Time to batten down the hatches, folks. This is it.

Bullion.Directory precious metals analysis 03 July, 2023

Bullion.Directory precious metals analysis 03 July, 2023

By Peter Reagan

Financial Market Strategist at Birch Gold Group

It could be a long recession, too. It’s not that surprising, once you take the highlights of HSBC’s into account:

…blaring recession warnings across Western economies and investors should brace for a turbulent period ahead…

… central bankers in the UK and Europe continue to hike rates…

a more gloomy view of the economic conditions.

Even worse, chief strategist Joseph Little added a bit of context: “The recession is not going to be big enough to really purge all inflation pressures out of the system. As a result, this points to a regime of somewhat higher inflation and interest rates over time.”

See, economies operate in well-defined cycles. There are four stages:

- Expansion

- Peak

- Contraction

- Trough

Large expansions and high peaks tend to be followed by steep contractions. It’s called “reversion to the mean” and it’s the economic version of the law of gravity.

If you’re a visual thinker, this screengrab from Ray Dalio’s explainer How the Economic Machine Works may help you visualize what we’re talking about:

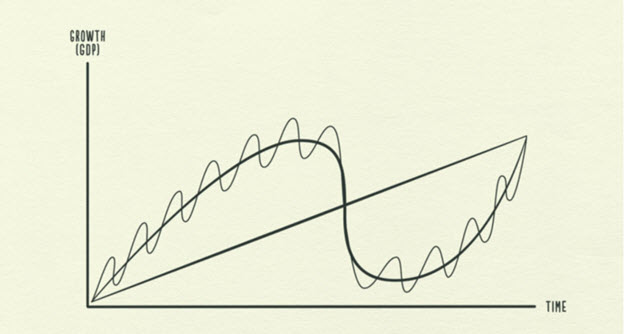

The straight line in the chart is GDP growth – or productivity. This generally increases over time as new tools and technologies make workers more productive. Over the very long term (Dalio says 75-100 years), innovation increases productivity (measured by GDP). Over the long term, we’re able to create real wealth.

Dalio’s essential argument is that credit and debt are the forces that drive the economic cycle. Without credit and debt, we’d see slow and steady productivity growth.

With credit and debt, we see a series of economic booms and busts – peaks and troughs.

The challenge, as with any economic forecast, is to figure out where we are…

I see two scenarios.

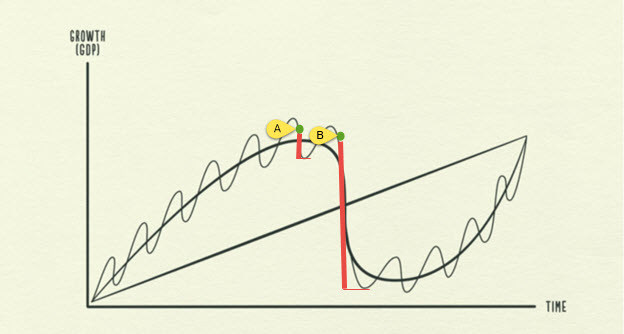

In the first, we’re on the cusp of a typical downturn, a standard-issue recession. That’s labeled “A” on the chart below.

In the second, we’re past the peak of economic growth for this long-term cycle, about to enter a prolonged downturn marked by massive deleveraging and drastic economic contraction. That’s labeled “B” below.

Here’s the challenging thing: there’s no way to know for sure whether today, we’re at a scenario “A” moment or a scenario “B” moment.

That only becomes clear in hindsight. And that’s not terribly helpful… As my colleague Phillip Patrick says, “Forecasting the past is easy.”

The most useful thing we can do is examine the economic indicators we have available today, and use them to make educated guesses about the short-term future.

HSBC’s Little expects a “year long contraction” based on a few factors:

First, we have the rapid tightening of financial conditions that caused a downturn in the credit cycle. Second, markets do not appear to be pricing a particularly pessimistic view of the world.

We think the incoming news flow over the next six months could be tough to digest…

See, credit drives asset prices up – and credit contractions tend to drive asset prices down. This is easy to understand if you think of credit simply as cash – when the world has more cash, the world can bid asset prices up. For a while.

Until that cash runs out and the bills come due.

Speaking of bills, the cost of keeping up with rising prices has pushed the nation to the limit already…

“Big Short” Burry warns consumer spending can’t prop up the economy much longer

Legendary “Big Short” investor Michael Burry doesn’t like what he sees, warning that the typical American household is dangerously close to tapped out:

U.S. Personal Savings fell to 2013 levels, the savings rate to 2008 levels – while revolving credit card debt grew at a record-setting pace back to the pre-COVID peak despite all those $trillions of cash dropped in their laps.

Looming: a consumer recession and more earnings trouble.

Burry is right about personal savings, too. The COVID-era personal savings trend, which included unprecedented levels of federal stimulus money handed to consumers, has dropped well below the normal trend.

If consumers can’t prop up an economy that is already showing signs of strain, we’re on the edge of an economic contraction.

Large, or small? Are we talking about a once or twice a decade contraction, or a once a century event?

Consider that consumer debt isn’t only at record high levels, it isn’t being paid off. That’s worrisome. Consider also that all that consumer debt must be paid off – that credit simply borrows cash from the future for today’s spending.

The bill still comes due. In this case, it’s a $17 trillion consumer debt bill. (On top of the $32 trillion government debt bill.)

I don’t know whether we’re in scenario “A” or scenario “B” right now. I hope it’s the former but I fear it’s the latter. Although this moment seems more perilous than most, uncertainty is a fact of life. We just have to accept that the future is unknowable.

That doesn’t mean there’s nothing we can do today, though.

Gold and silver shine brighter in uncertain times

No matter what happens over the next six months, next year, or beyond – one thing is certain: There is a lot of uncertainty in the economy.

Have you taken the steps necessary to ensure your financial future is on stable ground? That you and your family will be okay, regardless of tomorrow’s headlines?

It’s easier to find assets that rise in price when everything else does than assets that are resilient during economic contractions… That’s a major reason to consider diversifying your savings with physical precious metals. Gold and silver have a historical track record as safe havens and stores of value, whether the economy is booming or collapsing.

Physical precious metals are also prized for their inflation resistance – which makes planning for an uncertain future much easier.

It’s easy to learn more about the benefits of diversifying with physical precious metals. You can get all the information about them for free right here.

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply