Gold and gold stocks just declined, which is normal given their technical situation, but the direct trigger is really interesting this time.

Bullion.Directory precious metals analysis 09 June, 2023

Bullion.Directory precious metals analysis 09 June, 2023

By Przemysław K. Radomski

Founder of GoldPriceForecast.com

Hear that? That’s the canary in the coal mine.

The Bank of Canada just raised interest rates after two no-change decisions, and it was quite common for the Fed to follow the BoC.

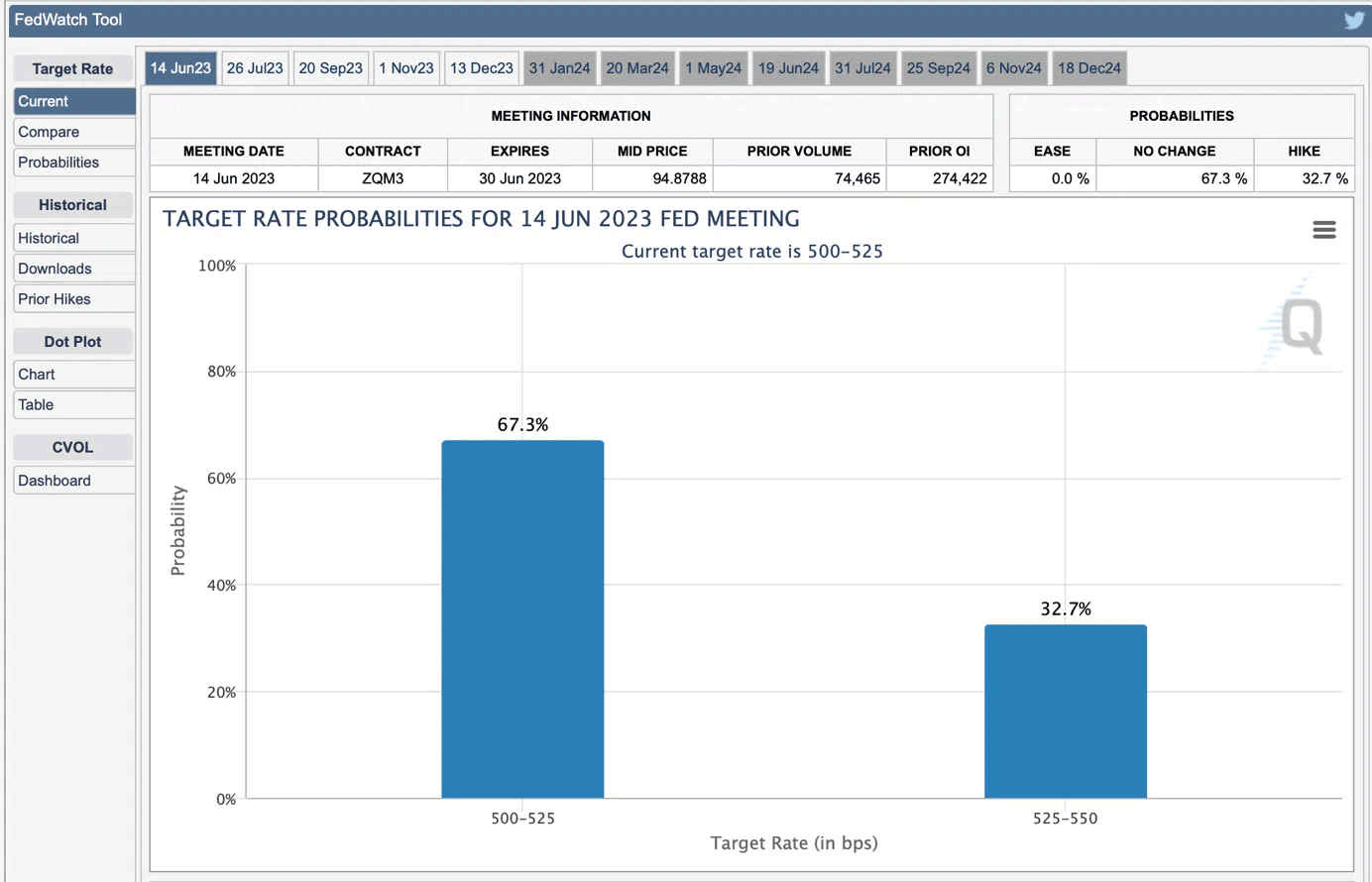

Could the Fed really be raising interest rates soon? That’s exactly what the BoC’s decision is suggesting. The next FOMC meeting is in six days, and most market participants still expect rates to be kept at their current levels.

According to the CME Fedwatch tool, less than a third of market participants currently expect rates to be increased, despite the “canary’s chirp”.

However, that was enough to mostly counter the “rates are going to be cut!” narrative. The precious metals market initially reacted with declines, but it’s quite likely that it’s not the end of those moves, as many still don’t realize that the situation is not dovish.

Why would this be the case? Because it was most likely the investment public that pushed the prices higher recently! And this group of investors is not known for deep market studies. The investment public tends to follow the primary emotion that’s out there, and recently people got very bullish – even as far as mining stocks were concerned, despite them being in a medium-term downtrend.

Yesterday, I wrote the following on the above chart:

On the very short-term GDXJ and GLD charts, we see that the former is still driven by the stock market’s performance, but as we see a top in the latter, the former is likely to slide, and the decline in it is likely to then accelerate in the following weeks – due to what’s likely ahead for the stock market, as I discussed above and in yesterday’s analysis.

Gold seems ready to move to new lows any hour now.

Why? Because it’s already close to those lows and we have intraday confirmations from silver.

Silver just moved close to its Tuesday intraday high, while gold is very far from its Tuesday peak.

This means that the white metal is outperforming on a very short-term basis. This is what tends to happen before bigger moves to the downside.

This would be a perfect moment for gold to slide, as it already more than verified the breakdown below its rising support line and then took an extra breather. This is where slides tend to start.

Also, let’s keep in mind that markets tend to move on rumors and then reverse on facts. If the Fed is indeed about to hike interest rates, then gold might decline shortly and then form a bottom shortly after the rates are indeed hiked. That would likely be just a short-term bottom, of course.

Could this be the move that pushes the GDXJ to its previous lows of about $33?

It’s a big maybe at this stage, but that’s indeed what could happen.

Junior miners are after not one but two moves to their 38.2% Fibonacci retracement, which means that the decline can now definitely resume.

Since the very recent run-up is most likely just a correction, and moves that follow corrections tend to be similar to the moves that preceded them, we can expect to see a repeat of the May decline. This would indeed imply a move to the ~$33 area. This support level is quite strong because it’s where we have two important supports – the previous lows and the 61.8% Fibonacci retracement.

Given today’s position in the RSI, it seems that it will move to 30 or so when the GDXJ moves close to $33.

So, we might have a short-term buying opportunity then. Of course, I’ll keep my Gold Trading Alerts subscribers posted.

Also, please note that the recent back-and-forth movement between $36 and $38 is something that we already saw before.

Given the somewhat symmetrical nature of the recent price moves (it’s still less volatile on the road down, but let’s not get used to it as fear is a more powerful emotion than greed), it seems that the decline can now continue.

Przemyslaw Radomski

Przemyslaw K. Radomski, CFA, has over twenty years of expertise in precious metals. Treating self-growth and conscious capitalism as core principles, he is the founder of GoldPriceForecast.com

As a CFA charterholder, he shares the highest standards for professional excellence and ethics for the ultimate benefit of society and believes that the greatest potential is currently in the precious metals sector. For that reason it is his main point of interest to help you make the most of that potential.

This article was originally published here

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply