Santa Claus is coming to town! What will he give gold: a gift or a rod?

Bullion.Directory precious metals analysis 23 December, 2021

Bullion.Directory precious metals analysis 23 December, 2021

By Arkadiusz Sieroń, PhD

Lead Economist and Overview Editor at Sunshine Profits

Like most of 2021, gold has been rubbing against $1,800 this week but did not have the strength to permanently rise above this level. Despite a surge in inflation and very low real interest rates, the yellow metal didn’t rally. Thus, we could say that gold was rather naughty this year and doesn’t deserve gifts from Santa.

However, maybe it’s not gold’s fault, but our too high expectations? After all, gold had to compete with cryptocurrencies and industrial metals (or commodities in general), both of which performed exceptionally well during periods of high inflation. Despite all the Fed’s hawkish rhetoric and tapering of quantitative easing, gold didn’t break down.

Hence, it all depends on the perspective. The same applies to historical analyses and forecasts for 2022. The bears compare the current situation with the 2011-2013 period. The 2020 peak looked like the 2011 peak. Thus, after a period of consolidation, we could see a big decline, just as it happened in 2013.

On the other hand, gold bulls prefer to compare today with 2015, as we are only a few months away from the Fed’s interest rate hikes. As a reminder, gold bottomed in December 2015, so the hope is that we will see another bottom soon, followed by an upward move. In other words, the bears believe that the replay of the “taper tantrum” is still ahead of us, while the bulls claim that the worst is already behind us.

Implications for Gold

Who is right? Of course, me! But seriously: both sides make valid points. Contrary to 2013, the current tapering was well telegraphed and well received by the markets. Thus, the worst can indeed be already behind us. Especially that the 2020 economic crisis was very deep, but also very short, so everything was very condensed.

I mean: the Great Recession lasted one and a half years, while the Great Lockdown lasted only two months. The first taper tantrum occurred in 2013, while the first hike in the federal funds rate – at the end of 2015. We won’t wait that long now, so the period of downward pressure on gold prices stemming from expectations of the Fed’s tightening cycle will be limited.

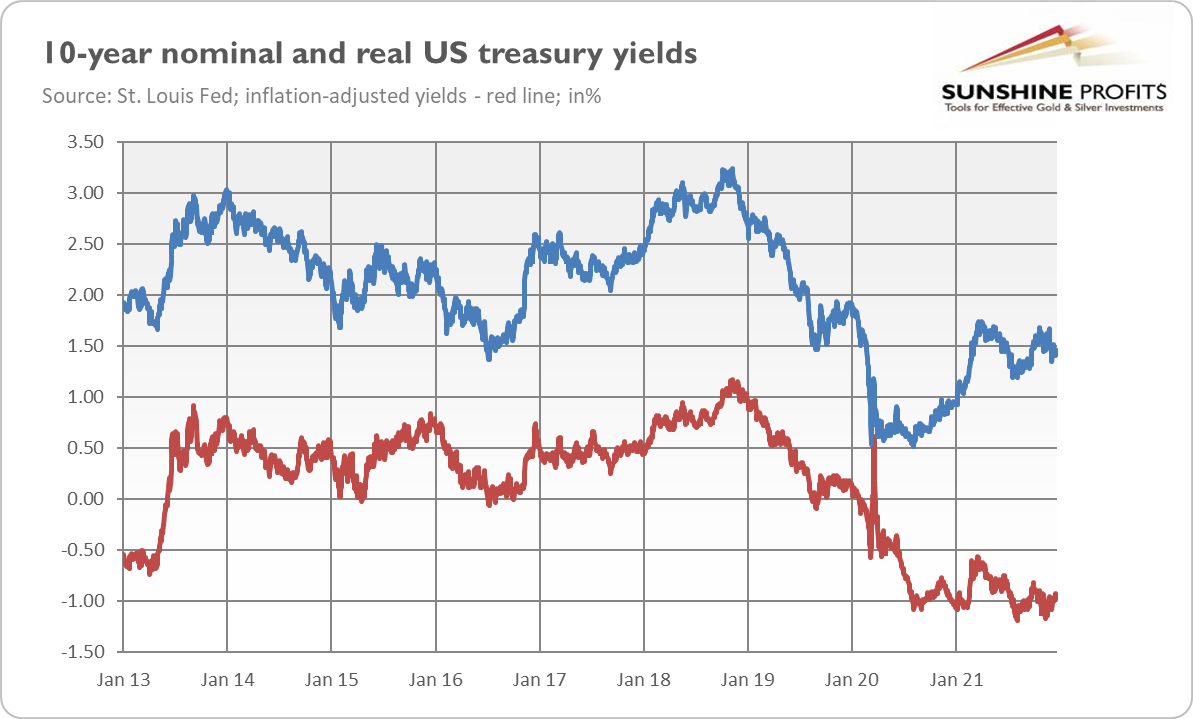

Having said that, gold bears highlight an important point: real interest rates haven’t normalized yet. As the chart below shows, although nominal bond yields have rebounded somewhat from the August 2020 bottom, real rates haven’t followed.

The reason was, of course, the surge in inflation. However, if inflation eases, inflation-adjusted rates will go up. Additional risk here is that the Fed will surprise the markets on a hawkish side.

The bottom line is that Santa Claus may bring gold a rod this time. Although gold’s reaction to the recent FOMC meeting was solid, the overall performance of the yellow metal this month is worse compared to the historically strong action in December. I don’t expect a similarly strong downward move as in 2013, but real interest rates could normalize somewhat in 2022, given the upcoming Fed’s tightening cycle and possible peak in inflation. The level of indebtedness will limit the scope of the move, but it won’t change the direction.

Anyway, whether you are a gold bull or a gold bear, I wish you a truly merry and golden Christmas (or just winter holidays)! Let the profits shine, even if gold won’t!

Arkadiusz Sieroń

Arkadiusz Sieroń – is a certified Investment Adviser, long-time precious metals market enthusiast, Ph.D. candidate and a free market advocate who believes in the power of peaceful and voluntary cooperation of people.

He is an economist and board member at the Polish Mises Institute think tank, a Laureate of the 6th International Vernon Smith Prize and the author of Sunshine Profits’ bi-weekly Fundamental Gold Report and monthly Gold Market Overview.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply