Two Fun Social Security Trends we Can Thank Bidenomics For

Bullion.Directory precious metals analysis 10 January, 2024

Bullion.Directory precious metals analysis 10 January, 2024

By Peter Reagan

Financial Market Strategist at Birch Gold Group

The administration is eager to tell you this is a strong finish to 2023’s spectacular job growth.

Bidenomics is winning!

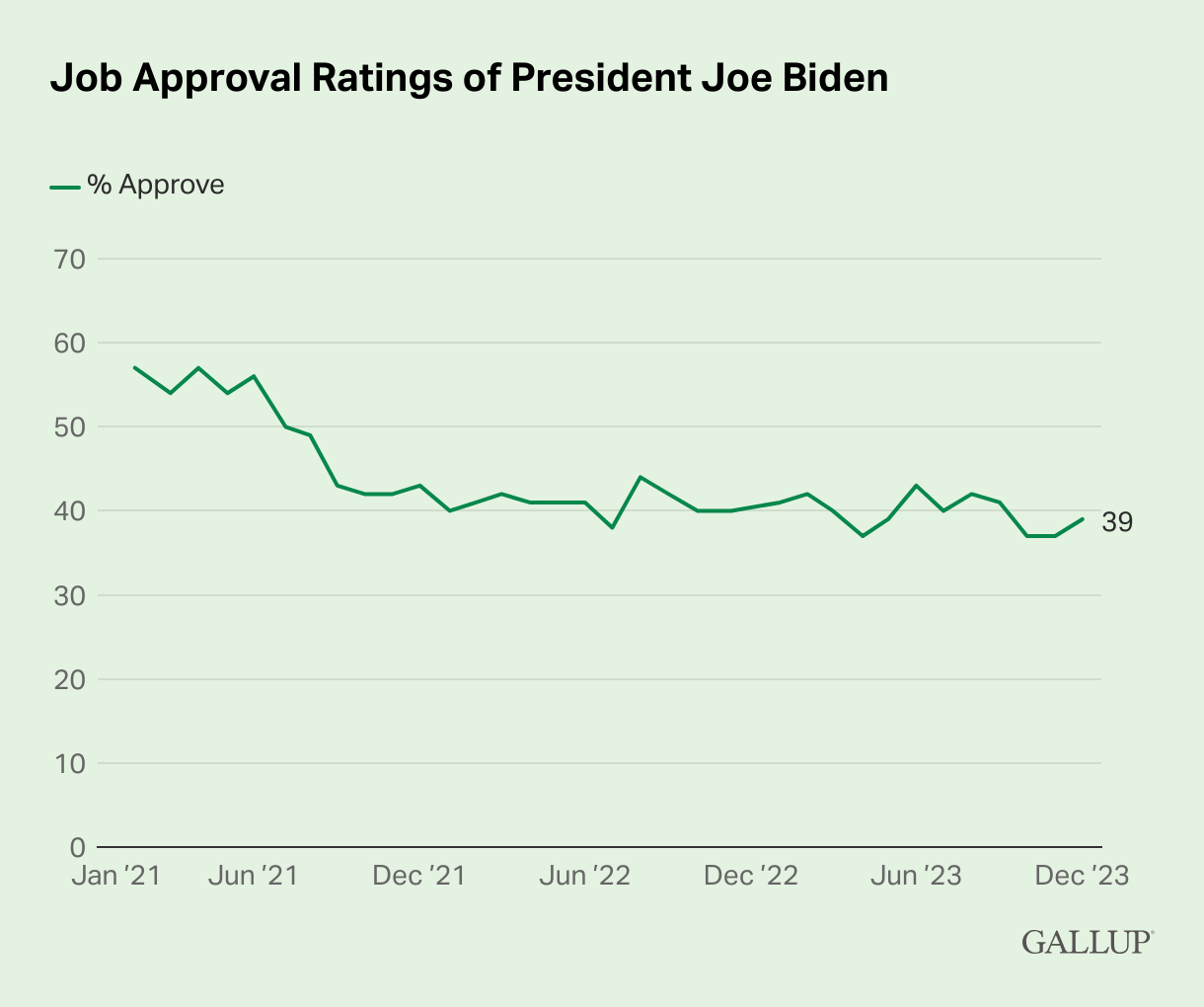

But despite the laser-focus on that one job creation number, American voters aren’t buying it. (The latest Presidential job approval rating of 39% makes the case.)

via Gallup

So let’s dive into this job creation and evaluate the strength of the labor market…

There is some good news (if we dig deep enough)

It’s good news that 216,000 jobs were added to the market. Even the 3.7% unemployment rate is in line with expectations.

More good news: Private sector earnings rose 4.1%, on average, finally outstripping official inflation numbers of 3.1%.

Now we look at the other side of the coin…

Mike Shedlock nets it out for us – since June 2023:

Jobs up 216,000 but employment down 683,000

See, there’s a difference between “jobs” and “employment.”

Jobs are open positions. Until the position is filled, a job is hypothetical.

Employment means an individual is working a job and getting paid for it. Of the two numbers, employment is much more important.

This sort of doubletalk is exactly what I’m referring to when I complain that economic reports are more political than economic…

Back to Shedlock:

From the full-time employment peak in June of 2023, full time employment is down by 1,591,000. In the same time frame, jobs are up by 1,157,000.

The problem is, most of that “job growth” is concentrated in just a handful of industries, according to the Wall Street Journal:

Job growth also became more concentrated in a handful of industries: healthcare and social assistance (which includes private-sector child-care workers, home-care aides and social workers), leisure and hospitality, as well as state and local government. Outside those sectors, hiring slowed sharply and in some areas contracted.

According to the official update, we found that construction, wholesale, and transportation jobs – you know, jobs that make a difference in the real economy – actually decreased. A staggering 24% of these positions are government jobs! That’s 52,000 of the 216,000 jobs to be exact.

Overall, welfare state bloat was responsible for some 60% of new jobs in 2023.

This reminded me of the section in J.M. Keynes’s The General Theory of Employment, Interest, and Money where he recommended that government spending on virtually any activity could help reduce high levels of unemployment. Even if that activity is as pointless as digging holes and then refilling them. He argues government spending would inject money into the economy, increase demand, and thus stimulate economic activity. (From Chapter 10, The Marginal Propensity to Consume and the Multiplier, if you care to fact-check.)

Is this really a good idea? Because, if so, every American could have a government job, and a government paycheck. Why even bother digging the holes?

I’ll leave it to my readers to work out the obvious issues here.

There’s another concern you should take even more seriously, especially if you’re nearing retirement age…

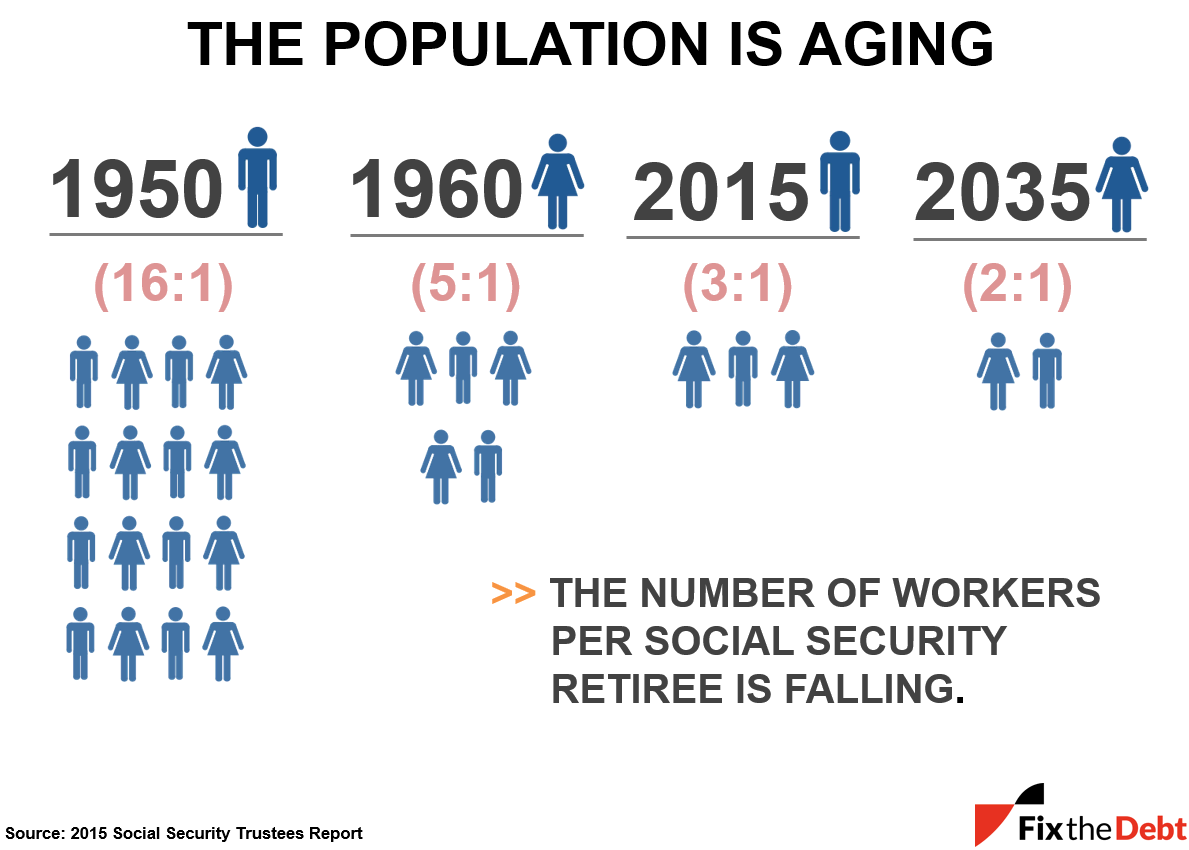

Aging population, shrinking workforce pressure Social Security

The Committee for a Responsible Federal Budget (CRFB) made an interesting observation back in 2015 that Biden’s “job growth” has to contend with today.

Eight years ago, Senator Lindsey Graham (R-SC) stated:

In 1950, there were 16 workers for every retiree. How many are there today? There’s three. In 20 years, there’s going to be two, and you’re going to have 80 million baby boomers like me retiring in mass wanting a Social Security check, and their Medicare bills paid.

You can see that observation more clearly reflected on the graphic below:

Bidenomics can’t fix this. In fairness, it’s doubtful that any POTUS elected in 2024 will be able to reverse the trend.

What’s obvious is that this dynamic will increase the pressure on Social Security. Per the CRFB:

In a recent New York Times opinion piece which keyed off a recent analysis from Karen Smith and Committee for a Responsible Federal Budget board member Eugene Steuerle, Glenn Kramon and Steuerle explain that the aging of the population and growing cost of benefits are putting the Social Security and Medicare trust funds in jeopardy.

With 17 percent of the population now over 65 (up from only 12 percent three decades ago) and the Social Security and Medicare programs paying most seniors far more than they paid in, the authors argue that For the Good of the Country, Older Americans Should Work More and Take Less.

“For the Good of the Country,” are you willing to “Work More”? Postpone your retirement five or six years? (Maybe pick up a government-hole-digging job on the side?)

Are you willing to “Take Less” of the benefits you paid for and that the government has promised you?

Can the NYT’s op-ed page shame you into giving up your Social Security benefits?

I sincerely doubt it. And if that’s the best plan they can come up with to salvage Social Security, then we’re all in a lot of trouble…

What will you do if they retire retirement?

The nation faces two huge challenges:

- The backdoor implementation of a comprehensive welfare state (at taxpayer expense!)

- A steady decline in productive employment that’s absolutely necessary to support the demands on Social Security and Medicare

The first challenge can be addressed by a change in leadership, so get out there and vote.

The second challenge? It’s been unfolding for 70 years now. The only plan I’ve seen to solve it is a marketing scheme based on simple math – right in line with the NYT op-ed I cited above.

The economy is precarious – even more so if we remove bureaucratic bloat from the jobs numbers – and Social Security is far from secure.

Right now you must make absolutely certain your savings are properly diversified to keep your retirement plan on-track. Physical precious metals (especially gold and silver) have historically served as safe-haven stores of value, preserving wealth during troubling economic times. That’s because precious metals have intrinsic value (based on both their inherent utility as well as supply and demand).

In fact, the price of physical gold in 2023 rose about 13% (handily beating inflation).

Take control of your financial future while there is still time! You can get the information you need to consider precious metals in our free kit.

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply