will eventually, any day now…”

Nonsense. Russia’s currency, GDP, and banks are thriving:

The ruble is steady at about 92:1 (compare this to Biden’s claims from 2022 that “the ruble will be rubble”). Russia’s debt-to-GDP level is 17.2%, compared with the U.S. level of 131.0%. Russian bank profits for 2024 are projected to exceed the record profits in 2023.

In other words, Russia’s economy is outperforming the U.S. by almost every measure, and is doing so on a more sustainable level from a debt perspective.

So, let’s take stock…

Two years after these shock-and-awe sanctions intended to pressure Russia into ending its invasion of Ukraine:

- Russia’s economy is outperforming not only the U.S. but also NATO allies (including the UK’s, Germany’s etc.)

- The embargo on Russian oil by the West had zero impact on Russian exports

- Russia’s defense and military industries are booming (talk about unintended consequences!)

Don’t misunderstand! I’m no fan of Vladimir Putin.

But I’m also not a fan of the Biden administration’s half-baked plan to teach Russia a lesson. It’s a total failure.

At this point, a rational person would assess the situation, look at the data and make a new plan.

Never one to learn from his mistakes, President Biden has instead opened a new front in his financial war on Russia.

This time, though, I’m seriously concerned he’s gone too far…

“This is outright theft”

Thanks to a recently passed piece of legislation, the Biden administration plans to take control of Russia’s frozen assets.

Rickards provided a nice summary:

The House passed the “REPO Act” this weekend, which authorizes the administration to seize about $20 billion worth of Russian assets sitting in U.S. banks, mostly Treasury securities. It would then transfer that money to Ukraine.

The securities were legally purchased by Russia using dollars earned through the sale of oil prior to the war. They were frozen in early 2022. That means the securities are still legally owned by Russia, but they can’t be sold or pledged, and Russia can’t receive the interest or cash at maturity.

But this legislation goes one step further and authorizes the actual seizure of these assets. This is outright theft and a violation of the Sovereign Immunities Act, but no one seems to care about that.

We’ve discussed dollar weaponization repeatedly over the last couple of years.

This development is next-level.

Freezing assets is bad enough – but seizing those legally-purchased assets? In violation of all international law?

That’s the act of an autocrat. Which is exactly what Biden calls Putin.

Is this a good idea? Probably not. Russia already can’t get its hands on those assets. So how does stealing them make Russia’s situation worse?

It doesn’t!

Instead, what it does accomplish (again, unintended consequences) is send a message to the rest of the world.

It’s not a hopeful message.

Are dollars assets? Or liabilities?

In today’s financialized world, most financial assets are based on debt. They’re promises to pay. As Ray Dalio recently reminded us:

…the dollar, to a lesser extent the euro, to a much lesser extent the yen, and to an even lesser extent the Chinese renminbi… are held in debt assets – i.e., they are debt-backed money—i.e., currency = debt. In other words, when you hold these monies, you are holding debt liabilities, which are promises to deliver you money.

The REPO Act has broken this promise to deliver money.

Which begs the question: What if central banks start to view dollars as a liability rather than an asset?

This Wall Street Journal article shows that economists were already grappling with this question back in 2022:

Recent events highlight the error in this thinking: Barring gold, these assets are someone else’s liability – someone who can just decide they are worth nothing…

What can investors do? For once, the old trope may not be ill advised: buy gold. Many of the world’s central banks will surely be doing it.

Indeed, 2022 was the biggest year for central bank gold-buying in history.

2023 was a close second-place, coming in just 4% below the previous year’s record.

The lesson is quite clear. What we think of as assets can become liabilities overnight.

So what can we do about it?

Do you have enough non-debt money?

Between brutal loss of purchasing power over the last three years, and now this escalation of dollar weaponization, you have to wonder: How much more abuse can the dollar take?

There’s no way to know.

That’s why Dalio wants you to ponder the question, “Do you have enough non-debt money?”

Gold, on the other hand, is a non-debt-backed form of money. It’s like cash, except unlike cash, which is devalued by risks of default or inflation, gold is supported by risks of debt defaults and inflation. It is held by central banks and other investors for this reason. In fact, gold is the third-most-held reserve currency by central banks, more so than the yen or renminbi…

When the financial system is working well – which is when there aren’t debt and inflation crises and the borrower-debtor governments printing debt-backed monies are meeting their obligations and paying their interest without printing and devaluing money – debt assets and other financial assets are good assets to hold; on the other hand, when the reverse is the case, gold is a good asset to own. That’s the main reason that gold is a good diversifier and why I have some in my portfolio.

Physical precious metals are just about the only asset that isn’t someone else’s liability. They aren’t an easily-broken promise to pay. They’re not an obligation.

With physical precious metals, you either own them or you don’t. Learn more about why physical gold ownership is vital.

Do you have enough non-debt money?

If all the promises to pay you own were broken, where would that leave you?

After considering these questions, you may decide it’s wise to diversify your savings with physical precious metals. If so, Birch Gold Group can help.

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply