Will This Recession Rival the Great Depression?

Bullion.Directory precious metals analysis 04 July, 2022

Bullion.Directory precious metals analysis 04 July, 2022

By Peter Reagan

Financial Market Strategist at Birch Gold Group

We think we are in a recession. We were wrong on one thing and that was inflation being as sustained as it has been.

Well, she’s far from the only one who was wrong about inflation. And she’s just one of many CEOs issuing stark warnings about the U.S. economy.

Let me explain why I think we’re already in recession. Here’s what a recession is:

The working definition of a recession is two consecutive quarters of negative economic growth as measured by a country’s gross domestic product (GDP)

Technically, the National Bureau of Economic Research (NBER) can declare a recession at any time (that’s why the pandemic panic recession only lasted two months). However, we’ll stick with the more traditional working definition: two consecutive quarters of GDP decline.

The first quarter of 2022 saw a sharp economic contraction measured in “real GDP” (adjusted for inflation – if we don’t adjust for inflation, it’s way too easy to fudge the numbers). This is the first contraction since the pandemic panic, and a strong indicator that the economy was slowing.

Initial Q1 estimates placed GDP growth at -1.4%, which was revised to -1.5%, and most recently revised down again to -1.6%.

So what about the second quarter of the year?

The Atlanta Fed’s GDPNow report forecasts changes in real GDP ahead of the Bureau of Economic Analysis (BEA)’s official reports. (Yes, our nation has an absolutely absurd number of bureaus, commissions and departments all monitoring the same data – your tax dollars at work!) Over the past two months, GDPNow second-quarter estimates have steadily declined from +2.5% to, as of this morning, -1.0%. (Just four days ago, the number was +0.3%!)

Short of a miracle, the forecast isn’t likely to improve much.

There you have it: two consecutive quarters of economic contraction. By my calculations, we’re officially in a recession.

I’ve excerpted from the BEA’s explanations of why this slowdown is happening right now:

record trade deficits, supply constraints, worker shortages and high inflation

exports dropped

consumer spending growth was revised lower… decrease in spending on goods, namely groceries and gasoline

housing investment was subdued

With politics removed from the analysis, notice how the BEA’s analysts don’t blame Putin as a factor in the slowdown?

Pretty much everything on the list lines up with what we’d expect to see, historically, during a recession.

Keep in mind, recessions are a fact of life. They’re cyclical. So the real question is, will this one be typical?

Recession virtually guaranteed – but recovery is not

I expect this recession to be unlike anything we’ve seen for decades.

Why?

We’re too close to the line. After decades of near-zero interest rates, there’s just not much the Fed can do to stimulate the economy. As Jim Rickards put it:

Monetary policy won’t get us out because the Fed is basically out of “dry powder,” despite its recent rate hikes. There’s just not enough room to cut rates before being back to zero.

That’s pretty straight-forward. The current Effective Federal Funds Rate (EFFR), despite the “shock and awe” talk, despite the reeling markets and collapsing bubble, only 1.58%. It’s still far too close to zero, especially considering that the Fed’s own Taylor Rule says rates should be somewhere between 5.4%-9.3%.

We’ve got a long way to go – and we’ve already seen the damage a paltry 1.5% increase in rates did to the economy.

Does Fed Chair Jerome Powell have the steely nerves and the steady hand necessary to keep increasing rates despite this ongoing economic slowdown?

Honestly, I doubt it. At some point later this year, I fully expect recession to become a bigger political liability than inflation, at which point the Biden administration and the Fed will fire up the old printing presses once again and flood the economy with dollars.

That’s the approach they used in the past – after the dot-com bust, during the Great Recession, and spectacularly during the pandemic panic.

Here’s the thing that makes this time different: as the number of dollars increases, their impact on the economy decreases. In other words, dollars spent to dig the U.S. economy out of this hole will actually make matters worse.

Here’s why…

The shrinking Keynesian multiplier

Famous economist John Maynard Keynes, in his classic 1936 work The General Theory of Employment, Interest and Money, developed the notion that deficit spending can boost economic growth.

It works like this:

- The government gives away $20 to you

- You use that $20 to buy a few gallons of gas

- The gas station owner uses that $20 to pay his fuel supplier

- The fuel supplier uses that $20 to repair their fleet of tanker trucks

- And so on.

Basically, by handing you $20, in this example the government has created at least $60 of economic activity. This is called the “Keynesian multiplier.”

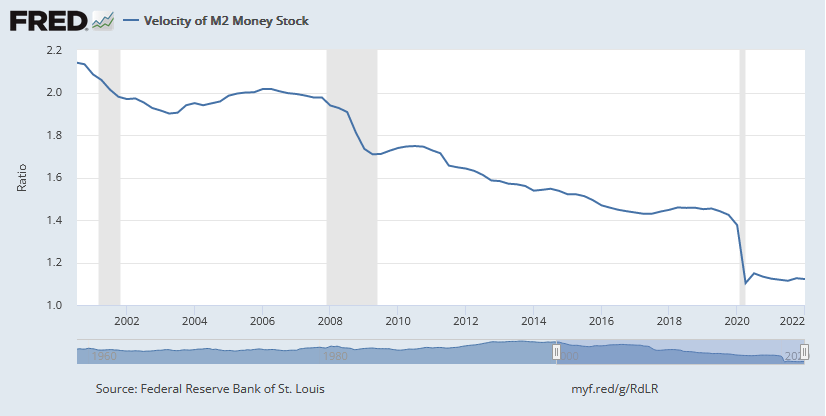

How many times every dollar gets passed from hand-to-hand is called “the velocity of money.” Higher velocities mean more economic activity, greater confidence, and robust growth.

The velocity of money decreases during times of economic pessimism or uncertainty. When we talk about “emptying your bank account and hiding the money under your mattress,” that’s just an evocative way of saying, the velocity of money is slowing.

Makes sense, right?

There’s only one issue with the Keynesian multiplier (other than how to measure it) – as the money supply goes up, its velocity goes down.

It’s pretty easy to see in this chart how the velocity of money has been slowing over the last two decades:

Economists Carmen Reinhart and Ken Rogoff found that there’s a “tipping point” beyond which every $1 of deficit spending creates less than $1 of economic activity. (That tipping point is a 90% debt-to-GDP ratio – and the U.S. is currently over 120%.) They explore this idea in detail in their book This Time Is Different: Eight Centuries of Financial Folly. Or you can read the executive summary here.

Here’s the take-away:

Every dollar of deficit spending the U.S. government authorizes results in less than a dollar of economic growth – and more than a dollar of debt.

(“More than a dollar of debt” because we have to pay interest on the money borrowed by the government.)

In other words, we’re so deep in the hole every dollar spent to save us just digs us deeper into the hole.

Here’s the bottom line: this recession is likely to be very different from any the U.S. has experienced before. The tools government has relied on the past won’t work this time. I expect the “new normal” to include continued high inflation, declining economic activity, high unemployment and, in sum, another lost decade.

Remember, that’s on a national level. Individuals can still make prudent choices to ensure they’re insulated from the worst of the economic chaos.

One way out of the hole

When you find yourself in a hole, well, you should see if you can build a staircase out of it.

(Of course, the better way is not to fall into it in the first place, but who knows if that’s even possible?)

Inflation is burning through cash, consuming what little purchasing power the dollar has. Stocks are shaky at best, and we’re in the “worst bond market since 1842.” That means it’s the perfect time to learn how to build a golden staircase for yourself and your family.

Diversifying your savings with physical gold and silver can boost your economic resilience, and are historic safe haven investments.

Granted, there are a number of other inflation-resistant investments available to you that may be exactly what you need.

Most importantly, please take this opportunity to make a plan for staying financially sound during this recession. If you’re not sure whether physical precious metals are right for you, we can answer any questions you have. Whatever you ultimately decide, however you choose to build your own staircase out of the hole, I strongly encourage you to start right now. Before the hole gets so deep we can no longer see the sunlight.

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply