I hate to be the bearer of bad news, I really do. Even though you might’ve expected I’d be used to it by now.

Bullion.Directory precious metals analysis 14 February, 2025

Bullion.Directory precious metals analysis 14 February, 2025

By Peter Reagan

Financial Market Strategist at Birch Gold Group

Even in today’s highly polarized culture, I think we can all agree on at least one thing: Inflation is terrible.

Not the idea itself – rather, the experience of watching the cost of living increase. Noticeably rising, day after day, month after month… Lower-income families (who spend more of their income on necessities) have the hardest time.

The super-wealthy have it easiest – but everyone, even Davos types, are smart enough to at least acknowledge that inflation is terrible.

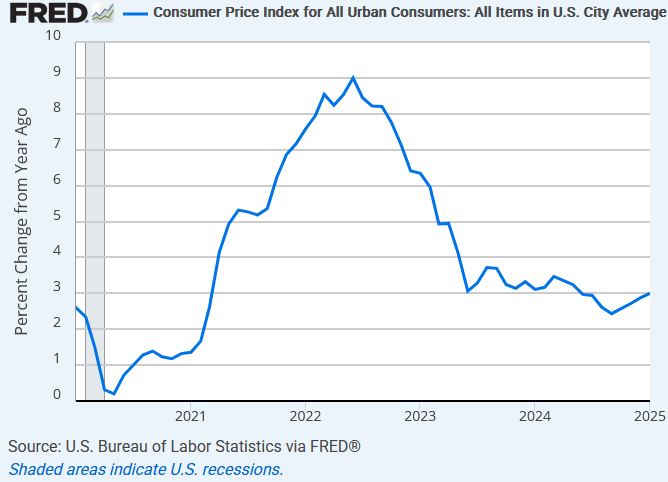

Now, we’re better off today than we were just two years ago:

And the Federal Reserve is happy to take credit. Andrew Moran with The Epoch Times writes,

“I would say we’re close, but not there on inflation,“ Federal Reserve Chair Jerome Powell told the House Financial Services Committee during his semi-annual monetary policy report testimony. ”Last year, inflation was 2.6 percent – so great progress – but we’re not quite there yet.”

Powell makes it sound like it’s no big deal. Maybe from his perspective, it really is! After all, the man’s net worth is approximately $50 million.

I doubt his chauffeur tells him how much it costs to fill up the limousine, or that his chef complains about the price of eggs.

Mr. Powell simply doesn’t live in the same world that you and I do.

So what’s inflation like for everyday American families?

Permanent purchasing power destruction

Powell addressed the annual rate of inflation in his comments above. The Federal Reserve targets a 2% annual inflation rate.

You and I deal with the accumulated purchasing power destruction caused by inflation. Which adds up over time.

The most recent official inflation report says that, overall, prices rose by 0.5% in January.

Just half a percent, right? If that rate persists, at the end of the year, we see a 6% increase in the cost of living.

THREE times the Fed’s target!

Does that sound like “we’re close, but not there on inflation” to you?

What’s worse, those price increases compound over time, too – like interest in a savings account, but in reverse.

The compounding is one of the big reasons why, no matter how “close” CPI is to the 2% target, it still feels like so many Americans are struggling to make ends.

That’s because they really are struggling.

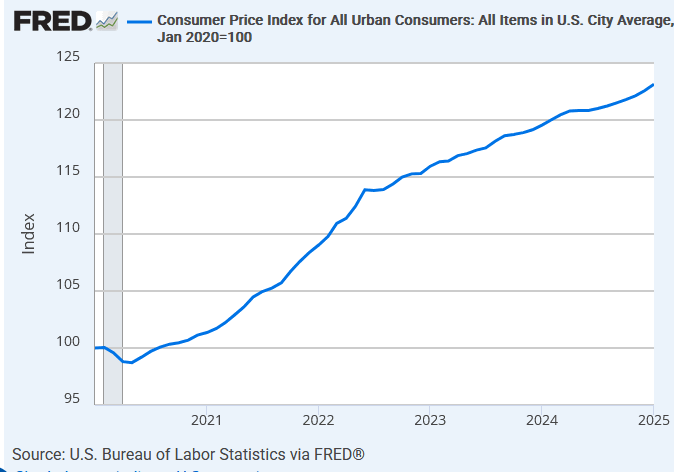

Here’s another version of exactly the same chart as above – this time, showing the cumulative price increases since January 2020:

The official cost of living has risen more than 23% in the last five years alone!

Arguably, the cost of living crisis (along with utter failures to acknowledge or address it) cost the Biden administration a second term.

Why has inflation been such a knotty issue for our elected officials to solve?

The price of “free”

There are a number of reasons why the government hasn’t grabbed inflation by the root and yanked it out of our economy

One is just the reality of politicians trying to get reelected. Let’s face it: Most people like free things. So a time-honored way to win political power is to promise voters free things (and hope you manage to retire before the real price of those freebies comes due). So often, elections become a contest to see who can make the biggest promises…

It’s like Oprah’s famous “You get a car! And you get a car! And you get a car! Everyone gets a car!” meme.

Since our federal government finances these freebies by borrowing money – which increases the global dollar supply – every dollar of deficit spending effectively devalues every other dollar in existence.

In other words, those freebies aren’t free!

We all end up paying for them – but the cost isn’t reflected by a reduction in our bank balance. So most people only see what they’re getting, and don’t realize what they’re losing in exchange.

There’s another barrier to solving the inflation problem, though.

Even the most well-meaning, logical and rational approach to the economic problem will fail if based on faulty information.

That’s another way of saying CPI, the official inflation calculation, is severely flawed.

Garbage in, garbage out

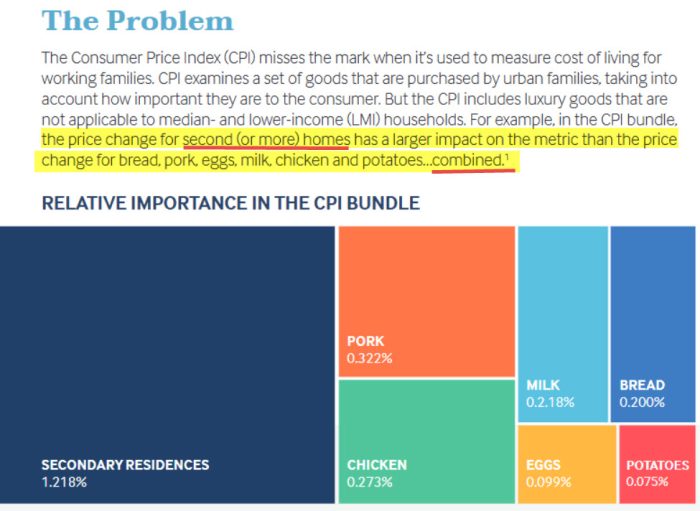

To be clear, the CPI’s statistics may be accurate, but the data used in the CPI doesn’t accurately reflect the average American’s situation.

Eugene Ludwig of the Ludwig Institute for Shared Economic Prosperity and a former U.S. Comptroller of the Currency decided to look into this disparity between government economic statistics, such as the CPI numbers, and reality.

In a recent article discussing this gap, Ludwig writes:

Perhaps the most prominent issue of the 2024 campaign — inflation — tracks much the same story. Democrats spent much of the campaign pointing out that inflation had abated by Election Day, even if prices remained elevated from pre-pandemic levels. Moreover, many noted that wages (according to the prevailing statistic that takes only full-time work into account) had risen at a faster clip. These claims were based on observations drawn largely from the Consumer Price Index, an indicator that tracks the prices charged for 80,000 goods and services across the economy.

This is a special interest of mine – but I didn’t know the CPI tracks an astonishing 80,000 different prices. That just seems like too many!

Granted, there are (on average) about 300,000 different items in the average American home. But those are gathered over a lifetime.

Even so, it seems simply impossible to me that my family could possibly buy 80,000 different things in five years, let alone one year!

I’ll set my astonishment aside – Ludwig continues:

But the CPI also perceives reality through a very rosy looking glass. Those with modest incomes purchase only a fraction of the 80,000 goods the CPI tracks, spending a much greater share of their earnings on basics like groceries, health care and rent. And that, of course, affects the overall figure: If prices for eggs, insurance premiums and studio apartment leases rise at a faster clip than those of luxury goods and second homes, the CPI underestimates the impact of inflation on the bulk of Americans. That, of course, is exactly what has happened.

In fact, the entire article makes a very compelling case, and I encourage you to read the whole thing here.

Frankly, I was a little skeptical at first – then this element of the Ludwig Institute’s whitepaper describing the problem with CPI totally changed my mind.

Via Ludwig Institute for Shared Economic Prosperity; highlights and underline added.

If you start with bad data, even if all of your reasoning is correct, you’ll still get the wrong answers and conclusions.

As computer programmers used to say, “Garbage in, garbage out.”

So what happens if we calculate the cost of living based on actual American household expenses?

The Ludwig Institute for Shared Economic Prosperity gives us these details:

LISEP today issued data for its 2023 True Living Cost (TLC) Index, a cost-of-living metric tracking the change in prices for essential items and services needed to maintain a basic standard of living. The TLC shows a 9.4% increase in the cost of basic needs in 2023 – more than double the 4.1% reported by the Consumer Price Index for All Urban Consumers (CPI).

CPI captured less than half of actual, real-world cost of living increases?

Well, that’s their conclusion – and if we extrapolate from that data point, we can estimate that the actual cost of living for American families has risen 46% since January 2020.

I speak to everyday Americans daily – and let me tell you, their experience tells me a 46% increase in the cost of living is much closer to reality than the CPI’s 23%.

That’s a far, far cry from Chairman Powell’s “great progress – but we’re not quite there yet,” isn’t it?

This would not be such a big deal if so many federal decisions weren’t based on a fundamentally unsound metric!

Social Security payments, for example, get regular cost-of-living adjustments (COLAs). Those COLAs are based on CPI – and therefore, do not keep up with real-world prices!

In fact, every inflation-indexed financial product is based on CPI.

Which simply means they’re broken.

Over the last five years, the price of gold has tracked the actual increase in the cost of living much more closely than official CPI numbers. In my mind, that’s the best possible case for diversifying your savings with inflation-resistant physical precious metals.

Official inflation measurements are broken.

Which means everything they’re based on is also broken.

I strongly recommend you take the necessary steps today to protect yourself, and your family, from the cost-of-living crisis. Learn more about inflation-resistant investments here, and see the benefits of diversifying with physical gold.

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply