Your $5,000 DOGE Stimulus Check Could Be On It’s Way. Possibly. Maybe.

Bullion.Directory precious metals analysis 21 February, 2025

Bullion.Directory precious metals analysis 21 February, 2025

By Peter Reagan

Financial Market Strategist at Birch Gold Group

Depending on your perspective, you may love or you may hate DOGE. Either way, seems like they’re taking a scalpel (or a chainsaw) to the federal government’s budget.

So far, they claim to have cut $55 billion of Federal spending, and that’s a lot of money. No doubt about it.

To put it into perspective, though, the 2025 Federal budget is $7.266 trillion, so, a savings of $55 billion is only 0.76%.

Less than 1%.

So, they have a long way to go to get to the $2 trillion in savings that they’re aiming for with DOGE. Having said that, $55 billion is a start, and I’ll take it.

And, according to Musk, you may get to take advantage of the DOGE savings, too.

DOGE savings for you?

Yes, there was a rumor that with the reduction in the federal government’s wasteful spending (and there is a lot of wasteful spending on the part of the federal government), you and I could see more than just a possible reduction in the federal debt (though that would be great).

In fact, Musk himself mentioned the idea of sending a rebate to Americans because DOGE is able to cut government waste. Jason Lalljee with Axios writes,

Elon Musk plans to “check with” President Trump about a proposal to send Americans rebate checks with money saved through slash-and-burn DOGE cuts

Why it matters: The proposal is for $5,000 “dividend” checks, a number that comes from Musk’s original goal of saving the government $2 trillion via budget cuts.

So, if Musk and company are able to cut Federal spending by $2 trillion, then, instead of paying down the Federal debt, they’re looking to see if they can send you and I and every American a stimulus check.

Then that rumor was confirmed:

A lovely thought. After all, who doesn’t love free cash in their pocket?

And an extra $5,000 could be a nice down payment on a car.

Or it could replace the old laptop with something shiny and new, wouldn’t it? I mean, the prudent might even consider saving that DOGE stimulus money, tucking it away into a rainy-day fund.

Let me point out, though, that this is much more a question of IF, not when…

First, we need $2 trillion in savings

Why am I recommending caution instead of celebration over the DOGE stimulus checks?

A few reasons, actually.

First, as I mentioned earlier, that $5,000 figure (and sending out checks at all) is assuming that DOGE can actually find $2 trillion in savings.

As I’ve talked about before, that simply may not be possible when the majority of the federal government’s spending is non-discretionary. That means they’re mandated by law and do not require annual approval by Congress. These include such programs as Social Security, Medicare and Medicaid, as well as interest payments on the national debt.

These expenses must be paid, regardless of other budgetary decisions.

Now, the $55 billion saved so far? That’s not nothing! But it’s less than 3% of DOGE’s target.

Second, we have to consider how other economic policies will affect prices.

Specifically, tariffs. Now, I don’t want to debate the pros and cons, the benefits and drawbacks of tariffs – we’ve covered that extensively.

Instead, I just want to provide a high-level estimate of how Trump’s proposed tariff changes will affect the cost of living.

The Budget Lab at Yale University offered the most comprehensive analysis I know of, to date. You can dig into the details to your heart’s content at the link, but let me net it out for you:

- The cost of living rises 1.7-2.1%

- The equivalent of an average per-household cost of $2,700-$3,400

When it comes to tariffs, the costs are more or less immediate – while the benefits (increased domestic production, economic growth and so on) take years to materialize.

The average family in America would pay $3,000 more (on average) every year due to tariff-related cost of living increases. (I’ve seen some estimates as high as $5,000 per family!)

So, the DOGE stimulus checks, if they’re ever mailed out, will offer relief from a rising cost of living. Which would be welcome!

After successfully slashing $2 trillion from government spending, would a DOGE stimulus check really be the best use of those funds?

DOGE and the national debt

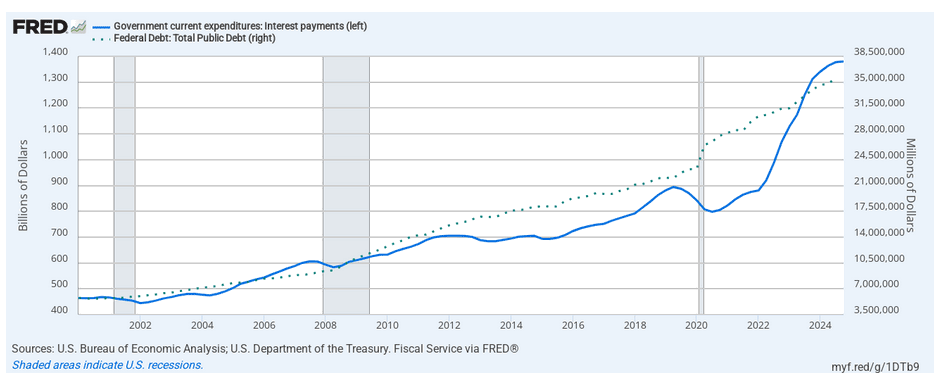

We’ve been discussing the national debt (and the rising cost of financing it) for years now.

Take a look:

Currently, the national debt is growing much faster than GDP. Interest payments alone are now over $1 trillion per year – the 2nd biggest expense on the federal government’s budget!

Here’s why this matters: Every dollar the federal government borrows, whether it’s to pay a soldier, build a bridge or refinance old debt – every dollar of debt increases the world’s supply of dollars. Which reduces the purchasing power of all other dollars!

Call it inflation, call it currency devaluation – call it whatever you want.

The reality is debt destroys purchasing power. As the national debt goes up, the cost of living rises, too.

That means sending out DOGE stimulus checks – instead of using the money to pay down the national debt – will raise the cost of living. (Above and beyond the tariff costs we discussed earlier.)

And there’s another major issue we should mention…

The DOGE depression

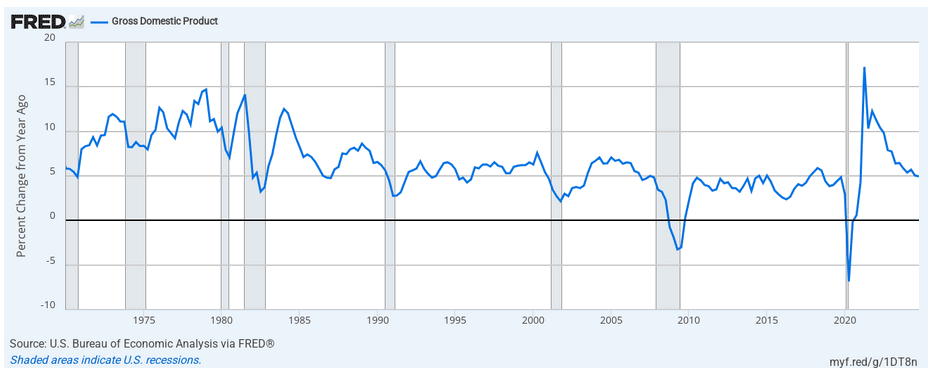

Federal government spending is a massive component of Gross Domestic Product (GDP – the measure of economic activity in the U.S.)

Consider these numbers:

- Government spending: $7.266 trillion

- GDP: $29.34 trillion

- Contribution of government spending to GDP: 25%

Say Musk and company are able to find $2 trillion in savings, that would lower GDP by 6.8%.

The result would be massive economic contraction. And when I say “massive,” that’s exactly what I mean – “massive” as in the WORST of the pandemic panic.

Here, this chart shows what I’m talking about – over the last 50 years, there’s only been one single quarter when GDP dropped that much. Q2 2020, the worst moment of the Covid-19 pandemic.

For further context, Forbes notes that the Great Recession (December 2007 to June 2009) saw a peak GDP decline of “only” 4.3%.

Talk about a Catch-22!

In other words, it’s conceivable that if DOGE is able to accomplish their goal, our nation would suffer the economic equivalent of another pandemic panic.

Now, don’t misunderstand me. It’s great, in the long run, to get rid of waste. To increase efficiency and eliminate unnecessary programs. Yes, I feel bad for the federal employees who’d lose their jobs.

In the long run, this is a necessary step to create a sustainable, healthy and productive economy.

In the short run, though, it’s economically indistinguishable from a disaster.

Buckle up – it’s going to be a bumpy ride…

Friends, please don’t think I enjoy bringing you bad news.

I believe it’s my responsibility, my duty, to point out the unintended consequences of “good news” stories like a $5,000 DOGE stimulus check.

There are an awful lot of Americans who’d prefer not to know about the consequences. They’d prefer to take their DOGE dividend to Best Buy and get the biggest TV they can afford. They’d prefer not to know what happens next.

I’ve never been that kind of person, and I hope you aren’t either. I hope you see the value in the knowledge I’m providing. This isn’t a matter of politics, either – unintended consequences and second-order effects aren’t red or blue! They’re reality.

Now, you can choose to ignore reality. That’s your privilege. If, instead, you choose to accept reality and truly understand the path ahead, you can take decisive action now to protect yourself and your family.

One of the most important things that you can do to protect yourself from the economic hardships that lay ahead is to diversify your savings with inflation-resistant investments.

Ideally, those assets would also offer protection during recessions – a true safe haven.

I believe the best (perhaps the only) safe haven asset is physical precious metals. You can learn more about the benefits of precious metals here.

And, who knows? If you find a DOGE stimulus check in your mailbox, you could apply that unexpected windfall toward building an intrinsically-valuable, inflation-resistant form of wealth that will provide financial stability in good times and bad times alike.

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply