Gold is typically thought to move inversely to the US dollar. Is it time to abandon this preconception?

Bullion.Directory precious metals analysis 28 January, 2015

Bullion.Directory precious metals analysis 28 January, 2015

By Christopher Lemieux

Senior Analyst at Bullion.Directory; Senior FX and Commodities Analyst at FX Analytics

The US dollar is going strong, but is it perhaps time to change the preconception that a strong US dollar is automatically bad for gold?

This inverse relationship is seen regularly to the point that many assume it to always be the case, but in times of uncertainty, this typical inverse pattern breaks and gold remains on top.

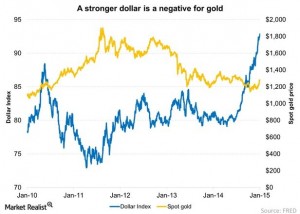

BlackRock’s Russ Koesterich, CFA, gives the inverse relationship the benefit of the doubt in Market Realist’s “Why Gold and the Dollar Move in Opposite Directions.”

Koesterich goes to say that a strong dollar is bad for gold because it makes the commodity more expensive – and yes this is true in relation to gold priced in any currency.

The article also points out the assumption that the Federal Reserve “may” raise rates, which is also positive for the dollar and bad for gold.

Conversely, this is one of the reasons I believe the Fed won’t raise rates because deflationary pressures will continue to rise, and that is opposite of the Fed’s intention.

Under normal circumstances, the inverse relationship of the two makes perfect sense. However, we’re at a time in history where the financial world is changed beyond recognition.

Central banks are omnipotent, and their modus operandi is currency debasement. Gold priced in euros just reached a 21-month high, following the European Central Bank’s quantitative easing announcement; and gold priced in yen has been an amazing trade during the Bank of Japan’s kamikaze monetary policies.

But, the dollar is rising, not falling, right?

True. But the question is not why gold should fall given the strong dollar – the real question is “why is gold not falling given a strong dollar?”

The answer is simple: gold is a central bank hedge. The ultimate currency hedge.

Furthermore, the performance of the dollar – although not new – is not normal.

Up over 20 percent since the parabolic move first began, these moves can often foreshadow the impending destruction of capital.

In “US Dollar Rally: The Beginning of the End,” I outlined three previous times the dollar rose by at least 20 percent: 1988-89, 1999-2001 and 2007-9. Each move was followed by double-digit declines of at least 16 percent in the US dollar index.

In addition, the last two descents took equities down with it – the “tech bubble” and the “Great Recession.”

Omens are lurking as the dollar and gold relationship is mirroring that of 2008.

In the above mentioned article, Koesterich presented a graph showing gold and the dollar. Notice January’s decoupling of the US dollar mirrors that in January 2010, following the Fed’s implementation of quantitative easing. So, is more easing from the Fed coming?

Likely, and there’s more chance of it than a meaningful rate hike by the Fed.

It is important to rethink common ideologies on investing because markets are dynamic and ever-changing. This is why both fund managers and retail traders are slaughtered in epic market collapses. They fail to evolve along with financial markets, continuously trying to fit the round peg in a square hole with the square peg in plain sight.

Gold rose significantly in the dollar collapse in 2000-01 and 2007-09. During the Great Recession, gold was further boosted by the Fed’s ill-fated QE attempts. You do not need inflation for strong gold gains, you just need central banks to remain in business.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Leave a Reply