Adam Rozencwajg: Five-figure gold will become a long-term reality

Bullion.Directory precious metals analysis 20 June, 2023

Bullion.Directory precious metals analysis 20 June, 2023

By Peter Reagan

Financial Market Strategist at Birch Gold Group

These days, they’re somewhat commonplace and across the board. Rozencwajg could be called someone with no skin in the game, as he says his firm exited precious metals when gold first hit $2,070 over what looked to be a better opportunity in oil. Indeed, the metal pulled back while energy did what it did.

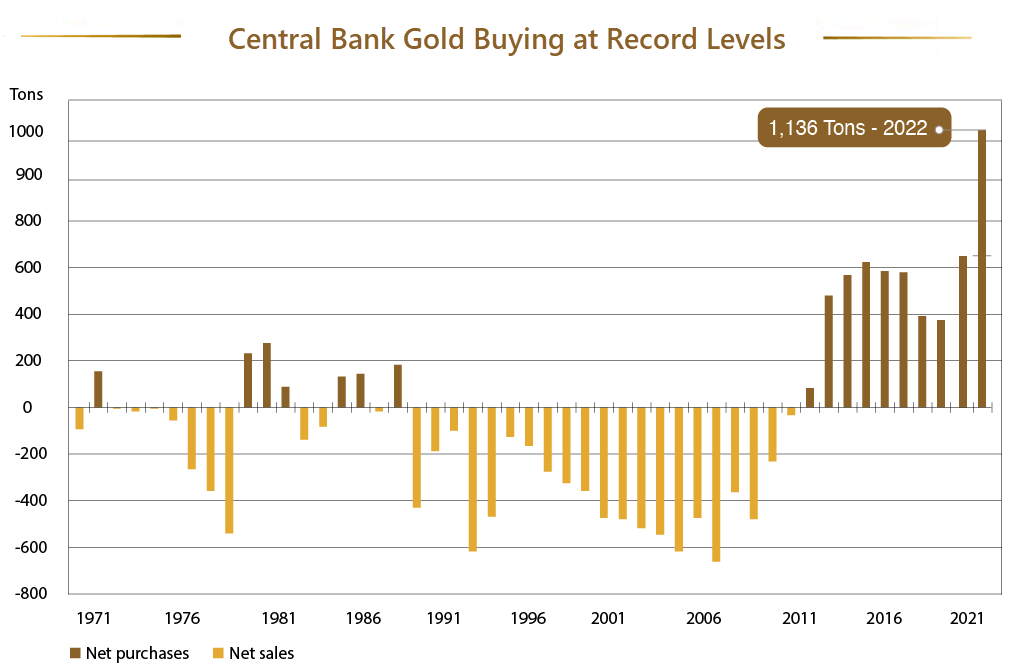

In this video interview with Next News Network, Rozencwajg explains why it’s now time for the firm to reassess. While everyone was focused on interest rate hikes as gold went from $1,650 to $1,950 this year, Rozencwajg sees other factors driving gold prices higher elsewhere. He believes that central bank purchases in Q3 and Q4 last year might have started another leg in the bull market which has very positive implications.

Rozencwajg made a point of explaining what “inelastic demand” means. It’s an important enough concept I’ll explain in my own way… Economists generally recognize two types of demand – elastic and inelastic. Elastic demand responds to prices: consumption goes up when prices fall, and households cut back on those purchases when prices rise (like vacations and restaurant dining). Inelastic demand stays about the same, regardless of prices (think utilities and prescription drugs).

In this context, Rozencwajg is discussing gold purchases that happen without concern about gold’s price. That’s exactly what central banks have been doing.

Rozencwajg claims this sort of insensitivity to gold’s price – which, let’s face it, is inevitable when you’re spending someone else’s money – is exactly what drives bull markets.

So why are global central banks buying gold at a record pace, regardless of price? Rozencwajg believes it’s part of a deliberate de-dollarization program. Sanctions against Russia was a bridge too far, given the history of weaponizing the U.S. dollar. We’ve discussed this at length before – suffice to say, for now, that every central banker in the world is now seeing their U.S. dollar reserve as a liability rather than an asset. Declining purchasing power was bad enough, but now, to learn that their emergency fund could be frozen or even seized when they need it most? For many nations, that’s the last straw.

Rozencwajg touched on quite a few other interesting and overlooked points, including price sensitivity among investors. Buyers of physical gold tend to stockpile when prices are low. On the other hand, the Western speculator likes gold it when its price goes up. During bull runs, this dynamic tends to squeeze the gold supply even more and results in the kind of price targets Rozencwajg sets.

Rozencwajg sets a long-term price forecast for gold is in the $12,000-$15,000 range. Yes, per ounce. He says his analysts are preparing a research report explaining this price target in the context of both history and modern market forces.

As a bit of a teaser, Rozencwajg explained that gold’s above ground reserves, relative to gold’s huge role in the global financial market, make this kind of price inevitable.

Does this sound absurd? A 520% gain in gold’s price (at the low end) strike you as a pipe dream?

In June 2002, gold sold for $320/oz. and silver was less than $5/oz.

In other words, we’ve already seen a 500%+ gain in gold’s price in living memory. Silver was along for the ride, too, racking up 367% gains over the same period.

Any time you see a gold price target that strikes you as absurd, remember this: in a world of unconstrained money-printing, there is no natural ceiling for gold’s price. I think it’s safe to expect gold’s price to rise, buoyed by an ocean of freshly-printed-currency, for as long as the world’s governments insist that the current, unbacked-currency experiment continue.

And isn’t it interesting that the same central banks who say, “We don’t need a gold standard – our currency is just fine,” are also buying gold in record quantities at the same time?

How bad is the silver supply versus current prices?

In the interview above, Rozencwajg also touched upon silver and the gains that haven’t materialized… so far. All attempts to normalize the silver price, such as those by the Reddit Wallstreetsilver community and the like, have so far failed and the price hasn’t budged. But Rozencwajg still says that silver will not only catch up massively, but that we could have a “third Hunt brothers” scenario where someone tries to corner the market with success.

Dominic Frisby says he’s ambivalent on silver: a little good, a little bad. In his case, the bad seems to come almost exclusively from silver not delivering on what it should. This isn’t a crypto project or a listed company that overpromises: every day, the fundamental picture for silver gets stronger, but we’re stuck treating $24 to $26 as a big move.

How long can that go on? The historical average on silver prices would put the metal around $130 right now, and that’s actually not counting supply and demand. An analysis on SchiffGold mentions how predictions that solar panels will need less silver have sort of backfired. No sooner did manufacturers figure out how to skim on silver by up to 80% than did solar cell technology change. And the new technologies in the form of TOPCon and SHJ panels, ones that absorb solar energy more efficiently will require 30% to 80% more silver.

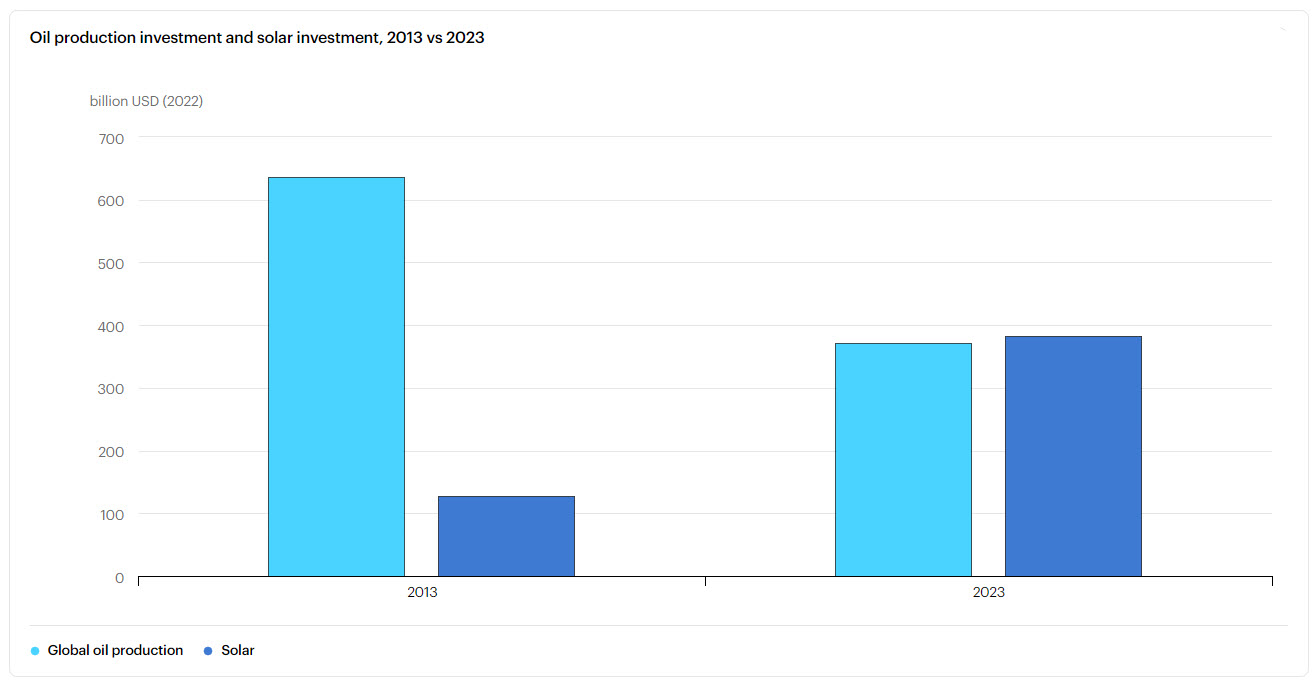

The International Energy Association (IEA) predicts that, this year, investment into solar panel technology will outstrip investment in oil production. Chalk it up to green regulation all you want, that is huge for silver prices.

CC BY 4.0 via International Energy Agency

And then we get to the numbers… Last year’s record silver demand resulted in a meager 0.6% deficit percentage which translates to a not-so-meager 237.7 million ounces.

It was the second annual deficit in a row, yet it was so significant that it offset 11 years of silver surplus.

That’s the ongoing issue with how mines operate: a surplus is far easier to remedy than a deficit. A recent research paper said solar panels will probably consume 20% of the current annual supply by 2027. What will that mean if supply continues to shrink by almost 1% every year?

The same paper says that, by 2050, solar panel production will have used 85%-98% of the current global silver reserves.

Truly, it’s becoming a question of how long can silver keep doing its detached-from-reality show before exploding.

In Turkey, couples can’t afford to get married anymore

Fake gold is on the rise in Turkey, but not in the sense that might make us want to shake our heads. Well, maybe not for the usual reasons. At least it’s not a scam. Turkish couples just can’t afford to adorn themselves in the amount of gold they normally would for a wedding.

It’s a trend that has been going on for a while, but it’s quite curious to see how it escalated over the past few years. When it was first reported some months into the lockdowns, a gram of gold went for 437 lira, a record price back then. It was already too expensive for many, if not most citizens, giving rise to “imitation gold,” as it is known in the local markets.

Fortunately, this “imitation gold” is sold with full disclosure that it isn’t the real thing. Couples who’d like a traditional Turkish wedding look, but can’t afford it, turn to fake gold.

Back when it was first reported, jewelers lamented how they’re going out of business due to the surge in gold prices. Since then, though, they might have reconsidered. Less than three years later, one gram of gold now costs nearly 1,500 lira (mostly due to Turkish hyperinflation, but also in part because of the central bank’s gold buying efforts).

Newlyweds may buy as much as an entire pound of fake gold for the wedding. Wedding gifts, we’ll hope, consist of real gold, even in small quantities. What better gift to represent the enduring nature of wedlock than incorruptible, safe-haven gold?

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply