The total amount of publicly held debt in the United States is nearing $34 trillion.

Bullion.Directory precious metals analysis 16 February, 2024

Bullion.Directory precious metals analysis 16 February, 2024

By Peter Reagan

Financial Market Strategist at Birch Gold Group

In addition, GDP can’t keep up with the pace that debt keeps piling up. Expressed officially as the ratio of Public Debt to GDP, that sits at a record 120% – and it’s still rising.

As you’re soon about to discover, however, there is a good chance that this story is taking a sharp turn for the worse.

In fact, the debt and deficit situation has the potential to be so bad, that whatever purchasing power you have left could evaporate into thin air…

“The outlook worsens”

It’s outrageous to think that one line item from the Treasury’s statement could be worth so little, yet cost so much.

In this case, that line item is an interest payment to service the debt, and it robs almost half of all tax receipts according to the Heritage Foundation:

Interest on the federal debt is now so immense that it’s consuming 40% of all personal income taxes. The largest source of revenue for the federal government is increasingly being devoted to just servicing the debt, not even paying it down.

The recent monthly Treasury statement from the Fiscal Service showed that the Treasury Department paid $88.9 billion in October on interest for the federal debt. That’s almost double what it paid in October of the previous year. Worse, the Treasury is projecting interest payments for the fiscal year to exceed $1 trillion. Every month that goes by, the Treasury increases that forecast as the outlook worsens.

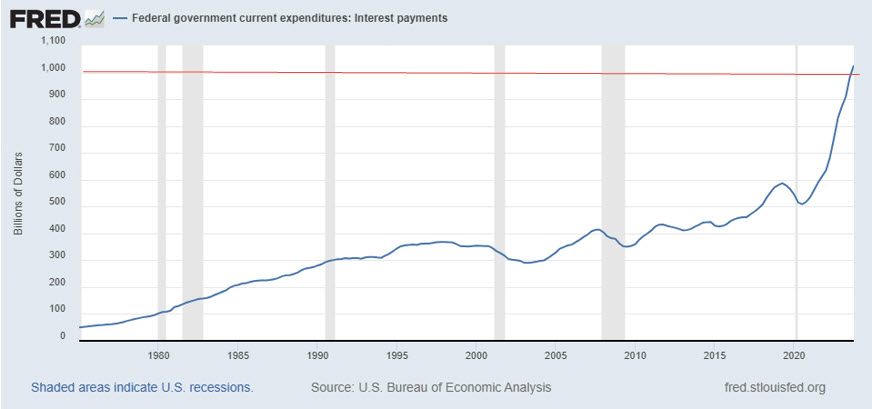

The Heritage piece was published in November 2023, so we’ll see if their prediction plays out as expected for the fiscal year. But interest payments on the federal debt have already topped $1 trillion in total (see official graph below):

Via Federal Reserve of St. Louis with red line added to indicate $1 trillion/year interest payments

Plus, it looks as though the current fiscal year is already off to the races in terms of servicing the debt in one year. As economist E.J. Antoni warned on X-Twitter:

Following the interest payments, Antoni also noted in another post that the national budget deficit is outpacing last year by 16%:

Incredibly, according to the Congressional Budget Office, the budget deficits don’t show any signs of slowing down for the next decade:

The Congressional Budget Office (CBO) projects that the U.S. government will run trillion-dollar deficits over the next 10 years, resulting in a cumulative deficit of $20.0 trillion between 2025 and 2034.

Finally, over at Mishtalk, Mike Shedlock warned not to expect any sort of “post WWII-like” economic recovery to save the day, and to beware of Congressional “spending sprees”:

The current setup is nothing like the situation following WWII. Don’t expect another baby boom. Instead, expect a massive wave of boomer retirements (already started) that will pressure Medicare and Social Security. Depending on the kindness of foreigners to increase demand for US treasuries is not exactly a great plan. Artificial Intelligence (AI) will undoubtedly increase productivity. But that is not going to offset the willingness of Congress to spend more and more money on wars, defense, foreign aid, child tax credits, free education, and other free money handouts, while trying to be the world’s policeman.

Talk about the potential for reckless management of the U.S. economy over the next decade. Miracles could happen, but more “fiscal irresponsibility” appears to be the new normal, at least in the near future.

Now, I’ve thrown a lot of numbers at you. Hundreds of billions, then trillions of dollars, flying out the door… It’s easy to let your eyes glaze over and shrug.

That would be a big mistake. Here’s why…

Why federal deficits and the national debt is more than just accounting

There are two reasons why the national debt, its deficits, and the almost-insurmountable interest payments we’ve covered above should give you pause:

- Generally, as the national debt increases, so does the money required to account for it. That has been lowering the purchasing power of all other dollars since World War II.

- The primary way to repay the debt is by raising taxes, by slashing government spending (which could include cuts to Social Security), or allowing the Fed to “print” money (which causes inflation).

On top of that, important government services could feel the impact of reckless government spending and piling national debt, according to Antoni:

Plus, if another financial crisis like 2007-2009 happens, the government may not be able to rescue the economy at all, according to the Peter G. Peterson Foundation:

On its current path, the United States is at greater risk of a fiscal crisis, and high amounts of debt could leave policy makers with much less flexibility to deal with unexpected events. If the country faces another major recession like that of 2007–2009, it will be more difficult to recover.

So much for Bidenomics, and it sure doesn’t seem like the next POTUS will be able to perform the miracle required to turn things around. But we’ll have to wait and see.

Because this crisis has been over 50 years in the making – and it might be too late for anyone to solve the problem. That’s why it’s absolutely urgent, right now, that you consider just how closely your own financial future is tied to the future of the U.S. dollar…

Diversification away from debt-based assets

As you can plainly see, the national debt isn’t just some fancy government accounting result. It has the potential to affect you every single day.

But that also means prudent Americans can consider two “tried and true” ways to ensure your financial future is not tied to the anchor of the sinking U.S. dollar:

- Diversify your savings (properly) with assets that aren’t based on IOUs or promises to pay

- Don’t ignore the reality of the debt situation; rather, incorporate it into your financial plans

There are just a handful of assets that aren’t based on debt, are inflation-resistant, and can help you build resilience to economic turmoil: Physical precious metals. They’re just about the only financial assets you can not only own, you can hold in your hand. You can’t own physical precious metals in standard retirement savings accounts, though… You need a special Precious Metals IRA. Fortunately, just about everyone can afford to diversify their retirement savings with real, physical gold and silver. (Can you afford not to?)

The first step is to request this free information kit. The next step is up to you.

But don’t wait long!

The national debt is growing much, much faster than ever before in history. And one way or another, you and I will be paying for it for the rest of our lives…

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply