Fed Roundtable Reveals a “Perfect Economic Storm” Approaching

Bullion.Directory precious metals analysis 28 March, 2024

Bullion.Directory precious metals analysis 28 March, 2024

By Peter Reagan

Financial Market Strategist at Birch Gold Group

Some members of the Federal Reserve board, including Chairman Powell, tried to listen to the concerns that a handful of panelists had, and the result wasn’t surprising.

The Fed got an earful during a town hall-type event event recently:

Higher interest rates together with instability in commodity prices “has a stranglehold on the American agriculturalist right now, which leads to a stranglehold on all of rural America,” said Whitney Ferris-Hansen, who owns and operates J/W Farms and Ranch in Burlington, Colorado.

Here’s a perspective on the stark reality of Bidenomics and its effects American families:

“We’re basically in the midst of a perfect storm,” said Derrick Chubbs, president and CEO of Second Harvest Food Bank of Central Florida in Orlando, Florida, noting increased costs of healthcare, childcare, transportation and insurance, along with groceries and housing.”

This is thanks to the “stranglehold” of high rates and inflation, along with a cooling labor market, according to an executive from Indeed who also commented.

Finally, at the event Powell said the Fed expects to start cutting rates later this year, but only once they feel they have inflation under control. (Which could take a while longer.)

So let’s take a deeper look into what all of this could mean…

Watching the economic storm through rose-colored glasses

A recent article contrasted on-the-ground reality with the White House message that “everything is fine”:

President Joe Biden is trying to persuade Americans that the economy is on the upswing, and he has been touting economic indicators that he says prove it: easing inflation, rising job growth and wages, unemployment near record lows…

We could be generous and grant that’s the view from 30,000 feet (or from the Oval Office).

The reason Biden’s message isn’t resonating is pretty simple. It doesn’t reflect the economic reality we’re facing. For example:

Two years of steep inflation has hit working families hard, especially those living paycheck to paycheck.

For those who can’t make ends meet, pawn shops are increasingly filling the gap:

“Pawn balances have risen across the country in the past two years, said Laura Wasileski, spokeswoman for the National Pawnbrokers Association.

The reasons, she said, include “cost-of-living increases, the lack of access to credit, short-term emergencies, and the fact that 50% of American households do not have $1,000 in savings to cover those emergencies.”

Clay Baron, a fourth-generation pawnbroker in El Paso, Texas, is running out of space in his shop.

“When times are good and people have money, there’s going to be more money coming in. People will be buying the stuff,” Baron said. “When people need money, there’s going to be more money going out of the store, which is what’s happening now.”

One customer, Arturo Washington, was less worried about Baron’s inventory glut and more worried about filling his gas tank:

For those of us who are retired, the economy is going very badly… The cost of basic foods is very, very, very expensive. And every day they raise prices more on basic foods. It’s not right.

Not to quibble, and I really don’t intend to downplay Mr. Washington’s struggle – but there’s no shadowy cabal of grocers, no mysterious “they” colluding to squeeze every dime out of struggling families.

Across-the-board rising costs of living increases (inflation) come from dollar devaluation.

The money supply in the U.S. has risen 25% since 2020 – and, remember, more dollars doesn’t translate into more wealth. Printing more dollars instead devalues all other dollars in existence!

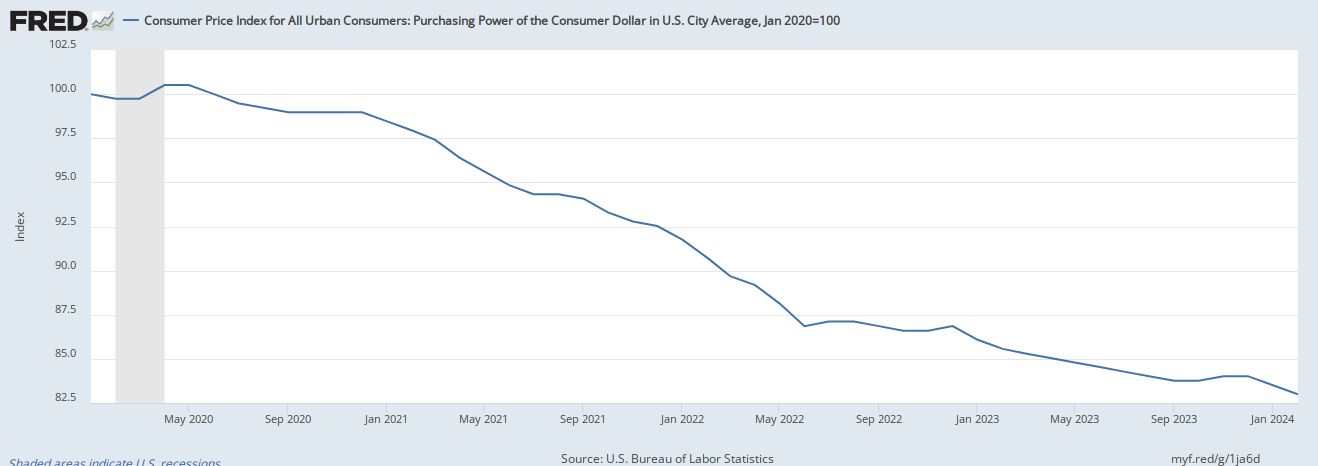

To drive the point home, the purchasing power of the dollar is down 17% since January 2020.

Image via St. Louis Federal Reserve

Will the dollar’s purchasing power continue to decline?

Almost certainly. Simply because the federal government continues racking up $1.7 trillion deficits year after year – which also boosts the money supply, further devaluing our dollars.

Which means we have more of the same to look forward to, and it isn’t a bed of roses…

Persistent inflation isn’t rosy, expensive mortgages aren’t rosy, and historic levels of consumer credit card debt aren’t rosy either.

Yet they’re all obvious consequences of the historic inflation of the U.S. money supply.

I suppose you could torture our metaphor by saying Bidenomics has in fact created a bed of roses, but one with a lot more thorns than flowers.

In fact, a record number of Americans took hardship withdrawals from their 401k retirement funds to make ends meet, some to avoid foreclosure:

A record share of 401(k) account holders took early withdrawals from their accounts last year for financial emergencies, according to internal data from Vanguard Group. Overall, 3.6% of its plan participants did so last year, up from 2.8% in 2022 and a pre pandemic average of about 2%.

Nearly 40% of those who took a hardship distribution last year did so to avoid foreclosure.

Ouch!

Seems like the 401k and the pawn shop are serving similar purposes these days…

Pawn shops overflowing and record 401k loans are a terrible sign for the economy. They’re the ominous clouds swirling on the horizon, forecasting an economic storm on its way.

We can hear thunder’s distant rumble, we can feel the wind picking up.

So what should we do?

Brace your savings for an economic storm

If you’re looking for one asset that can help shelter your nest egg, preserve your purchasing power and generally weather any economic storm?

Then consider the following: Physical precious metals like gold have historically provided an inflation-resistant store of value. Gold and silver are resistant to the dollar’s declining purchasing power.

Better still, thousands of years of history have taught us that, when the hard rain begins to fall, real gold and silver are just about the only asset everyone wants.

They’re just about the only assets immune to Federal Reserve tampering and federal government inflation.

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply