Does Powell Think 5% Annual Inflation is ‘Good Enough’?

Bullion.Directory precious metals analysis 28 June, 2023

Bullion.Directory precious metals analysis 28 June, 2023

By Peter Reagan

Financial Market Strategist at Birch Gold Group

Of course, Biden doesn’t deserve all of the blame for inflation heating up. After all, the previous administration spent trillions, and Powell’s Fed practically ignored it until the “inflation train” had already left the station.

Now, it looks as though the price inflation that’s been siphoning our savings could be sticking around for quite a while longer. It could even become “business as usual.”

To illustrate this, we’ll start with some of Powell’s recent remarks on the future of rates for the next 6 months:

Federal Reserve Chairman Jerome Powell on Wednesday affirmed that more interest rate increases are likely ahead as inflation is “well above” where it should be. “Inflation pressures continue to run high, and the process of getting inflation back down to 2% has a long way to go,” he said. Powell said the labor market is still tight though there are signs that conditions are loosening.

He noted that the number of open jobs still far exceeds the available labor pool.

Powell even included a deadline with his remarks: “Nearly all FOMC participants expect that it will be appropriate to raise interest rates somewhat further by the end of the year.”

But there’s also some good news. Both food and energy prices are finally cooling off after months of eroding people’s savings. Here’s what that means…

Food price inflation peaked at 11.4% in August of 2022, and has finally eased a bit to 6.7% in May (but still the highest mark in 25 years).

Surges in energy prices, which in June of 2022 peaked at 41.6% for only the second time since 1963, have finally slumped for the second consecutive month.

Unfortunately, that’s where the good news ends.

If it still feels like you’re spending too much of your hard-earned dollars on “the tax that no one voted for,” that’s because you’re right.

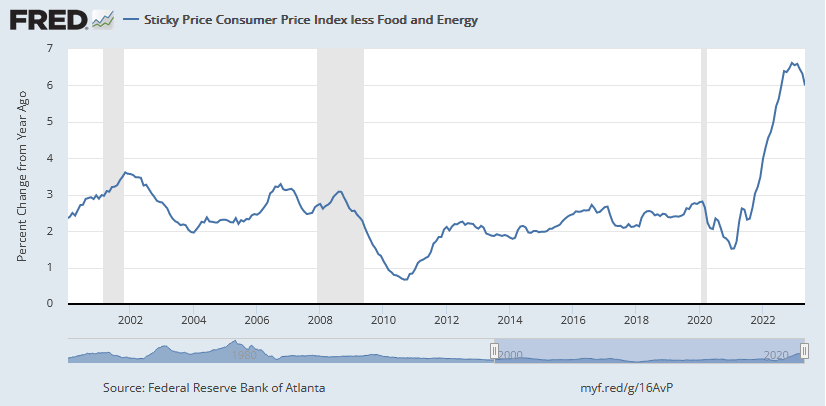

Core inflation, which measures prices excluding energy and food, is still running the hottest it’s ever been for at least the last 25 years. You can see this fact for yourself:

“Core inflation” used to be one of the Fed’s preferred measurements. Think about it – not many months ago, when we were staring down the barrel of 50-year-high inflation, what did they say?

“That’s just volatile food and energy prices. Nothing we can do about it – the Federal Reserve can’t make the corn grow or go drilling for more crude oil.”

Fair point – what they could do is get the money supply under control…

But I digress! The point is, the Fed has a track record of blaming “volatile food and energy prices” when inflation comes in above their estimates.

This time, though? That dog won’t hunt.

Which is likely why Powell said:

If you look at core PCE inflation over the last six months, you’re not seeing a lot of progress. It’s running at a level over 4.5%, far above our target and not really moving down. We want to see it moving down decisively, that’s all.

That’s not all he said, though…

We’re two-and-a-quarter years into this, and forecasters, including Fed forecasters, have consistently thought inflation was about to turn down and typically forecasted that it would, and been wrong.

Not all forecasters were wrong, Chairman Powell!

Core inflation “has not really moved down. It has not reacted much to our rate hikes. We’re going to have to keep at it.”

Despite saying all that, the Fed didn’t hike interest rates earlier this month.

What is going on?

Talking the talk, but not walking the walk

My grandma used to tell me, “Actions speak louder than words.”

I submit that, if the Fed were actually sincerely serious about fighting inflation, they would’ve raised interest rates. Skipping even a single opportunity to do so means higher inflation that lasts longer.

Chairman Powell isn’t the only one who thinks it could be a while before tightening monetary policy will impact core inflation in a meaningful way.

Gita Gopinath at the International Monetary Fund (IMF) appears to agree, as her recent remarks suggest:

[Policy-makers] may be too optimistic about the cost and difficulty of taming inflation, which then raises the sort of stability risk central banks might not be equipped to handle.“Inflation is taking too long to get back to target,” Gopinath told the European Central Bank’s annual get-together in Sintra, Portugal. “While headline inflation has eased significantly, inflation in services has stayed high, and the date by when it is expected to return to target could slip further.”

Such a delay would be costly, so central banks need to keep policy tight, despite an obvious cost to growth, she said.

Wait – “inflation is taking too long to get back to target”? I think she put the cart before the horse…

I think she actually meant to say, “Central banks are taking too long to get money supplies back to target.”

Remember, folks, “inflation” refers to increasing the money supply! Higher prices are a symptom of inflation – but the cause is an increase in the money supply.

Regardless of cause and effect, even Ms. Gopinath suspects that central banks might not be able to bring this inflation under control at all.

Let’s hope she’s wrong!

At that same meeting, Chairman Powell added a final point about inflation that’s uncharacteristically pessimistic:

It’s going to take some time. Inflation has proven to be more persistent than we expected and not less. Of course, if that day comes when that turns around, that’ll be great. But we don’t expect that.

Ouch!

So the battle to get inflation under control will take even longer. And he doesn’t expect that situation to change anytime soon.

Which makes me wonder – combine his tough inflation talk with his actions of not hiking interest rates in June – what’s the real agenda?

The “new normal” of 5% annual inflation

Right now, the Effective Federal Funds Rate (EFFR, what we call “interest rates” in relation to the Federal Reserve) 5.06%.

Inflation is just about exactly the same – 5%.

With both of those rates at about the same level, we could be seeing some sort of stable pricing equilibrium.

Other nations around the world are also doing their own versions of this “stop hiking rates and see whether inflation cools by itself” experiment.

For example, Canada tried pausing rate hikes at one point too, but ended up raising rates again. Australia also tried to pause its rate hiking schedule, but that effort failed spectacularly.

So instead of learning from these examples, the Fed decided to make the same mistake.

Maybe Fed doesn’t actually want to focus on lowering inflation at all? Maybe Powell is starting to think that prices are already somewhat stable according to the Fed’s dual mandate?

After all, 5% inflation is a far cry from hyperinflation. It’s bad but not quite out of control, right?

Could this be our “new normal” for the foreseeable future?

Don’t misunderstand – deliberately deciding 5% inflation is “good enough for government work” and then lying to us about it is not okay. Even if they sincerely believe that’s the best thing for the nation.

If that’s the case, level with us – tell us what’s at stake. Don’t try to tell us you’re serious about fighting inflation while passing up an opportunity to actually fight inflation.

The Fed’s official inflation target is still 2%. That’s a long way off (and may be subject to change without prior notice).

So what can we do?

Are you ready for this “new normal”?

Listen: The Fed have as much as admitted that, no matter what they do, inflation won’t ease for quite some time.

Can your savings withstand the corrosive effects of long-term inflation?

If you’re like most people, you don’t know for sure. Frankly, an awful lot of people working and saving today have never experienced inflation like this.

That means now is a good time to consider diversifying your savings with inflation-resistant assets. Physical precious metals like gold and silver have long set the standard for safe-haven stores of value, especially during periods of high inflation.

Long-term stable value? Resistant to inflation? If that sounds good to you, you can learn more about diversifying with physical precious metals for free right here.

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply