Wall Street Journal Asks If Nation Can Withstand Four Economic Shocks at Once

Bullion.Directory precious metals analysis 06 October, 2023

Bullion.Directory precious metals analysis 06 October, 2023

By Isaac Nuriani

CEO at Augusta Precious Metals

I’m not sure even he expected to hit the nail on the head quite as squarely as he apparently did.

Among the most prominent examples of that uncertainty was the banking crisis earlier this year, highlighted by the second- and third-largest bank failures in U.S. history.[1]

The widely expected return to dovish monetary policy in 2023 fell off the table, as well.[2] And the reason for that has been the surprising (to some) reality that inflation has persisted as it has. Headline inflation decided to reaccelerate in August, and core continues to stubbornly resist falling below 4%.[3]

We can’t forget the surge in household debt, either. In the second quarter, household debt crossed above the $17 trillion mark for the first time ever.[4] Also in the second quarter, credit-card debt surpassed $1 trillion for the first time ever.[5]

But as clear a picture of near-term uncertainty as we’ve had so far in 2023, the Wall Street Journal recently suggested things may get a good deal more uncertain.

Specifically, the Journal wondered aloud about the potential impact of not one but four economic shocks besetting the economy this fall at the same time: an expanded auto-workers strike; a lasting government shutdown; the resumption of payments by student-loan borrowers; and surging oil prices.[6]

Over the last few months, some analysts who earlier had projected the country would fall into recession between the end of 2023 and the beginning of 2024 have backed away from those forecasts.[7] But now, as multiple shocks circle over the head of an economy already beaten down by a two-year onslaught of inflation and rate hikes, the question is raised of whether that change in sentiment might, in retrospect, look a bit premature.

As the Journal suggests, each of the noted “shocks,” were they to occur singly, likely wouldn’t be sources of significant damage to the nation’s economic stability. But if they unfolded at the same time, the resulting impact could prove particularly daunting for the U.S. economy right now.

“It’s that quadruple threat of all elements that could disrupt economic activity,” suggests Gregory Daco, chief economist at EY-Parthenon.[8]

Let’s take a few minutes to look at each. By doing so, perhaps we can gain a better understanding of what their collective impact might mean.

Fed Chair Powell: Economy Has Had Momentum – Now, However, There’s “This Collection of Risks”

You probably already know the United Auto Workers (UAW) are on strike. They’ve been on strike since September 15, simultaneously walking out on the nation’s “Big Three” automakers – Ford, General Motors (GM) and Stellantis (formerly Chrysler) – for the first time in history.[9]

When UAW President Shawn Fain first called for the work stoppage, it translated to roughly 13,000 workers striking at three plants. A week later, Fain expanded the strike to include 38 parts-distribution plants of GM and Stellantis. Ford was let off the hook of this strike expansion, because, according to Fain, the union had seen some progress in its negotiations with the automaker.[10]

That didn’t last long, however. Last week, Fain decided he wasn’t happy with the way negotiations were going and expanded the strike again, this time focusing on Ford and General Motors as targets.[11]

As of the most recent walkout, there now are roughly 25,000 workers – about 17% of all UAW members at Ford, GM, Stellantis – on strike, presently.[12]

So far, the economic fallout from the strike has been relatively muted. That could change, however, given the apparent eagerness with which UAW President Fain seems willing to expand the work stoppage as he sees fit.

According to a recent report by Anderson Economic Group, the strike – through just the first two weeks – resulted in economic losses totaling roughly $4 billion.[13] And if the strike grows in scope, as it seems to be doing right before our eyes, Goldman Sachs says the impact could include a reduction in annualized GDP by as much as 0.1 percentage points each week.[14]

And that’s just the strike. We have yet to discuss any of the other shocks noted by the Journal.

University of Michigan economist Gabe Ehrlich is one who thinks that while neither the strike nor any of the other looming challenges may, individually, be a significant threat to the economy, that could be different if they end up attacking as a pack.

“I don’t expect the strike on its own to tip the national economy into recession, but there are other speed bumps coming,” Ehrlich said. “You put all those together and it looks like it might be a bumpy fourth quarter to end the year.”[15]

Another of those bumps is the possibility of a government shutdown.

An agreement was worked out in the nick of time last weekend to keep the lights on in Washington for another month and a half.[16] However, the short-term resolution hardly has the feel of something certain to hold Congress together beyond the current deadline – particularly in light of Speaker Kevin McCarthy’s historic ouster on Tuesday.

In fact, some analysts suggest the removal of McCarthy means the likelihood of a government shutdown sometime in the coming weeks is now greater.

Goldman Sachs: “Leadership Vacuum” Raises Likelihood of Government Shutdown

Jan Hatzius and his team at Goldman Sachs suggested in a note that the “leadership vacuum” resulting from McCarthy’s firing has increased the chances of a shutdown.[17]

“With many policy disputes remaining and a $120 billion difference between the parties on the preferred spending level for fiscal year 2024,” Hatzius writes, “it is difficult to see how Congress can pass the 12 necessary full-year spending bills before funding expires on Nov. 17.”[18]

The Journal notes that a partial five-week shutdown of the government in 2018 reduced GDP by 0.1% in the fourth quarter of that year, and by 0.2% in the first quarter of 2019.[19] It’s unclear how much of a guideline that is for a similar shutdown in the current climate.

But, with the speaker’s chair vacated, government potentially becomes just a little more chaotic.

“Markets might react negatively to government dysfunction,” suggested Brian Gardner, Stifel chief Washington policy strategist.[20]

Then there’s the matter of student-loan forbearance coming to an end after three and a half years.

When it went into effect in March 2020, roughly 11% of student loan balances were 90-plus days past due, according to the New York Fed. The 12-month “on-ramp” plan for the restart that says late payments won’t be penalized right away likely will go a long way to preventing a quick resurgence in delinquencies.

But some analysts suggest an increase is now only a matter of time.[21]

In terms of the general economy, the resumption of student-loan payments is expected to take a toll on consumer spending, which has shown itself to be quite resilient this year.[22]

According to recent analysis by Goldman Sachs, having to start making the payments again could mean a cost of roughly $70 billion per year to U.S. households. Goldman researchers go on to suggest that could translate into a 0.8-percentage-point decline from growth of consumer spending in the fourth quarter, slowing it down to 1.4%.[23]

On a related note, the renewal of loan payments is expected to negatively impact the personal savings rate, as well.[24] As of July, that rate had fallen to 3.9%, among its lowest measures ever.[25]

Still another concern, notes the Journal, is the matter of the ongoing surge in oil prices, which have been soaring over the last few months on the strength of cuts by major producers.

OPEC-plus began the production-slashing festivities last year in an effort to shore up prices.[26] Then, in July, Saudi Arabia announced an additional, unilateral production cut by an additional 1 million barrels per day.[27]

Russia initiated its own added unilateral cuts shortly thereafter: 500,000 barrels per day beginning in August, with another 300,000 per day starting last month.[28]

The production cuts pushed the cost of oil more than 20% higher over the course of the third quarter to above $90 per barrel, where it remains today.[29] Some analysts now project oil could climb to north of $100 per barrel before the end of 2023.[30]

Among the biggest impacts from higher energy costs is what they’ve done to inflation. A headline annual consumer price index that had been retreating suddenly accelerated in August – to 3.7% from 3.2% in July – on the back of a 10.6% month-over-month increase in the gasoline index.[31] And should oil stay elevated, or even jump higher, price pressures for consumers – along with the challenges facing the Fed – could intensify further.

There you have it. Four economic risks – or economic shocks, as the Journal calls them – poised to create problems for consumers and savers. As I noted earlier, perhaps any one of them, not so much. But collectively?

“It’s the strike, it’s government shutdown, resumption of student loan payments, higher long-term rates, oil price shock,” Fed Chair Jerome Powell said recently. “You’re coming into this with an economy that appears to have significant momentum. And that’s what we start with. But we do have this collection of risks.”[32]

In the eyes of some, having to face economic risks as a collection may be something we have to get used to.

Analysts: “Global Shocks Are Here to Stay”

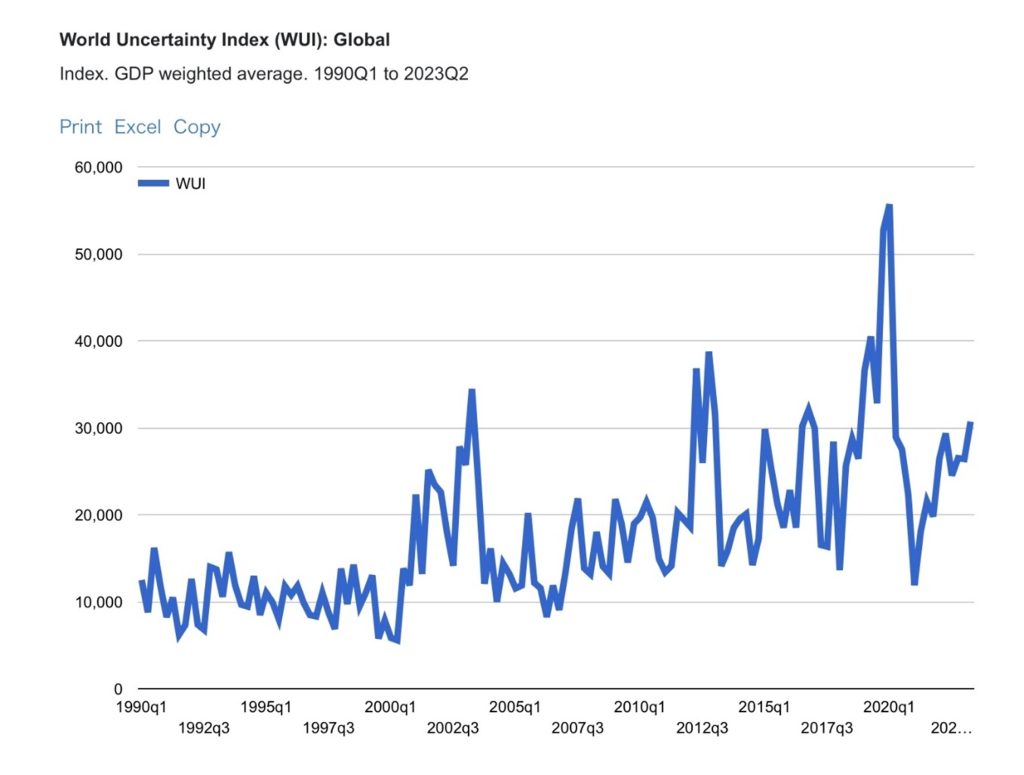

If any of us are surprised that economic shocks are coming at what might seem a steady pace, perhaps we shouldn’t be, based on what the World Uncertainty Index has been telling us for more than two decades. Since roughly the beginning of the millennium, the index has been trending broadly higher, overall, and sharply higher compared to the period 1990 to 2000.

From 1990 to 2000, the index fell 50%. From 2000 to 2010, the index rose more than 200%. And from 2000 to 2023, the index has surged well over 400%.[33]

In an article published last year in the Harvard Business Review, “Visualizing the Rise of Global Economic Uncertainty,” the architects of the index suggested that a new paradigm of global economic uncertainty now prevails.

Discussing the drivers of this new paradigm, including “greater geo-economic fragmentation,” the authors made the following declaration: “Global shocks are here to stay.”[34]

In a rather stunning assessment, asset managers BlackRock noted in their “2023 Global Outlook” at the beginning of the year that they considered the current worldwide economic and geopolitical landscape to be “the most fraught global environment since World War Two – a full break from the post-Cold-War era.”[35]

BlackRock later concluded that among the consequences of this greater uncertainty would be a “new regime of greater macro and market volatility – and persistently higher inflation.”[36]

A greater shock to the global economic system prompted by ongoing inflation challenges – along with the central bank response they effectively would mandate – is part of the outlook shared recently by J.P. Morgan CEO Jamie Dimon.

In an interview with the Times of India, Dimon pondered whether the world would be “prepared” for 7% interest rates, going on to clarify that could be “7% with stagflation.”[37]

It remains to be seen, of course, whether longer-term projections of greater uncertainty and volatility going forward come to pass. Even if we choose to doubt those, we know of the four legitimate, potential economic shocks sitting right in front of us that could create significant challenges for the U.S. economy in the months to come.

In my view, those are all a great indication that such shocks always could be lurking…and an indication, as well, of just how little control we have over when they might strike.

Isaac Nuriani

Isaac Nuriani is CEO at Augusta Precious Metals, America’s leading gold IRA specialists and Bullion.Directory’s go-to precious metals dealer for HNW (High Net Worth) investors.

Issac’s passion is educating and empowering retirement investors to protect their savings. He is a member of Ethics.net and the Industry Council for Tangible Assets (ICTA) – and leads a team of financial professionals at Augusta who share his commitment to service with integrity, as they help retirement savers use silver and gold IRAs to achieve effective diversification.

[1] Michael Keenan, GO Banking Rates, “The 15 Biggest Bank Failures in US History” (April 14, 2023, accessed 10/5/23).

[2] Bram Berkowitz, The Motley Fool, “Will the Fed Start Cutting Interest Rates In 2023? It’s Possible” (December 23, 2022, accessed 10/5/23).

[3] Bureau of Labor Statistics, “Consumer Price Index Archived News Releases” (accessed 10/5/23).

[4] Federal Reserve Bank of New York, “Total Household Debt Reaches $17.05 trillion in Q1 2023; Mortgage Loan Growth Slows” (May 15, 2023, accessed 10/5/23).

[5] Ann Saphir, Reuters.com, “US credit card debt tops $1 trillion, overall consumer debt little changed” (August 8, 2023, accessed 10/5/23).

[6] ] David Harrison, Wall Street Journal, “U.S. Economy Could Withstand One Shock, but Four at Once?” (September 24, 2023, accessed 10/5/23).

[7] Howard Schneider and Indradip Ghosh, Reuters.com, “Fed, economists make course correction on US recession predictions” (August 17, 2023, accessed 10/5/23).

[8] Harrison, “U.S. Economy Could Withstand One Shock.”

[9] Danielle Kaye, NPR.org, “The UAW launches a historic strike against all Big 3 automakers” (September 15, 2023, accessed 10/5/23).

[10] Ivana Saric and Joann Muller, Axios, “UAW expands strike against Ford, General Motors” (September 29, 2023, accessed 10/5/23).

[11] Ibid.

[12] Ibid.

[13] Max Zahn, ABC News, “Autoworkers strike has cost US economy nearly $4B, report says” (October 2, 2023, accessed 10/5/23).

[14] Harrison, “U.S. Economy Could Withstand One Shock.”

[15] Ibid.

[16] Lisa Mascaro, Kevin Freking and Stephen Groves, APNews.com, “Government shutdown averted with little time to spare as Biden signs funding before midnight” (October 1, 2023, accessed 10/5/23).

[17] Callum Keown, Barron’s, “What McCarthy’s Historic Ouster as House Speaker Means for Government Shutdown Odds” (October 4, 2023, accessed 10/5/23).

[18] Ibid.

[19] Harrison, “U.S. Economy Could Withstand One Shock.”

[20] Ben Werschkul, Yahoo Finance, “House vote to oust McCarthy could mean ‘weeks’ of chaos and higher odds of shutdown” (October 3, 2023, accessed 10/5/23).

[21] Elizabeth Renter, Fox59.com, “4 ways restarting student loan payments could impact the economy” (August 13, 2023, accessed 10/5/23).

[22] Bureau of Economic Analysis, “Consumer Spending” (September 29, 2023, accessed 10/5/23).

[23] Jordyn Holman, Jeanna Smialek and Jason Karaian, New York Times, “Will Restart of Student Loan Payments Be the Last Straw for Consumers?” (September 17, 2023, accessed 10/5/23).

[24] Renter, “4 ways restarting student loan payments.”

[25] Federal Reserve Bank of St. Louis, “Personal Saving Rate” (accessed 10/5/23).

[26] Conglin Xu, Oil & Gas Journal, “Saudi Arabia to further reduce output as OPEC+ sticks to 2023 production cut target” (June 5, 2023, accessed 10/5/23).

[27] Alex Lawler, Reuters.com, “OPEC oil output falls on Saudi cut and Nigerian outage, Reuters survey finds” (July 31, 2023, accessed 10/5/23).

[28] Robert Perkins, S&P Global, “Russian oil exports hit 11-month low as refinery downtime, output cuts bite” (September 4, 2023, accessed 10/5/23); Vladimir Soldatkin and Oksana Kobzeva, Reuters.com, “Russia extends oil exports cuts of 300,000 barrels per day until year-end, deputy PM Novak says” (September 5, 2023, accessed 10/5/23).

[29] Joe Wallace and David Uberti, Wall Street Journal, “The Fed’s Next Challenge: $100 Oil” (September 19, 2023, accessed 10/5/23).

[30] Sam Meredith, CNBC.com, “Oil just hit its highest level of the year — and some analysts expect a return to $100 before 2024” (September 15, 2023, accessed 10/5/23).

[31] Bureau of Labor Statistics, “Consumer Price Index Archived News Releases.”

[32] Harrison, “U.S. Economy Could Withstand One Shock.”

[33] World Uncertainty Index, “World Uncertainty Index (WUI): Global Index. GDP weighted average. 1990Q1 to 2023Q2” (accessed 10/5/23).

[34] Nicholas Bloom, Hites Ahir, and Davide Furceri, Harvard Business Review, “Visualizing the Rise of Global Economic Uncertainty” (September 29, 2022, accessed 10/5/23).

[35] BlackRock.com, “2023 Global Outlook” (accessed 10/5/23).

[36] Ibid.

[37] Mayur Shetty, Times of India, “‘Index inclusion to bring $25 billion foreign inflows’” (September 26, 2023, accessed 10/5/23).

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply