There’s an inflationary Trojan Horse Buried in the Tax Relief Bill

Bullion.Directory precious metals analysis 31 January, 2024

Bullion.Directory precious metals analysis 31 January, 2024

By Peter Reagan

Financial Market Strategist at Birch Gold Group

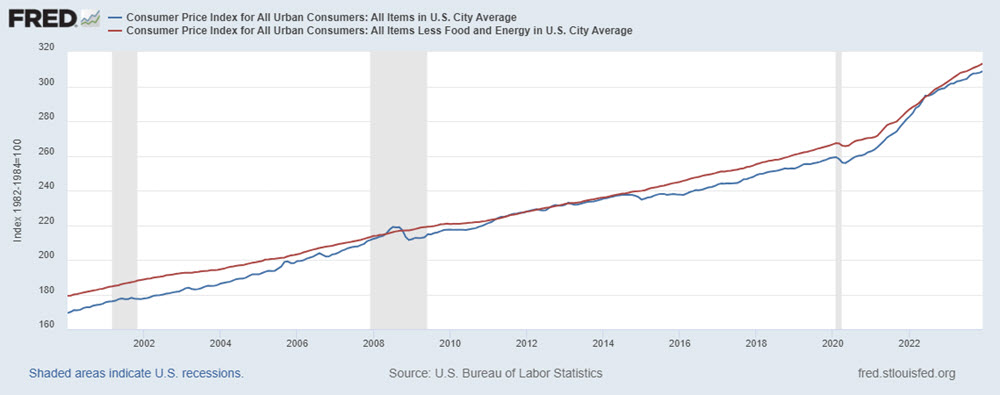

No matter how the corporate media spins it, he just can’t seem to lead the country out of this persistent economic trend. The rate of price inflation is easing, but core inflation remains at a pace not seen since the early 1990s.

You can see both consumer price inflation (blue line) and core price inflation (red line) reflected on the official graph below:

Unfortunately, the Fed’s efforts to ease inflation and the easing rate of inflation are both about to get some resistance.

That’s because the Biden Administration is actively working against these efforts. While the Fed tries to rein in the money supply, the White House is digging in the spurs instead…

The Trojan Horse hidden in “The Tax Relief” act

A recent article published on The Daily Signal revealed that legislation claiming to provide tax relief for the middle class doesn’t quite do what it says it will:

checking inside this Trojan horse known as The Tax Relief for American Families and Workers Act instead reveals a mixed bag that includes welfare expansions, corporate windfalls, and inflationary deficits.

Here’s exactly what this “Tax Relief” entails for those of us trying to plan for our taxes:

The only individual tax cut in the bill is a slight cost-of-living adjustment to the child tax credit – likely from $2,000 to $2,100 – that would apply to taxpayers’ 2025 and 2026 tax filings before expiring.

The bulk – 91.5% to be exact – of what is being described as “middle-class tax relief” is, in fact, an expansion of welfare benefits.

Okay, look, just calling it “welfare” doesn’t automatically make it a bad idea. We don’t usually think of “welfare” as something the middle class needs, certainly.

But times are tough! People are struggling! Maybe everyone needs a little welfare these days?

Well, there’s a catch.

Another report provided by the Heritage Foundation revealed exactly what you might expect from this bill:

The JCT’s formal estimate shows a 10-year deficit impact of only $399 million. However, the 10-year aggregate estimate obscures the uneven distribution of the bill’s deficits. According to the JCT, the bill would generate increased federal deficits of $117.5 billion in FY 2024 and an additional $37.8 billion in FY 2025.

In other words, this welfare expansion will cost three times more than the White House is willing to admit in the first year alone!

Okay, so why am I getting so worked up about this?

Why does it matter if the child tax credit is bumped up 5% in a half-hearted attempt to match the soaring cost of living?

Here’s how the Heritage Foundation explains the problem:

These deficits can be expected to drive further inflation and increasing interest rates as the government generates new money… divorced from increases in real productive capacity and as it crowds out private borrowing.

A lot of Americans (and far too many of our political leaders) seem to believe that the government has a magical treasure chest of wealth hidden somewhere.

Furthermore, they believe they’re entitled to their “fair share” of government-hoarded wealth. When their expenses go up, they want the government to compensate them for the difference.

Price of gas too high? Get a “gas tax rebate” (this was a real thing!).

Can’t afford a house? Don’t worry, there’s a government-sponsored entity that’s ready and willing to loan as much as it costs. Whether or not payments are affordable.

All they want is their share of the secret wealth in the government’s treasure chest.

But there’s no magic treasure chest.

The government cannot make wealth! The government’s revenue comes from one of two things:

- Taxation

- Debt

In an economic sense, taxation just shuffles dollars around. You pay your taxes and the government passes your dollars on to someone else. You have fewer dollars, they have more dollars, but the overall number of dollars doesn’t change.

Issuing debt, though? That doesn’t make wealth – it just makes more dollars. Since the value of currency, like everything else, is based on supply and demand, making more dollars simply decreases the purchasing power of all dollars everywhere.

It means more dollars chasing the same amount of goods and services.

During the Covid panic, the federal government handed Americans tidy little piles of cash. Everyone was happy – at first. Then everyone got angry when prices rose – that free money didn’t go as far as it used to.

That’s how inflation works.

This is not a situation the government can spend its way out of! Goodness knows the Biden administration has tried…

Over the past three years, President Biden has added $6 trillion to the national debt. That is a truly shocking amount of money!

Let me put it in perspective…

- Adjusted for inflation, $6 trillion is 20% more than the U.S. spent fighting World War II

- It’s twice as much as the entire national debt of Germany (in just three years!)

- By itself, $6 trillion would be the third biggest national debt in the world

So it’s no surprise that the annual cost of living has risen, on average, $11,400 for the typical American family.

Giving them more dollars doesn’t help!

The Biden administration hasn’t figured this out yet. They see there’s a fire, they hear people complaining about the smoke – and so they dump another bucket of gasoline on the blaze. No, the last 6 trillion buckets of gasoline didn’t put the fire out – but maybe this one will!

Hoping for relief? Well, it looks like the White House’s 2024 budget will rack up at least another $1.7 trillion in debt.

Don’t ask yourself how many dollars you’ve saved, or how many you earn. Ask yourself instead what you can do with those dollars. What are they worth?

More importantly, how much less with they be worth tomorrow?

Inflation-proof your savings

Dollars are essentially IOUs from the federal government. They have no intrinsic value – which means their purchasing power is subject to the whims of supply and demand (and nothing else).

Some assets have intrinsic value due to their utility or other benefits they provide.

Tangible assets are the only financial assets you can own and hold in your hand. They aren’t an IOU or a promise to pay. They can’t be printed, hacked or inflated into worthlessness.

Physical gold and silver have served throughout human history as safe haven assets, immune from the whims of governments or central bankers. The price of physical gold has been relatively stable in the face of the economic turmoil that Bidenomics has wrought upon everyday Americans during his first term. In fact, the price of gold grew almost 13% overall in 2023 (easily beating inflation).

Of course, getting your hands on some precious metals is just one of many different ways to bolster your resistance to inflation.

Now might be a good time to take a look at your retirement plan, and reconsider how your assets are diversified.

You can get all of the information you need to think about diversifying with precious metals in our free information kit.

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply