Pop some popcorn and pull up a chair. Things are about to get interesting.

Bullion.Directory precious metals analysis 16 February, 2024

Bullion.Directory precious metals analysis 16 February, 2024

By Mike Maharrey

Journalist, analyst and author at Money Metals Exchange

The bank bailout program established by the Federal Reserve in the wake of last spring’s banking crisis is scheduled to shut down on March 11.

Then what? There are a lot more questions than answers. For instance, will the Fed blink?

And if it doesn’t, how will the end of the bailout ripple through the financial system?

The Federal Reserve created the Bank Term Funding Program (BTFP) after the collapse of Silicon Valley Bank and Signature Bank last March, allowing banks to easily access cash “to help assure banks have the ability to meet the needs of all their depositors.”

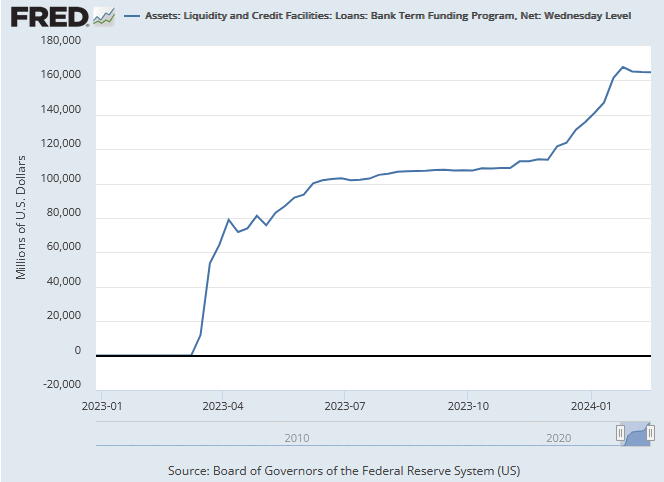

As one would expect, the balance in the program surged initially as banks tapped into the bailout. But borrowing never stopped. As you can see from the chart, borrowing leveled off in August before the sudden spike in November. Keep in mind that banks were still tapping into the bailout even as the total balance in the program plateaued. Some banks were paying off loans as others borrowed.

Were banks borrowing from the BTFP because a financial crisis was still bubbling under the surface, and they needed a bailout? Or were they taking advantage of a sweetheart deal inadvertently created by the Fed?

That’s hard to tell.

The Fed Offers Sick Banks a Sweetheart Deal

The BTFP was a sweetheart deal for cash-strapped banks struggling to cope with crashing bond portfolios as interest rates rose.

Through this lending facility, banks, savings associations, credit unions, and other eligible depository institutions can take out short-term loans (up to one year) using U.S. Treasuries, agency debt and mortgage-backed securities, and other qualifying assets as collateral.

That’s where the sweetheart deal comes in. Instead of valuing these collateral assets at their market value, banks can borrow against them “at par” (Face value).

When the Fed started raising interest rates, bond prices dropped precipitously (Bond yields and bond prices are inversely correlated.) As bond prices fell, the value of bank asset portfolios crashed along with them. Typically, the amount banks can borrow is based on the current market value of their bond portfolios. As bonds tanked their borrowing ability shrank. But by valuing collateral at par, the Fed allowed banks to borrow as if the value of the assets never dropped. Simply put, the BTFP allows banks to borrow more than they otherwise could.

Imagine if there was a tornado in your area that damaged your house. The home would suddenly be worth a lot less than it was before the storm, right? Now imagine going to the bank and asking for a second mortgage based on the value of your home before the tornado. Do you think that bank would make that loan?

Of course not.

The bank probably wouldn’t loan you money based on the lower value of your storm-damaged house, much less on what your home was worth before the tornado. Banks simply don’t accept collateral that is worth less than the amount of the loan.

That is unless you’re a bank in trouble.

The problems at Silicon Valley Bank (SVB) that led to its demise reveal the reason for the bailout.

SVB went under because it tried to sell undervalued bonds to raise cash. The plan was to sell the longer-term, lower-interest-rate bonds and reinvest the money into shorter-duration bonds with a higher yield. Instead, the sale dented the bank’s balance sheet with a $1.8 billion loss driving worried depositors to pull funds out of the bank.

The BTFP gave banks an alternative. They could quickly raise capital against their bond portfolios without realizing big losses in an outright sale. It gives banks a way out, or at least the opportunity to kick the can down the road for a year.

In effect, the bailout papered over significant problems in the banking system.

What Happens When the Bailout Shuts Down?

That remains unclear what will happen when the BTFP locks its doors on March 11.

In the first week of the BTFP, banks borrowed $11.9 billion from the program, along with more than $300 billion from the already-established Fed Discount Window. By April 5, the balance in the BTFP rose to just over $79 billion. By June, banks had borrowed around $100 billion. Borrowing plateaued before taking off again in November.

Troubled banks almost certainly accounted for the bulk of the borrowing in the early months of the bailout. Those early loans will start coming due in March. (Banks had one year from the loan date to repay.)

There are several unanswered questions. Have these banks improved their financial position since getting bailed out? Do they have the cash to pay back the loans? Will the end of the BTFP force them to liquidate their devalued bonds like SVB did?

If banks didn’t address their underlying problems over the last year, we may well see more small and regional banks go under in the coming months.

And If that happens, will the Fed blink and reopen the BTFP?

This is something to keep our eyes on.

Fed Sweetheart Deal 2.0

The Fed inadvertently offered a second sweetheart deal through the BTFP, and the central bank just took it away.

When the Fed announced the imminent shutdown of the “emergency” lending facility, it said it would continue making loans until March 11. But at the same time, it announced it would raise the interest rate it charged on those loans so it at least equals the rate paid on reserve balances parked at the Fed the day of the loan.

Why did it have to make this move?

The lower interest rate charged by BTFP created a profitable arbitrage opportunity. Banks could borrow money from the BTFP at a relatively low interest rate (using undervalued bonds as collateral) and then deposit the money in its reserve account at the Fed to earn a higher interest rate than it was paying on the loan.

For instance, the Fed charged a 4.93 percent interest rate on a BTFP loan as of Jan. 23. At the same time, the central bank was paying 5.4 percent on reserves. This allowed banks to earn nearly 50 basis points by borrowing money and then depositing it in their account at the Fed.

It would be like you taking a 7 percent second mortgage from ABC Bank and then depositing the money into an ABC Bank account that paid you 8 percent interest. Of course, you would never find that kind of deal in the real world.

As an analyst told Reuters, the interest rate discrepancy “gave banks free profits, which is not a good look.”

Yale School of Management’s Program on Financial Stability associate director of research Steven Kelly told Reuters the Fed was “not happy” with the situation.

But these are the types of unintended consequences programs like the BTFP always create. The question is how could the Ph.D. economists and bankers at the Fed not see this coming?

Regardless, increasing the interest rate appears to have put the brakes on additional borrowing from the program. The balance in the BTFP started falling after that announcement on Jan. 24 and has dropped by about $3 billion since.

Once the BTFP shuts down, that will end all the bailout borrowing. Struggling banks will no longer have that particular lifeline.

Do they still need it?

That remains unclear. Profit-seeking banks muddied the water. But there is a strong possibility that the bailout kept a lot of banks afloat. The big jump in BTFP borrowing in November could have been profit-seekers. But some could have been banks sincerely needing a bailout.

Only time will tell.

But it is almost certain that some of the banks that took out loans in the early days of the bailout will struggle to pay them back. That raises another question: will the Fed blink? Will it reopen the BTFP?

Will it extend repayment terms? Or will the entire banking system crack under the strain?

Pop some popcorn and pull up a chair. Things are about to get interesting.

Mike Maharrey

Mike Maharrey is a well-known author, journalist, financial analyst and writer at Money Metals Exchange, one of our top-rated US dealers and two-times winner of Bullion Dealer of the Year

He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida. Mike also serves as the national communications director for the Tenth Amendment Center and the managing editor of the SchiffGold website.

This article was originally published here

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply