Gold price futures jumped higher today – was the current gold price forecast affected?

Bullion.Directory precious metals analysis 30 January, 2024

Bullion.Directory precious metals analysis 30 January, 2024

By Przemysław K. Radomski

Founder of GoldPriceForecast.com

In short, not really.

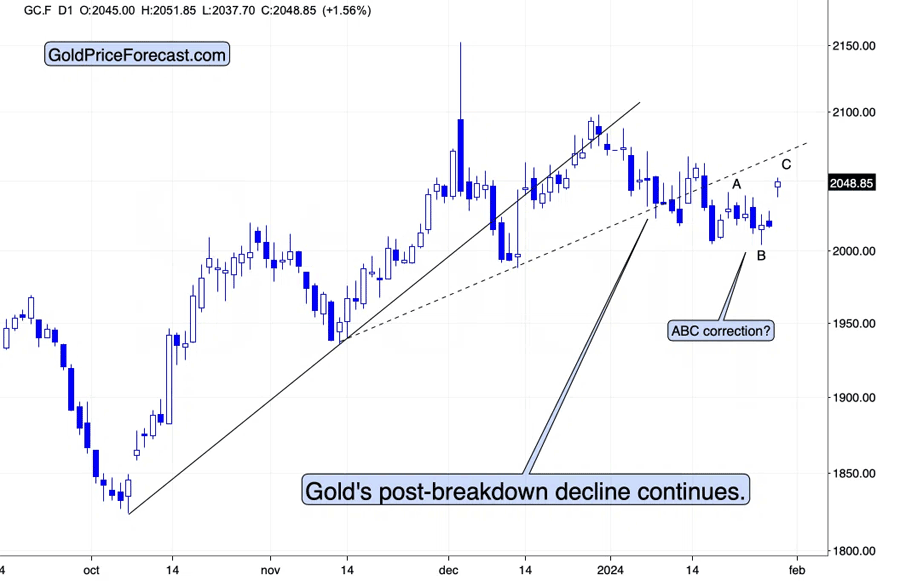

Gold declined in January in a back-and-forth manner, and today’s move higher fits this narrative.

No important breakdown was invalidated based on today’s move, and overall, the recent price moves took the form of an ABC correction pattern (sometimes called a “zigzag”), which is quite common.

In other words, today’s move higher is really uneventful.

Wednesday’s and Thursday’s sessions might be particularly interesting, as we’re going to get Fed’s next interest rate decision and the follow-up comments on Wednesday (as well as the ADP nonfarm employment change) and on Thursday we’re getting an analogous decision from The ECB. Plus, the U.S. initial jobless claims.

The interesting thing about the days that are rich in statistics is the fact that the volatility can precede them, even though nothing is happening (theoretically) on those days. In reality, that’s when many market participants try to guess what the fundamental news are going to be and how the market reacts to them… In a way making the market react before any news is released.

As I explained previously, it’s much better to focus on how the market is likely to interpret whatever is coming its way, and we know this thanks to technical chart analysis.

Thanks to this approach, you can be early in price moves, and you are less likely to be affected by fake rallies (like the one that we see today in gold price) or fake declines that tend to happen right before and/or right after important fundamental announcements.

There are many ways in which one can interpret data – and the prevailing way is likely to be determined based on the market’s emotional state – and that’s what you can detect using technical tools.

Right now, since gold hasn’t invalidated its breakouts, the outlook remains bearish.

Meanwhile, the USD Index is moving back and forth after breaking above its declining resistance line. Since this breakout has now been more than confirmed, it’s very likely (I don’t want to use the word “obvious” here, but it’s close to being obvious) that the next move up is a “done deal”. We’re simply waiting for the next “go” signal – a trigger.

The trigger can come from any news release or even without it. A fundamental trigger, like a favorable fundamental statistic being released would be useful. As we’re about to get quite a few of them, it’s quite possible that the market will view at least one of them as something bullish.

And if not, the USDX would simply consolidate for some time and then rally anyway – that’s what we can say based on just technicals. Whatever hits the market if it wants to rally, is likely to either trigger a rally or prolong a pause. Maybe a tiny decline. And a confirmed breakout is exactly what makes the environment bullish.

This is especially the case that the USD Index moved slightly below its rising, long-term support line and then soared back up. Last time it happened, it made the USDX form a yearly low and triggered a sizable rally.

So far, the size of the rally was tiny – when viewed from the broad perspective – so, the USDX is likely to rally further.

Something particularly interesting is also happening in the U.S. stocks right now.

The S&P 500 Index futures are trading above their previous highs, and it would be bullish if it wasn’t for the fact that this is the way in which the U.S. stocks have been moving recently is so similar to the way in which stocks topped two years ago.

I marked both cases with blue rectangles, and the similarity is uncanny. After the two smaller tops, the S&P 500 moved higher then moved back and forth (note: we are here) and then it plunged.

When stocks plunge, mining stocks – that have been particularly weak relative to both: gold and stocks – are likely to fall particularly hard.

The GDXJ, proxy for junior mining stocks, moved lower on Friday and closed below its declining resistance line and below the neck level of the recently broken head-and-shoulders pattern.

In other words, the breakdown below the H&S formation remains intact. This means that bearish implications remain intact as well.

The thing that I would like to stress here is that the back-and-forth movement that we saw in the last several days is not neutral. It’s bearish because it’s been taking place below the neck level of the H&S pattern. Even a daily rally that didn’t result in an invalidation of this breakdown had bearish implications.

At the moment of writing these words (about 40 minutes before the markets open in the U.S.), the GDXJ is up to $34.44 in pre-market trading.

That’s not a lot, especially compared to gold’s rally.

The bearish outlook for the junior miners remains intact, and it’s very likely that our profits from the short positions in them will grow further in the near future.

Przemyslaw Radomski

Przemyslaw K. Radomski, CFA, has over twenty years of expertise in precious metals. Treating self-growth and conscious capitalism as core principles, he is the founder of GoldPriceForecast.com

As a CFA charterholder, he shares the highest standards for professional excellence and ethics for the ultimate benefit of society and believes that the greatest potential is currently in the precious metals sector. For that reason it is his main point of interest to help you make the most of that potential.

This article was originally published here

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply