Why gold, the “king of commodities,” will become increasingly vital

Bullion.Directory precious metals analysis 05 September, 2023

Bullion.Directory precious metals analysis 05 September, 2023

By Peter Reagan

Financial Market Strategist at Birch Gold Group

The latest analysis, which focuses on natural resources more than anything else, explains why gold is becoming the must-have asset for the years ahead.

Not only gold, though… Uranium, oil and copper, too. These make the short list of investments that G&R likes in the decade that’s underway. Fortunately, gold is considerably more accessible and compact (and doesn’t cause radiation poisoning).

G&R stipulate that, in a round table of investors sitting and talking as the decade closes, those who bought gold early enough will be the biggest winners. Their gains will eclipse even those of investors in all of the four specific commodities mentioned above.

But what about the gold price? Isn’t it too high right now? Curiously, 1980 was one of three instances over the past century where G&R says gold was overvalued. On the other hand, the firm notes that gold has been severely undervalued only three times in history: the late 1960s, the 1990s and present day.

G&R looks to the Federal Reserve’s monetary base (M2) versus the Treasury’s gold holdings to get a gauge of this, and in accordance, gold is now even more undervalued than in the previous two instances.

Perhaps to give credibility to his forecast, Leigh Goehring points out his Forbes profile dating back all the way to 2000. Two decades ago, with $275/oz gold and lots of central bank selling, his forecast of a $2,500 gold price seemed very outlandish given the metal’s standing with investors. Soon enough, it had hit $1,910 within that bull cycle, still some ways off but certainly reinforcing Goehring’s reasoning.

Today, G&R’s forecasts of $14,000 gold on the conservative side and $32,000 from a logical one seem extreme, but are no less grounded in reality. For the latter scenario, the value of the Treasury’s gold holdings would only have to surpass the monetary base by 1.5 times, as it has in past gold bull markets.

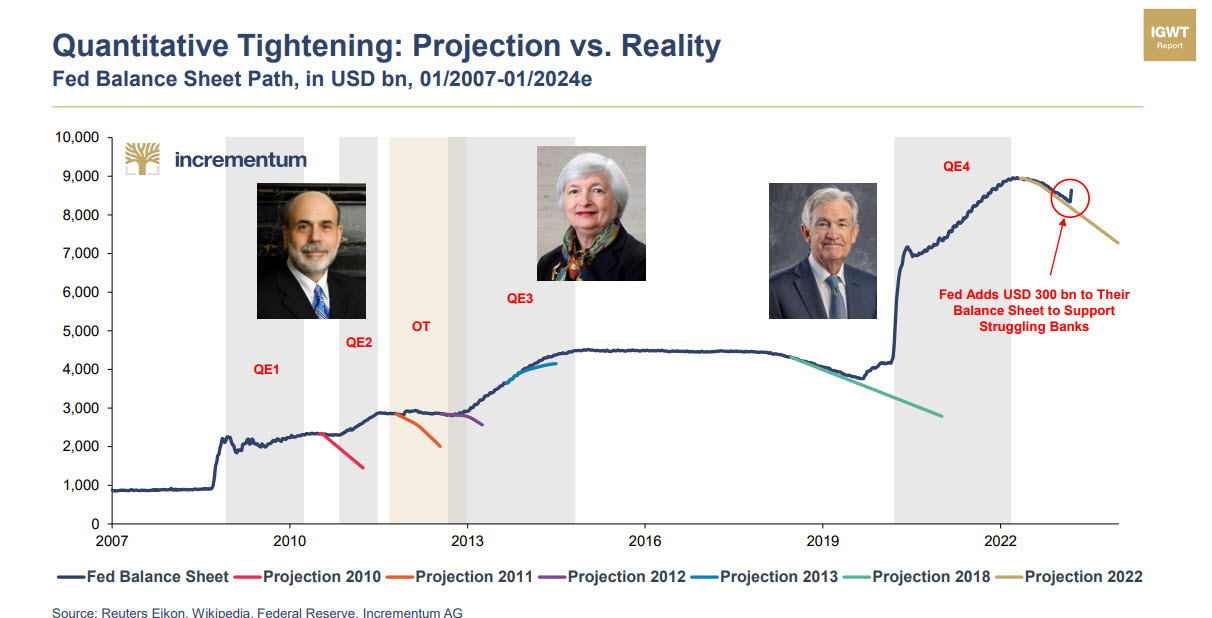

The former actually involves a considerable unwinding of money reserves on the Fed’s balance sheet, which officials want to do but seem unable to execute:

Likewise, an attempt by the U.S. to deal with its increasingly insurmountable debt problem by monetizing the debt pile would spark hyperinflation, and push gold into the stratosphere. In this scenario, their prediction of a $35,000/oz gold price would indicate a true economic disaster of almost unimaginable proportions – at least, for those whose savings depend on the dollar.

If G&R are again only slightly excessively bullish with their forecast as was the case in 2000, it’s easy to see why gold is their pick for the best-performing asset of this decade even amid all the attractive commodities that have stolen some of its luster so far.

The more we look into the gold standard, the likelier another one seems

Two things that we seem to say frequently:

- A return to a gold standard seems challenging

- Today’s monetary conditions are unprecedented in human history

Using Alasdair Macleod’s overview, it might be time to entertain an opposing side of view.

Being based in Britain, Macleod provides us with a very detailed insight of exactly how and why attempts to tether the British national currency to gold failed.

And the ties to our own monetary history are a lesson learned. In 1790, the first Treasury Secretary Alexander Hamilton had gotten approved a 20-year charter for a Bank of the United States, an institution essentially mimicking the Bank of England.

It wasn’t renewed by Congress in 1810 because of the enormity of the BoE’s failure to exercise sound money policies, which not only inflated its currency but would go on to force them to suspend its bullion redemption Act on three separate occasions in the 1800s.

Macleod says that the U.S. gold standard stood for nearly a century without alteration due to an understanding that central banks can’t be trusted with monetary stability.

The Federal Reserve, established in 1913, was not dissimilar from the Bank of the United States idea and unsurprisingly marked the beginning of the end for the gold standard in the U.S. On monetary affairs, Macleod says:

…the current situation whereby commercial bank credit takes its value from a government’s credit is an aberration. Indeed, every time the state has tried to take ultimate control over commercial credit, it has always failed. Our current monetary system, which has been in place since the suspension of the Bretton Woods Agreement in 1971 is now showing signs of having run its course.

The seasoned analyst is most interested in how BRICS plays out, as it seems, more than anything, a candidate to force the gold-resistant Western governments back towards sound money.

For now, despite official nods, BRICS itself remains structurally troubled and absent of gold. We need look no further than the ruble, which has lost 21% of its value in the past year, to see why these nations can’t afford another free-floating currency or settlement system.

The reintroduction of gold into the monetary system looks like it will be as hasty as it will forceful. To the former, it wouldn’t take much: Saudi Arabia and its allies beginning to accept gold as settlement, or China formally rejecting the Western monetary system by tethering the yuan to gold.

As for the latter, there is a reason virtually every nation with a functioning economy had a gold standard of sorts when it was fashionable. Once a national currency begins to have solid backing, there is little time for others to follow suit or to be cited alongside the Weimar Republic by historians and economists of the future.

Gold hits another all-time high (in Japanese yen this time) and nobody seems to care

If gold was experiencing the kind of action in the U.S. dollar as it’s seeing in the Japanese yen, our financial outlets might be publishing their articles with a yellowish hue as a background.

But nobody seems to care about the price movements in Japan, which have been nothing short of staggering.

Before the lockdowns began, the price of gold was ¥5,700 per gram. Around the same time, gold in the U.S. traded inside the $1,500-1,700 level. Though the price did rise to ¥7,000 shortly afterwards in line with our own move of gold past $2,000 for the first time, the gains were nothing compared to what was coming.

In the U.S., the Russian invasion of Ukraine threw gold towards another all-time high of $2,070, followed by what many would interpret as a steep decline until the start of this summer.

Yet the same invasion caused gold to rise above ¥8,000, and it only continued going up afterwards.

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply